EUR/USD Ends Week with a Whimper but a Recovery Remains in Play

EUR/USD PRICE, CHARTS AND ANALYSIS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

READ MORE: May Jobs Report: NFP Smashes Estimates as US Unemployment Rises to 7-Month High

The Euro lost ground against major G7 counterparts this week with EURGBP trading at lows last seen in November/December 2022. EUR/USD however remained the pair of interest, with the pair on course for a Doji weekly candle close following Friday’s sharp pullback.

Nothing much has change from a European Central Bank (ECB) perspective with ECB policymakers largely punting for one or two more 25bps hikes. This comes despite a drop in Euro Area inflation this week with the data seen as unlikely to sway the Central Bank from hiking rates in June, validated by comments from ECB policymakers following the inflation release.

Most Read: Euro Area Inflation Slows Hitting February 2022 Lows, EUR/USD Bid

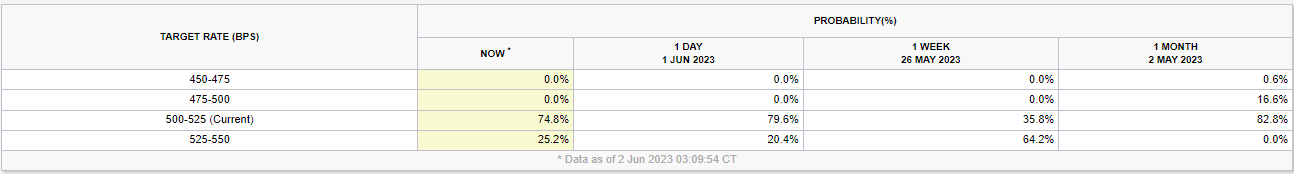

The Euro put in significant gains in the aftermath of the inflation print helped by the US debt ceiling agreement resulting in US Dollar weakness. The weakness in the US dollar was short lived however, as we the NFP report and US jobs data on Friday saw rate hike expectations for the Feds June meeting rise once more offering the US Dollar renewed support.

THE WEEK AHEAD, ISM DATA AND EURO GDP 3rd ESTIMATE

Heading into the new week, and we do not have a lot in terms of risk events or economic data releases where the Euro Area is concerned. The biggest risk to EURUSD however, no doubt rests with the ISM services PMI data out of the US while we also have Euro Area GDP Growth 3rd estimates due on June 8.

Given that the US is largely a service-based economy and concerns around services inflation persisting the Fed may keep a close watch on the release. A positive print could also see rate hike expectations from the Fed hawkishly repriced which could pose further downside risk for EURUSD.

Recommended by Zain Vawda

Top Trading Lessons

ECONOMIC CALENDAR FOR THE WEEK AHEAD

The week ahead on the calendar eases a bit with two ‘high’ rated data releases, and a host of ‘medium’ rated data releases expected.

Here are the two high ‘rated’ risk events for the week ahead on the economic calendar which could affect EURUSD:

