EUR/USD corrects lower to 1.0980 post-Payrolls

- EUR/USD now reverses initial gains and revisits 1.0980.

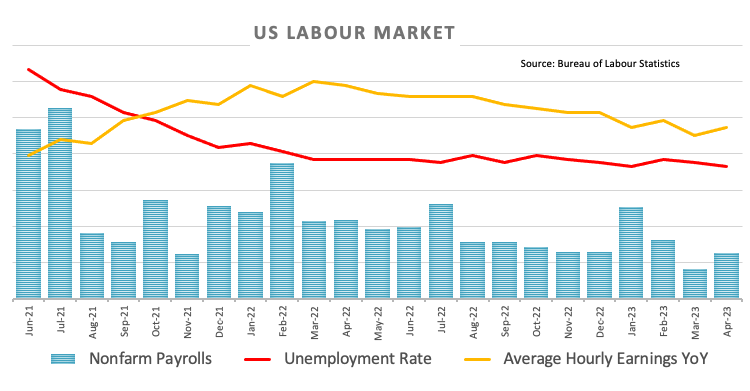

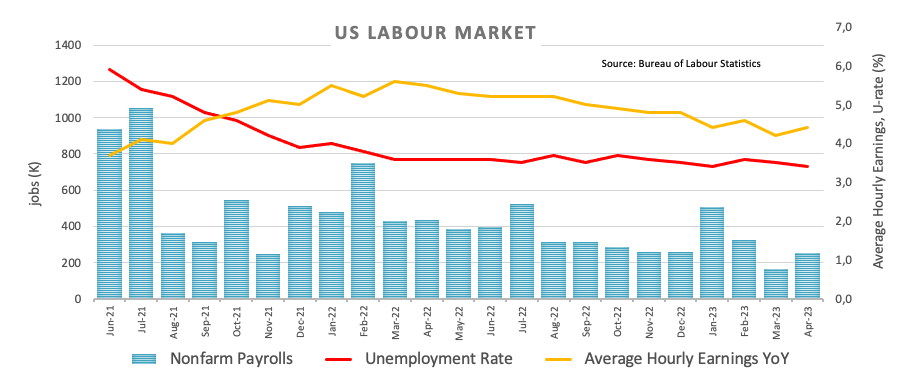

- US Non-farm Payrolls surprised to the upside in April.

- The unemployment rate dropped to 3.4%.

EUR/USD comes under further downside pressure and rapidly gives away the initial optimism, returning to the sub-1.1000 region in the wake of another solid prints from the US jobs report on Friday.

EUR/USD: Gains appear limited near 1.1100 so far

EUR/USD picks up extra selling pressure after the release of the Nonfarm Payrolls showed the US economy added 253K jobs during April, surpassing initial estimates for a gain of 180K jobs. In addition, the March reading was revised down to 165K (from 236K).

Further data saw the Unemployment Rate ticking lower to 3.4% and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.5% MoM and 4.4% from a year earlier. Additionally, the Participation Rate increased held steady at 62.6%.

Later in the session, the attention will be on the release of the Consumer Credit Change for the month of March.

What to look for around EUR

EUR/USD trims earlier gains and adds to the moderated pullback seen in the wake of the ECB gathering on Wednesday.

The movement of the euro's value is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Germany Construction PMI, EMU Retail Sales.

Eminent issues on the back boiler: Continuation (or not) of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.19% at 1.0989 and faces the next support at 1.0941 (monthly low May 2) followed by 1.0909 (weekly low April 17) and finally 1.0831 (monthly low April 10). Conversely, the surpass of 1.1095 (2023 high April 26) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022).

Comments are closed.