EUR/USD Eyes Short-Term Retracement as DXY Runs Into Confluence Area

EUR/USD PRICE FORECAST:

Recommended by Zain Vawda

Get Your Free EUR Forecast

READ MORE: US Dollar Forecast: Dollar Index Rally Continues with Fundamental and Technical Challenges Ahead

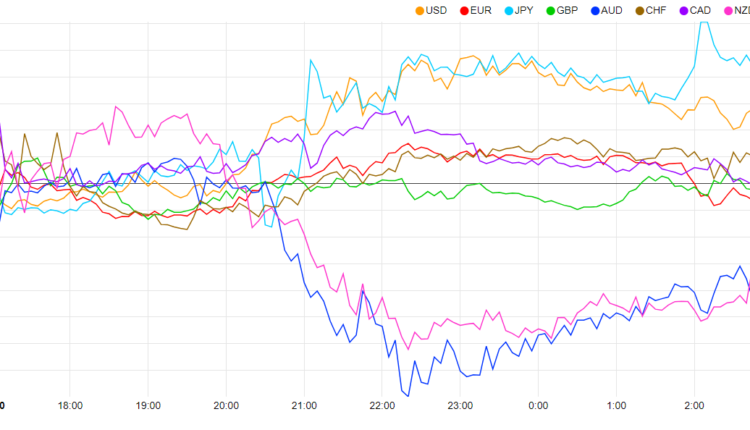

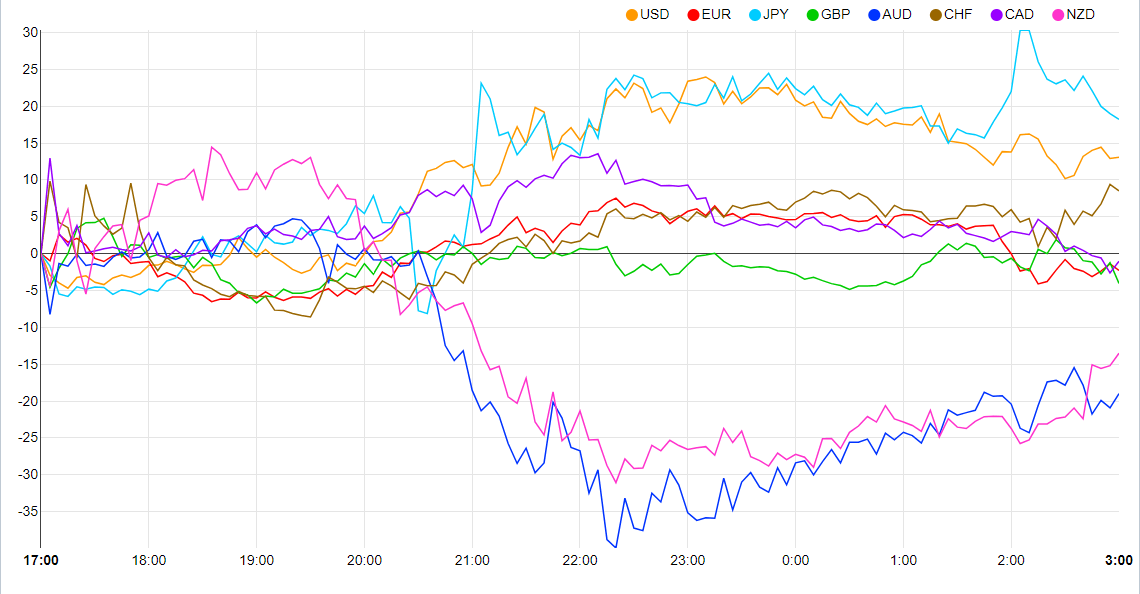

EUR/USD has continued to trickle lower this morning, but a short-term retracement is beginning to look like a possibility. The Dollar Index (DXY) however, may cap any sustained move to the upside as risk-off sentiment keeps the Greenback supported. The Dollar is the second strongest currency this morning per the Currency Strength Chart below.

Currency Strength Chart: Strongest – JPY, Weakest – AUD.

Source: FinancialJuice

CHINA REAL ESTATE WOES KEEPS US DOLLAR SUPPORTED

The risk-off tone this morning came about as Chinas real estate sector came to the fore once more. Country Garden which was at one time the largest private property developer in China risks default in a move that could have wider implications for the Chinese real estate market. There have long been concerns around the sector with hopes that a stimulus package by Government would ease concerns. Despite reports stating that the CCP were almost certain to come up with a renewed stimulus plan this has yet to materialize.

