EUR/USD extends the sharp bounce past 1.0700

- EUR/USD surpasses the 1.0700 mark, or 4-week highs.

- The dollar remains well on the defensive post-Payrolls.

- The next risk event will be the US CPI due on Tuesday.

The optimism around the European currency remains well in place at the beginning of the week and lifts EUR/USD back above the 1.0700 hurdle, or new 4-week tops.

EUR/USD now looks at US CPPI, ECB

EUR/USD advances for the third session in a row and moves north of the 1.0700 barrier, where some initial resistance seems to have emerged so far.

The continuation of the pair’s rebound comes in response to the persistent sell-off in the greenback, which was particularly exacerbated following the mixed results from the February Payrolls published last Friday.

By the same token, the USD Index (DXY) starts the week well in the negative territory and navigates multi-week lows pari passu with investors repricing of a 25 bps rate hike by the Fed at the March 22 gathering, while some speculation around a no rate at all seems to have also kicked in.

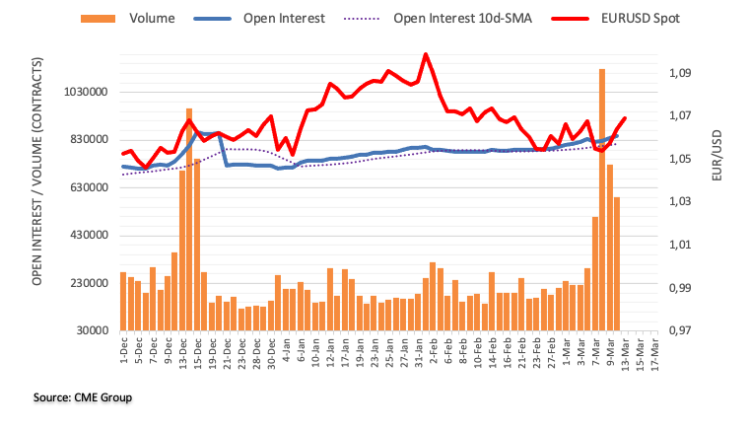

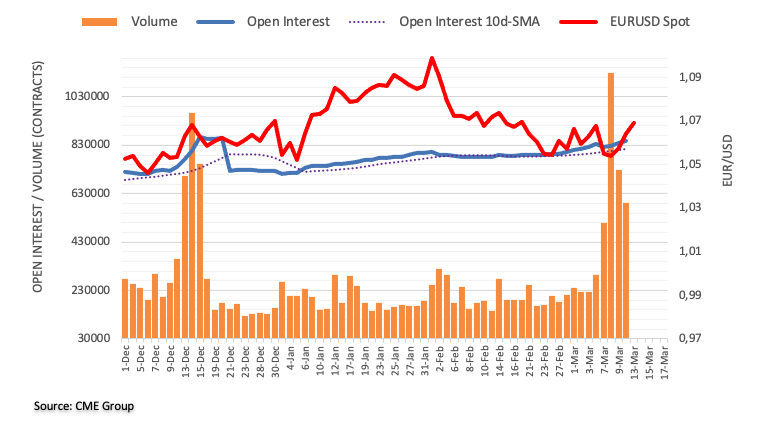

Supporting the view of a stronger EUR/USD, open interest increased in the last three sessions, while volume retreated to more “normal” levels following the post-Powell spike on March 7.

No data releases in the euro area should leave Tuesday’s release of US CPI for the month of February as the salient event in the first half of the week. Moving forward, the ECB meeting on March 16 should see the central bank hiking the policy rate by 50 bps.

What to look for around EUR

EUR/USD manages to reclaim the area above 1.0700 the figure at the beginning of the week, always amidst the persevering retracement in the greenback.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB past the March meeting, when the bank has already anticipated another 50 bps rate hike.

Key events in the euro area this week: Eurogroup Meeting (Monday) – ECOFIN Meeting (Tuesday) – EMU Industrial Production (Wednesday) – ECB Interest Rate decision, ECB Lagarde (Thursday) – EMU Final Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is advancing 0.33% at 1.0673 and the breakout of 1.0737 (monthly high March 13) would target 1.0804 (weekly high February 14) en route to 1.1032 (2023 high February 2). On the downside, the initial support comes at 1.0524 (monthly low March 8) seconded by 1.0481 (2023 low January 6) and finally 1.0323 (200-day SMA).

Comments are closed.