EUR/USD, EUR/JPY, EUR/GBP, Price Setups

Euro Vs US Dollar, Japanese Yen, British Pound – Outlook:

- EUR/USD looks deeply oversold as it tests strong support.

- EUR/GBP is attempting to break above a minor resistance; EUR/JPY looks heavy.

- What is the outlook and the key levels to watch in key Euro crosses?

Recommended by Manish Jaradi

How to Trade EUR/USD

The euro looks deeply oversold and could be set to recoup some of the recent losses against some of its peers ahead of the US Federal Reserve’s interest rate decision. How sustainable the bounce turns out to be remains a question.

Hawkish comments from several ECB officials are supporting the single currency for now and a potential skip by the Fed could provide the much-needed boost. EUR came under pressure last week after the ECB raised interest rates but indicated that policy rates are peaking. Money markets are currently pricing in around a 25% chance of one more ECB rate hike by the year-end.

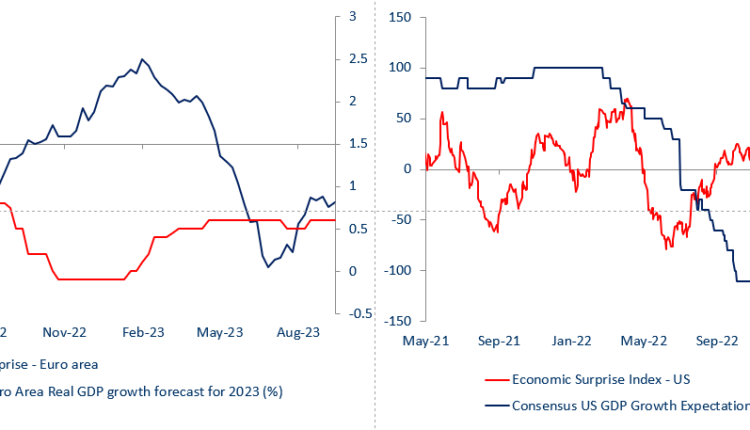

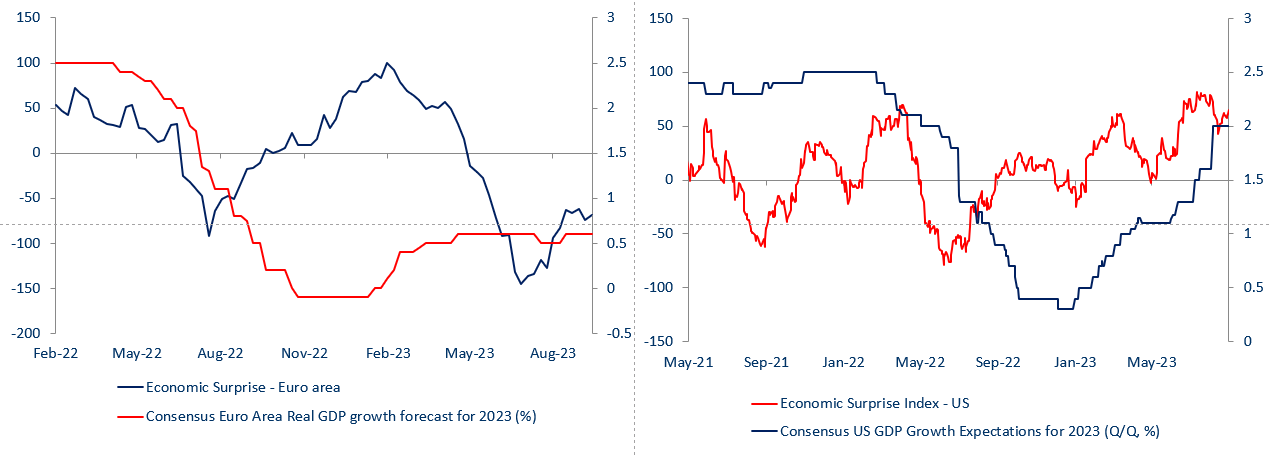

Economic Surprise Index – Euro Area and US

Chart Created by Manish Jaradi Using TradingView

Meanwhile, the US central bank is widely expected to keep the federal funds rate steady this week, while Powell is likely to be balanced in his assessment, emphasizing data-dependency about the near-term path of policy. The key focus will be on the Summary of Economic Projections (SEP) which will be released along with the September FOMC statement. In particular, the 2023 and 2024 median policy rates. For more details, see “How Will the US Dollar React to Fed Rate Decision Next Week?” published September 15.