The impact of this has seen risk-off sentiment dominate this morning with the US Dollars safe haven appeal remaining intact. The Dollar has printed four consecutive weeks of gains with the last time the index experienced five consecutive weeks of gains coming back in May 2022. The FOMC minutes are due later this week and it will be interesting to see if the DXY will retreat or will it be five successive weeks of gains?

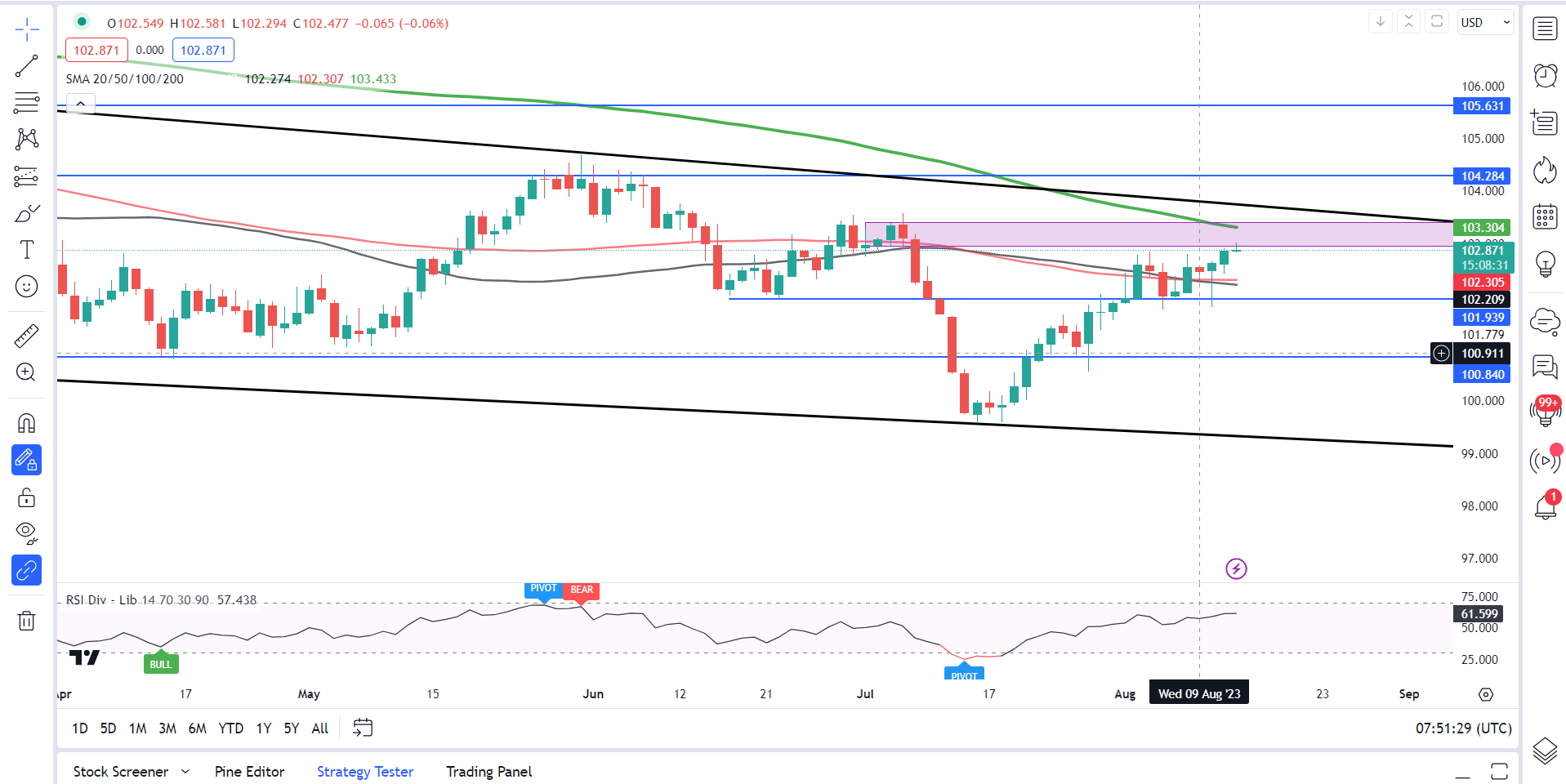

The DXY has run into a key confluence area as you can see on the chart below. I do believe there could be some room for further upside, but a lot of hurdles would need to be cleared. Resistance is currently provided by the 103.00 handle and just above the 200-day MA resting around the 103.30 mark.