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK

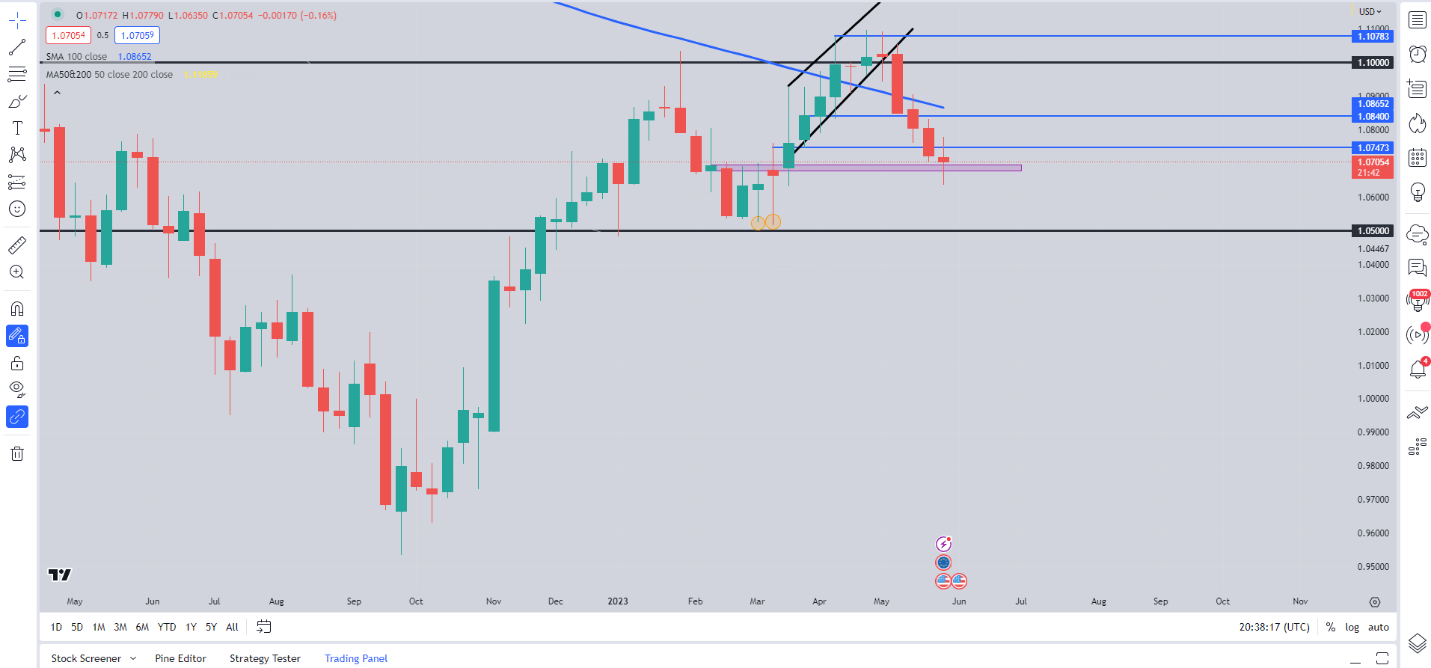

The weekly chart for EUR/USD above and we can see that price has pushed down to a key support level. The 1.0700 level is where the previous breakout occurred in early March before EUR/USD rallied to its YTD High. Having flirted with a break lower this week the pair is set to close the week on the cusp of the 1.0700 level once more while printing a Doji candle in the process.

EUR/USD Weekly Chart – June 2, 2023

Source: TradingView

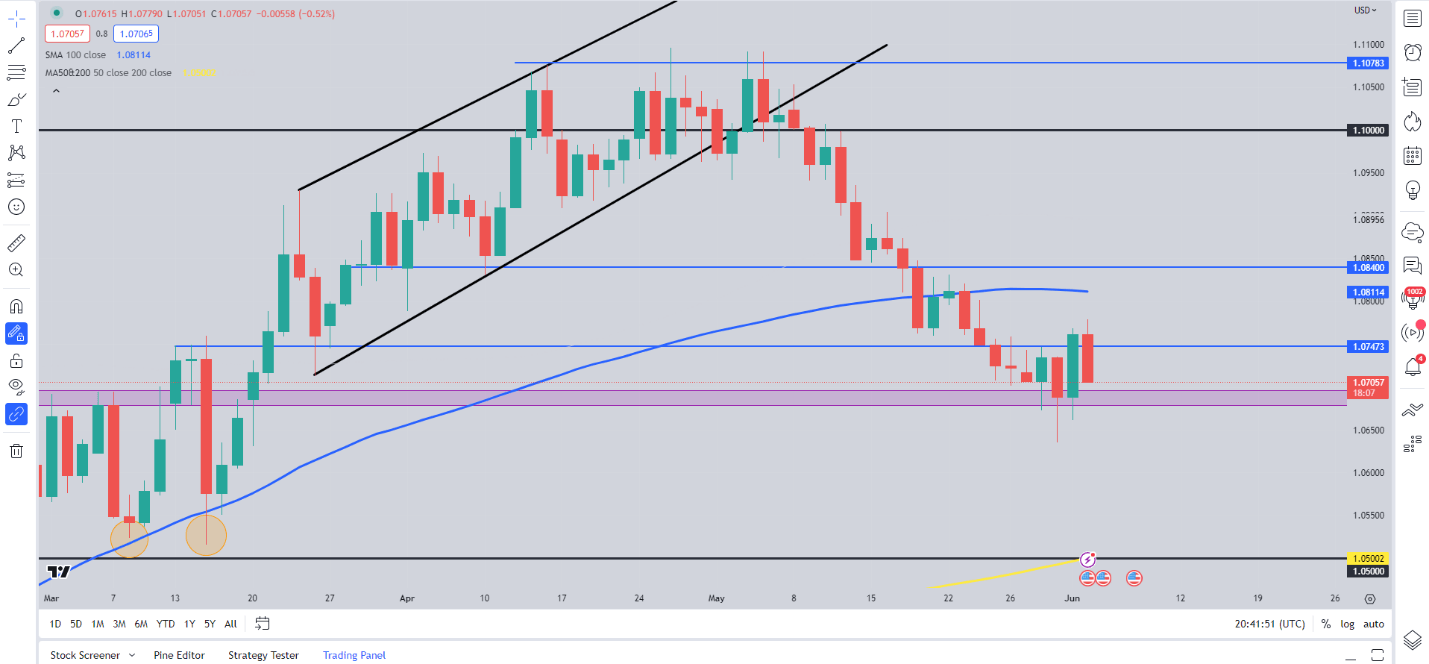

Dropping down to a daily timeframe and we can see that indecision around the 1.0700 mark has continued. We have now seen 6 trading days of price testing and rejecting around the support level as market expectations around the US dollar and Fed rate hikes in particular continue to sway.

A break of the key 1.0700 level could open up retest of the 1.0600 mark before focus shifts toward the psychological 1.0500 mark. A push higher from here has the tough task of breaking back above resistance and the 100-day MA at around 1.0810. The 100-day MA could prove stubborn as EURUSD had been stuck above the MA since November 2022. A break of the 1.0800 handle brings 1.0900 into focus and potentially the psychological 1.1000 level. We could very well be in for another week of rangebound price action between the 1.0600 and 1.0800 levels ahead of the Central Bank meetings later this month.

EUR/USD Daily Chart – June 2, 2023

Source: TradingView

Foundational Trading Knowledge

DailyFX Education Walkthrough

Recommended by Zain Vawda

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.