Having said that, for any bounce to be sustainable, the economic growth outlook for the Euro area needs to improve. The outperformance of US growth has been supporting the greenback globally as monetary policy outlooks converge.

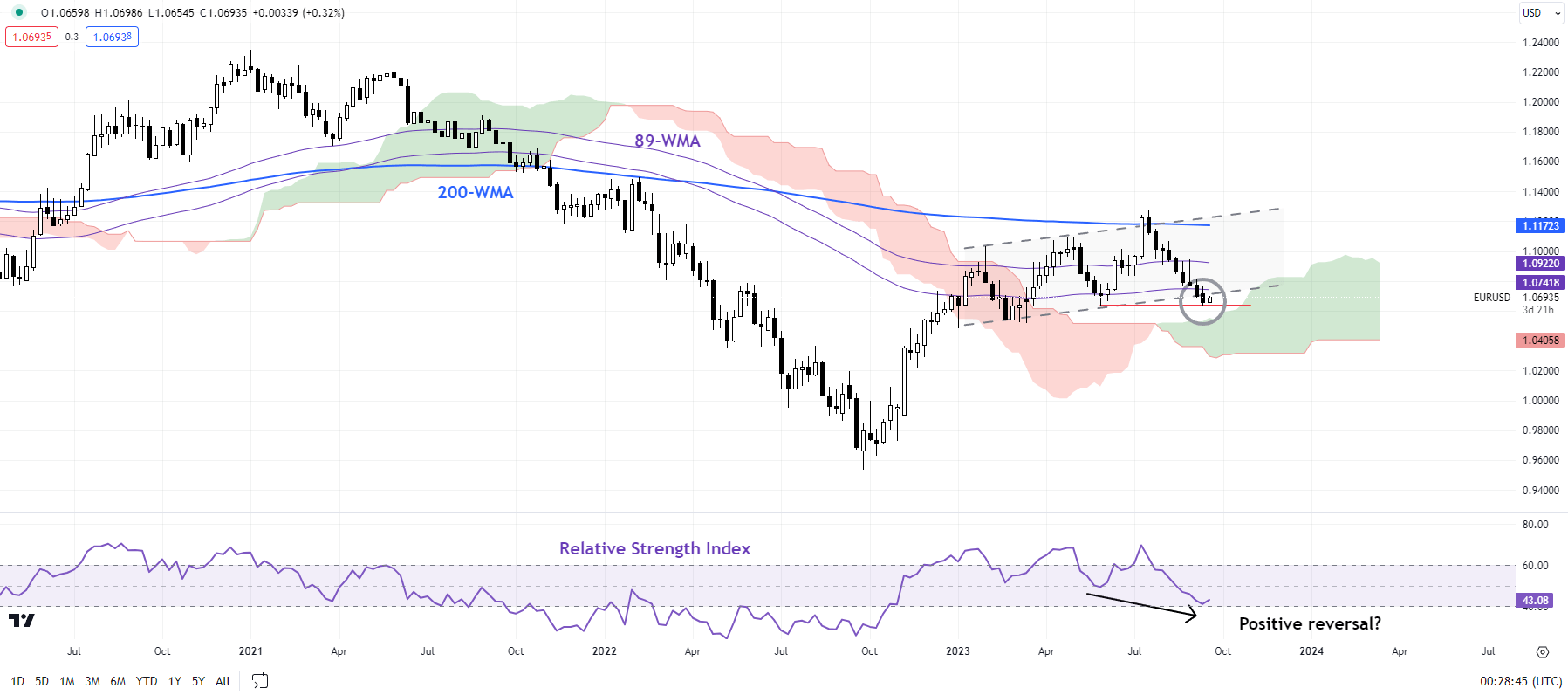

EUR/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

Recommended by Manish Jaradi

How to Trade FX with Your Stock Trading Strategy

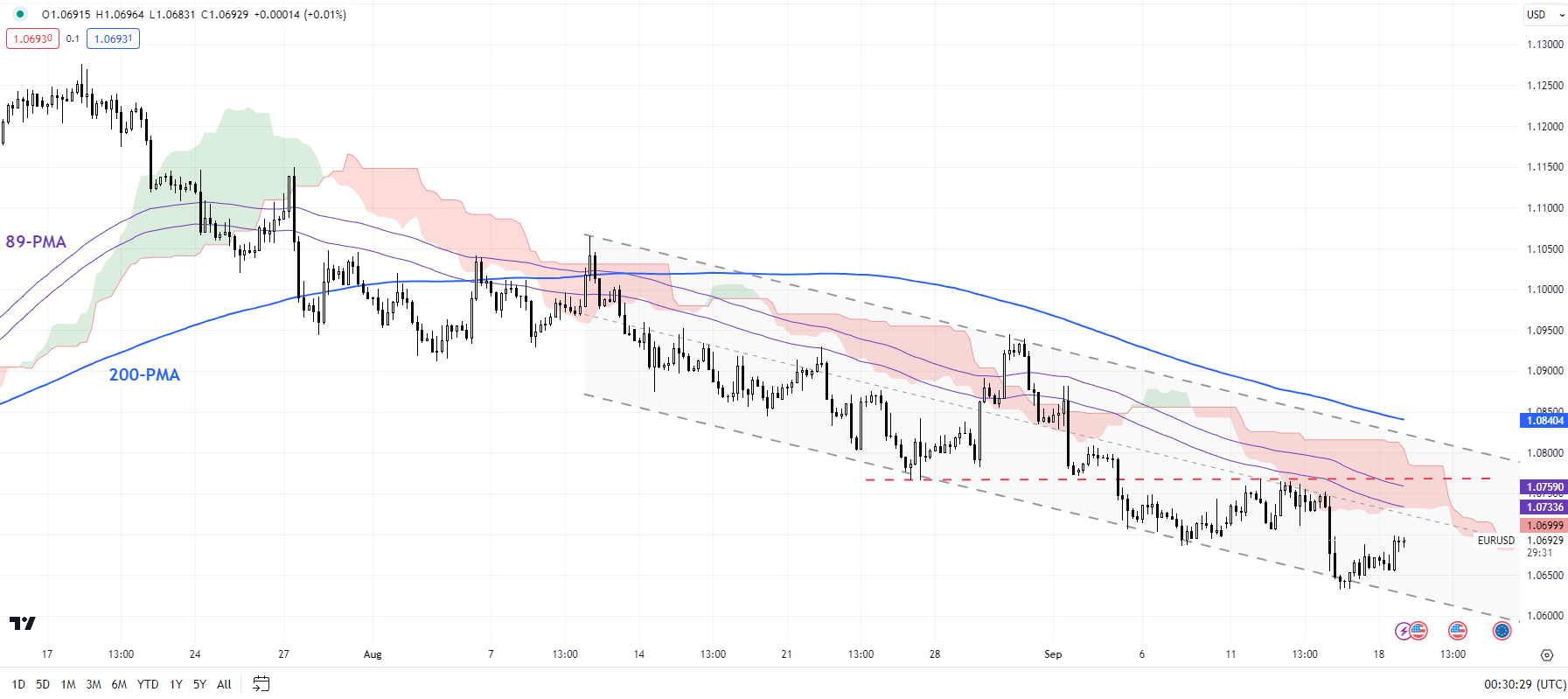

EUR/USD: At major support

On technical charts, EUR/USD is testing a major cushion at the June low of 1.0633. Back-to-back weeks of decline, oversold conditions, and a positive reversal on the weekly charts raise the odds of a short-term bounce. This support is strong and is unlikely to break cleanly, at least in the first attempt.

EUR/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

Having said that, the pair lacks upward momentum. On the 240-minute charts, a break above the initial barrier at last week’s high of 1.0770 is needed for the immediate downside risks to fade. A break above the August high of 1.0945 would be even more significant raising the odds that the two-month-long downtrend was over. For more discussion, see “Euro’s Downside Cushioned Ahead of Euro Area CPI, US PCE: EUR/USD, EUR/GBP Action,” published August 30.

