EUR/USD Unchanged as Euro Area Retail Sales Tick Higher but Miss Estimates

EUR RETAIL SALES KEY POINTS:

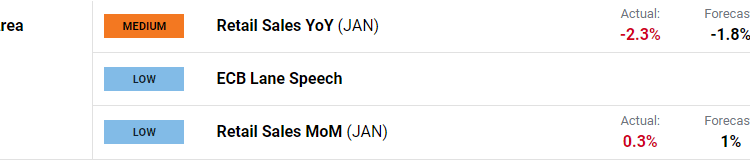

- Retail Sales YoY (JAN) Actual -2.3% Vs Forecast -1.8%.

- Retail Sales MoM (JAN) Actual 0.3% Vs Forecast 1%.

- Retail Sales Continue to be Weighed Down by Inflationary Pressures.

- Largest Yearly Decreases in the Total Retail Trade Volume Were Registered in Belgium (-8.9%), Germany (-6.8%).

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Euro Area retail sales decreased by 2.3 percent from a year earlier in January 2023 coming in worse than estimates of a 1.8% fall. The MoM figure reflected an increase0.3 percent from a month earlier following a downwardly revised 1.7 percent drop in December and missing market expectations of 1.0 percent growth.

Customize and filter live economic data via our DailyFX economic calendar

In the Euro Area in January 2023, compared with December 2022, the volume of retail trade increased by 1.8% for food, drinks and tobacco and by 0.8% for non-food products, while it decreased by 1.5% for automotive fuels. In the EU, the volume of retail trade increased by 1.8% for food, drinks and tobacco and by 1.1% for non-food products, while it decreased by 2.1% for automotive fuels according to Eurostat data.

EURO AREA AND ECB POLICY MOVING FORWARD

The ECB has largely continued its hawkish rhetoric of late with the majority of policymakers adamant a 50bps hike at the upcoming meeting remains a necessity. Given last week's core inflation data as well as comments over the weekend by ECB Presidents Lagarde, who stated that she sees further increases in the core inflation rate over the short term.

The Euro Area has continued to display resilience with today's S&P Global Eurozone Construction PMI continuing the trend, rising to 47.6 for the month of February 2023 compared to 46.1 in January. Although the print remains in contractionary territory home building activities contracted at its slowest pace in 7 months while commercial building activity was down for the eleventh straight month, with the pace of reduction little-changed from that seen in January. New business received by construction firms declined the least since last June and employment levels rose for the first time in 11 months while input cost inflation did soften with its best print since December 2020.

Today's Retail Sales data does indicate a slightly weaker start to the year than expected, however looking ahead there are a few positives notably that the Euro Area has managed to avoid a recession thus far while wages are showing signs of improvement. Business Confidence hit an eight-month high, suggesting a weaker degree of pessimism, yet signs of a potential rebound are yet to fully materialize.

MARKET REACTION

EURUSD Daily Chart

Source: TradingView, prepared by Zain Vawda

Initial reaction was relatively subdued with EURUSD remaining relatively unchanged as the Euro continues to find support from hawkish central bank rhetoric. The floor at 1.0500 continues to hold while immediate resistance rests at the 1.0700 handle with a break and daily candle close needed above if we are to see further upside. Given the current fundamentals in play there is every chance we remain rangebound at least until Fed Chair Powell begins his testimony tomorrow.

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.