Dollar Index (DXY) Daily Chart – August 14, 2023

Source: TradingView

Fridays PPI data out of the US showed a slight uptick and might be the reason behind some hawkish comments from Fed policymakers last week. There is some concern among members that inflation could pick up again as we head toward Q4 and the end of the year. August has historically been a choppy month for markets and this trend could continue given the uncertainties in play at the moment.

Recommended by Zain Vawda

How to Trade EUR/USD

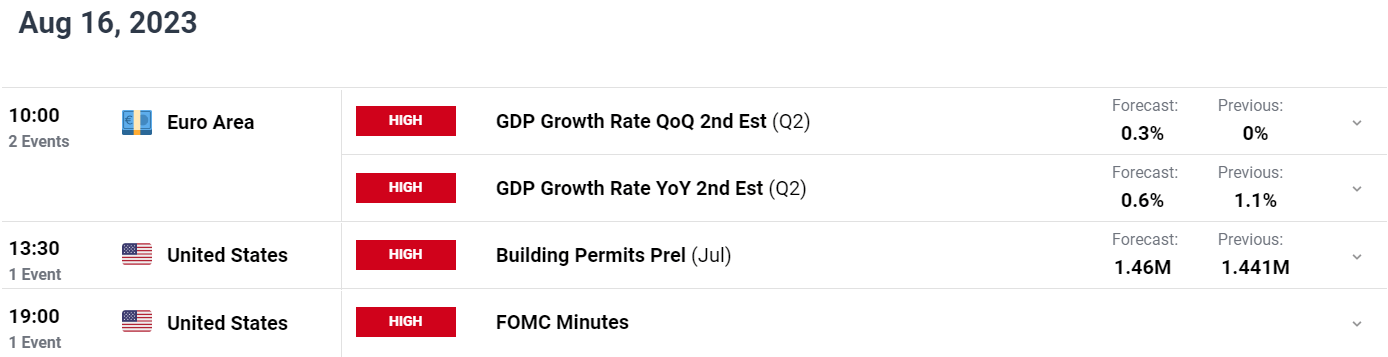

RISK EVENTS AHEAD

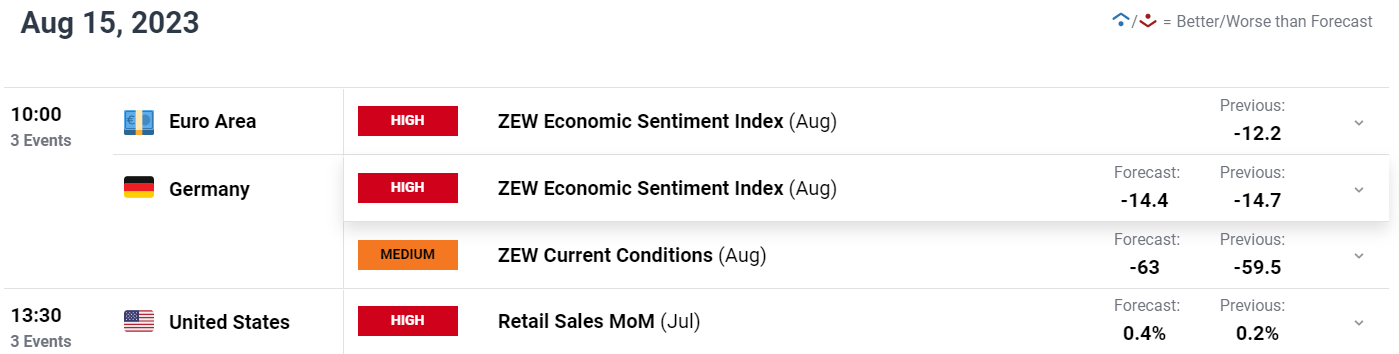

A quiet day in terms of risk events on the economic calendar but things should pick up pretty quickly tomorrow. We have the ZEW Economic conditions and sentiment data out from the Euro Area and Germany respectively before focus will undoubtedly switch to Wednesdays FOMC minutes release and US retail sales data.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