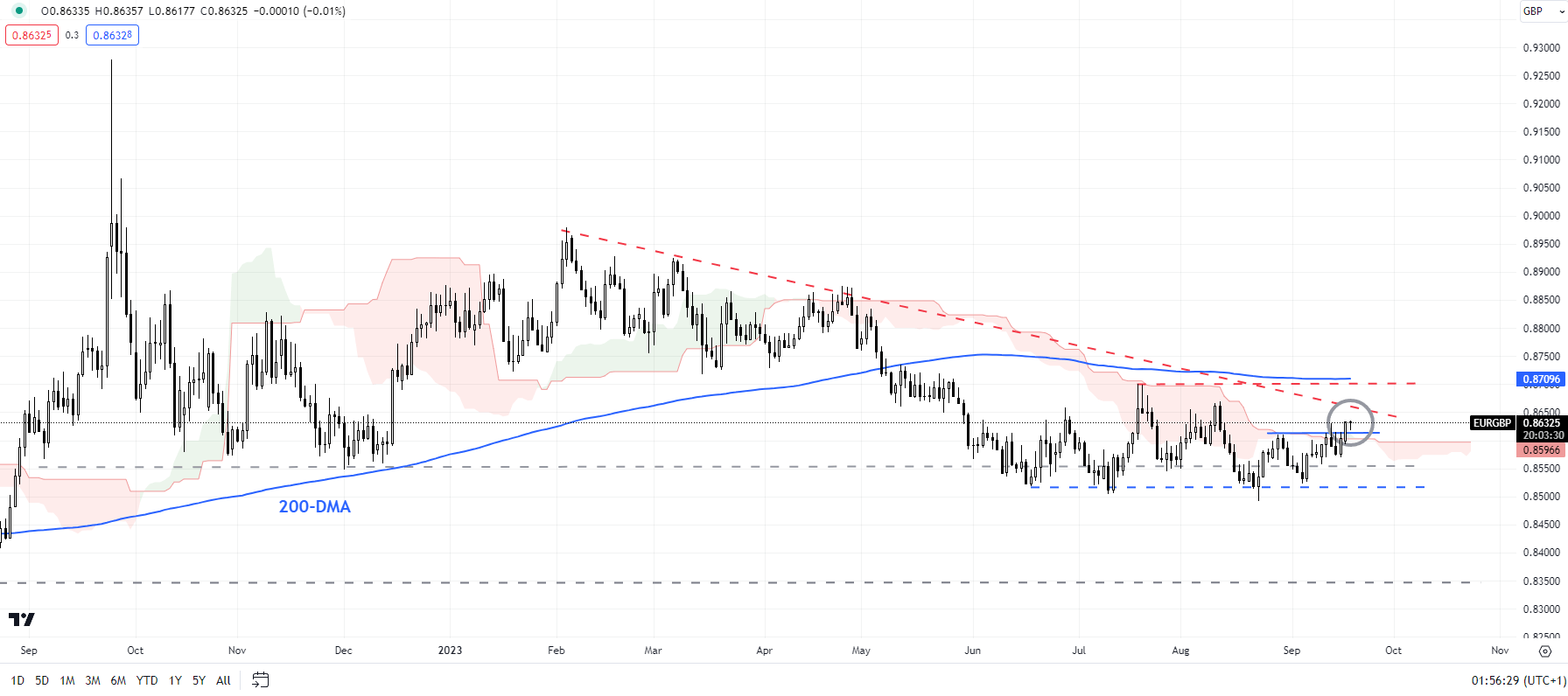

EUR/GBP Daily Chart

Chart Created by Manish Jaradi Using TradingView

EUR/GBP: Flexes muscles

EUR/GBP appears to be flexing muscles as it tries to break above minor resistance at the August high of 0.8610. While important, a break above the July high of 0.8700 and coinciding with the 200-day moving average would be far more significant. Such a break could pave the way toward the April high of 0.8875.

