EUR/USD Susceptible to Further Losses Below the 1.0665 Level

EUR/USD PRICE, CHARTS AND ANALYSIS:

READ MORE: Euro Steadied the Ship Ahead of CPI as Treasury Yields Leap. Lower EUR/USD?

Recommended by Zain Vawda

Get Your Free EUR Forecast

EUR/USD FUNDAMENTAL OUTLOOK

EURUSD posted modest gains in the Asian session testing a key level of support turned resistance around the 1.06650 handle. The Euro has since struggled to hold onto gains against the greenback with rising geopolitical tensions seemingly keeping the Euro bulls at bay.

Yesterday’s data out of the Eurozone showed further improvement with flash PMIs beating estimates in the service sector while manufacturing was marginally down. The Zew sentiment survey reflected improving sentiment and optimism with expectations and current conditions beating estimates in both the Euro Area and Germany.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

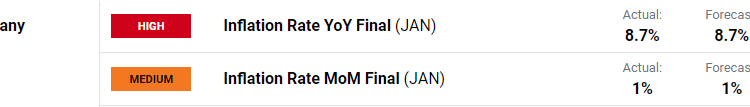

This morning brought German Inflation data for January which ticked higher from December backing up comments from ECB President Christine Lagarde for a 50bps hike at the ECB’s upcoming meeting. The Ifo Business Climate for February continued to tick higher with Ifo Economists stating that 45.4% of companies complained about supply chain bottlenecks in February (compared to 48.4% in January) while warning that a German recession will not be avoided but is expected to be mild. A further positive for the Euro Area but a sign that challenges remain.

For all market-moving economic releases and events, see the DailyFX Calendar

FOMC MEETING MINUTES

Later today we have the Federal Reserve meeting minutes release which will give further insights into how close we came to a 50bps hike in February. It should also provide market participants with an idea of how high Fed policymakers think rates will need to rise moving forward. Given the rise in rate hike expectations last week and the slew of positive data that came after the February meeting I do not think tonight’s release will have a huge impact on markets or be enough to keep the Dollar rally going. Markets are now pricing in the probability of a peak rate of 5.25% in June at 58.7%, up from 46% a week ago and 3.2% a month ago. Should this come to fruition there is every chance that the dollar rally loses steam allowing EURUSD to tick higher as the ECB ramps up its own hawkish rhetoric with a 50bps hike in March looking likely.

Source: CME Fedwatch Tool

TECHNICAL OUTLOOK AND FINAL THOUGHTS

Without any surprise from tonight’s Fed meeting the main risk for EURUSD to move higher rests with the geopolitical situation developing in Europe. Comments yesterday from both Russian President Vladimir Putin and US Secretary of State Anthony Blinken stoked the risk-off sentiment in markets with further comments today likely to be monitored closely.

From a technical perspective, EURUSD saw a daily candle close below the key 1.06650 level. This key support now resistance level holds the key from a technical standpoint with a push above likely to result in a positive end to the week for the pair.

A break above the 1.06650 handle is likely to result in a push toward the 1.0700 level and potentially higher. Alternatively, should we continue to trickle lower support rests around the 1.0600 handle and below that at 1.0550.

EUR/USD Daily Chart – February 22, 2023

Source: TradingView

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.