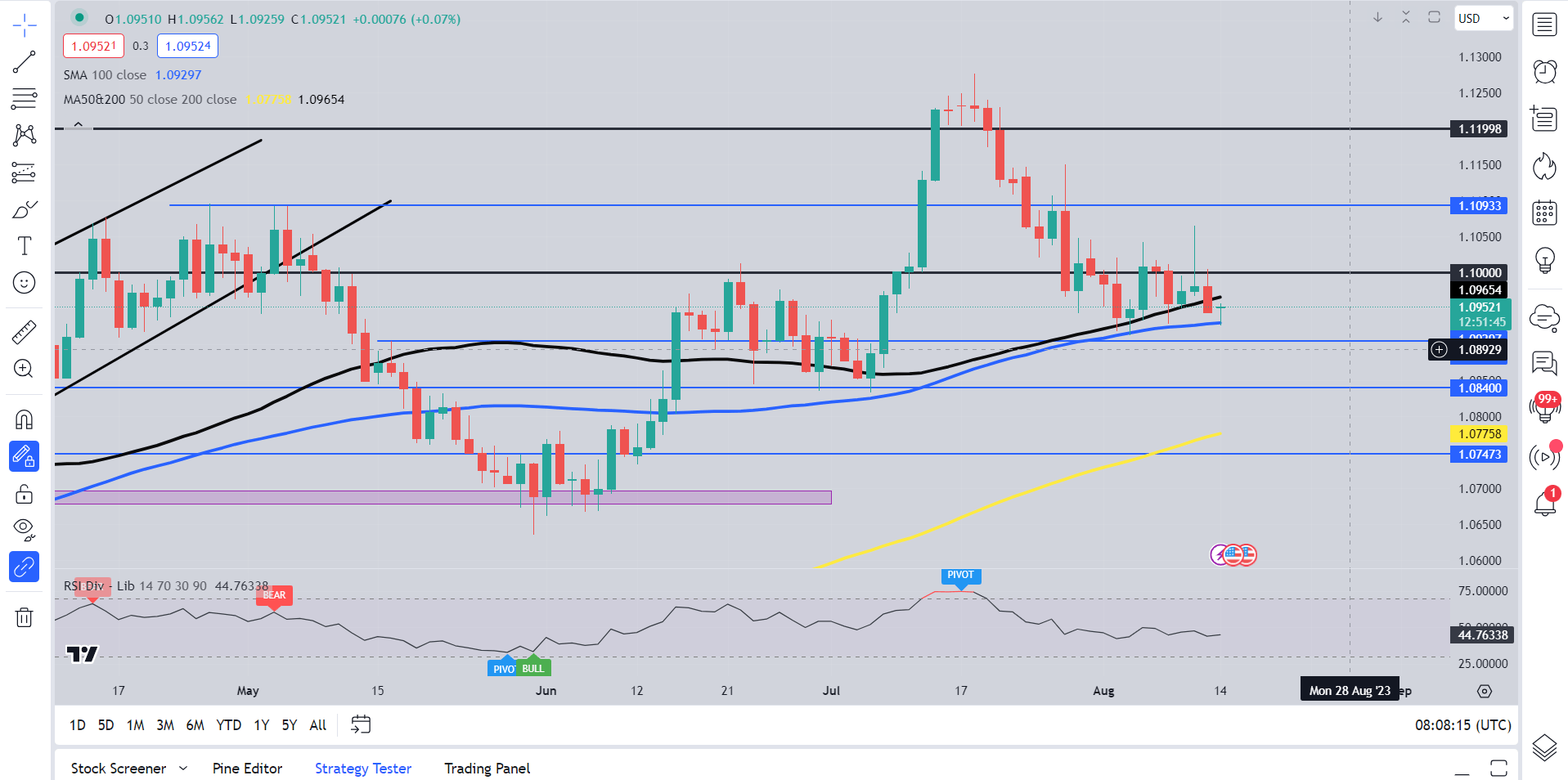

Looking at EURUSD from a technical perspective and last week's daily candle close on Friday does not bode well for bulls. EURUSD printed a marubozu shooting star candle off key resistance at the psychological 1.1000 level.

The shooting star marubozu candle does hint at downside continuation, however given the US Dollar dynamic I think we could be in for a short-term retracement before continuing lower.

On the upside resistance is provided by the 50-day MA around the 1.0970 handle before a retest of the 1.1000 becomes a possibility. A downside move could retest the 100-day MA at the 1.0930 mark before any attempt by EURUSD to move lower.

EUR/USD Daily Chart – August 14, 2023

Source: TradingView

Key Levels to Keep an Eye On

Support Levels

Resistance Levels

IG CLIENT SENTIMENT DATA

IGCSshows retail traders are currently Net-Long on EURUSD, with 58% of traders currently holding LONG positions.

To Get the Full IG Client Sentiment Breakdown as well as Tips, Please Download the Guide Below

| Change in | Longs | Shorts | OI |

| Daily | 4% | 2% | 4% |

| Weekly | 17% | -15% | 1% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.