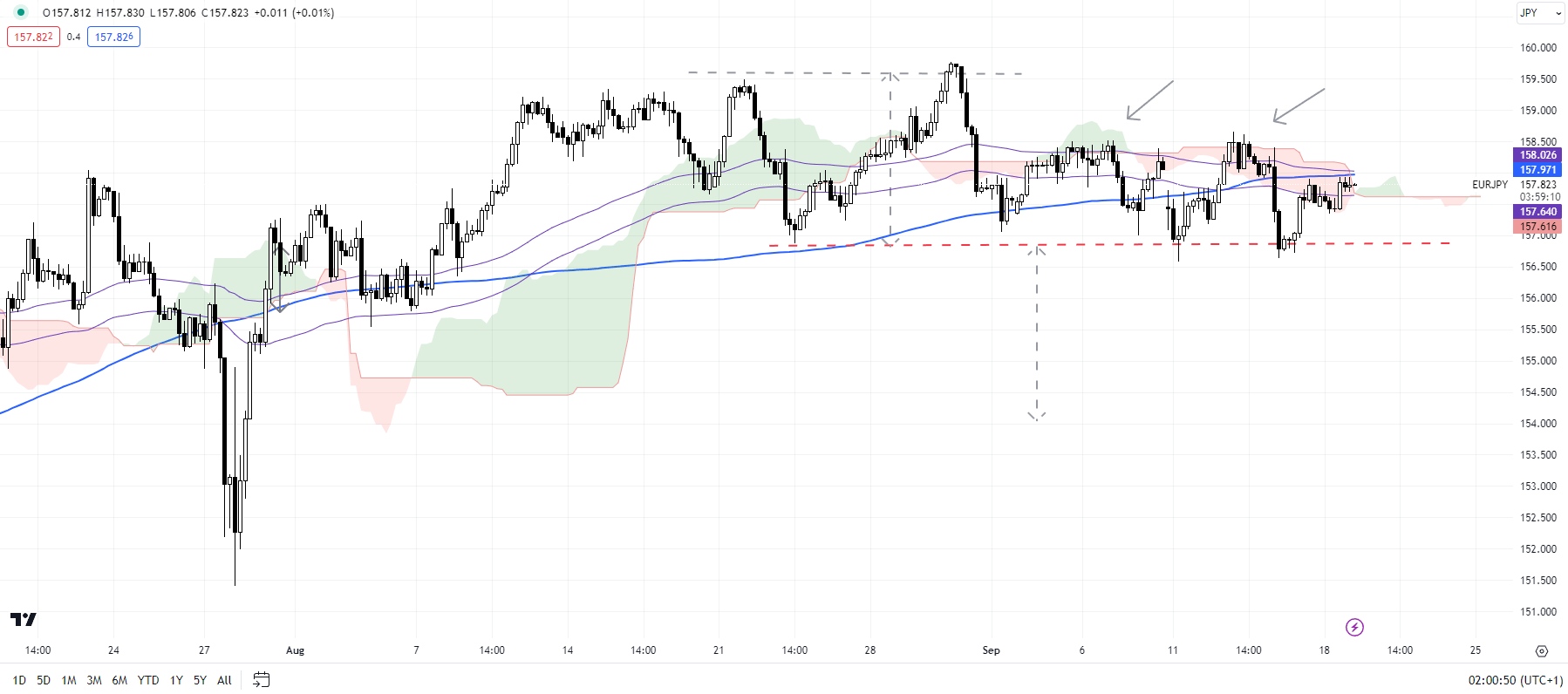

EUR/JPY 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

EUR/JPY: Looks heavy

EUR/JPY is testing quite strong horizontal trendline support from August (at about 156.85-157.00). As highlighted in the previous update, any break below would trigger a double top (the August highs), with a potential price objective of around 154.00. See “Japanese Yen’s Slide Pauses but for How Long? USD/JPY, EUR/JPY, MXN/JPY Price Setups,” published September 4. Having said that, any retreat is unlikely to pose a threat to the broader EUR/JPY uptrend while the cross holds above the July low of 151.50.

Recommended by Manish Jaradi

The Fundamentals of Breakout Trading

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Comments are closed.