EUR/USD Bid Post-PPI as FOMC Looms

EUR/USD ANALYSIS

- Weak euro area economic data has left the euro vulnerable.

- Will elevated US inflation prompt EUR selloff?

- EUR/USD approaches key support zone.

Elevate your trading skills and gain a competitive edge. Get your hands on the EURO Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

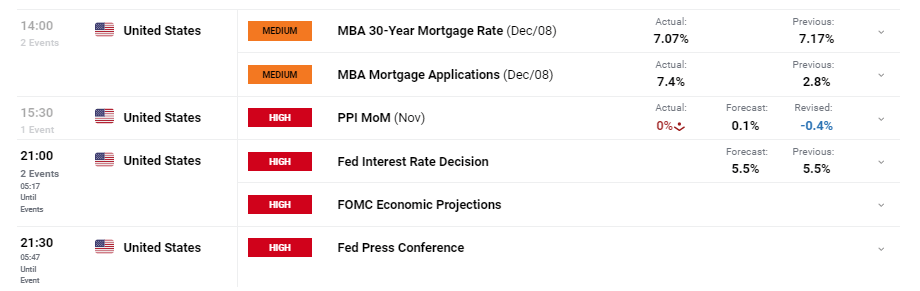

The euro found some support during the latter part of the European session after dismal eurozone industrial production data (see economic calendar) missed on both YoY and MoM metrics. Yet another data point that reflects a slowing euro economy. Of recent, the euro area has been showing signs minimal improvement and despite some weaker US data, the euro area remains vulnerable to further downside. The pullback gained traction when US PPI missed forecasts and could have a knock-on influence on CPI going forward. PPI is often referred to as a leading indicator as lower producer prices tend to filter through to the price of goods – a net positive for the Fed and its current restrictive monetary policy stance.

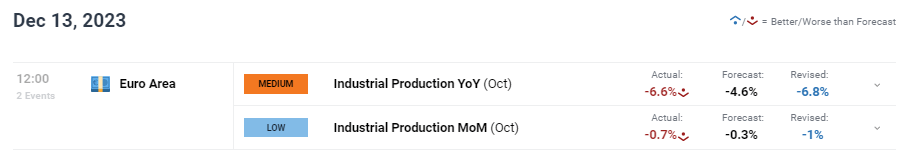

ECONOMIC CALENDAR (GMT+02:00)

Source: DailyFX Economic Calendar

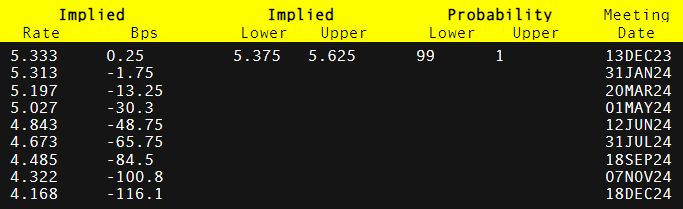

The rest of the trading day will be dominated by US factors, chiefly the Federal Reserve’s interest rate announcement. Post-PPI, cumulative rate cuts by the Fed for 2024 have increased roughly 6bps to 116bps shown below. Although the Fed is seeing improvement in its goal to quell inflationary pressures, easing too quickly could undo much of the progress. Fed Chair Jerome Powell is likely to pushback against rate cut forecasts (a strategy I believe the European Central Bank (ECB) will adopt as well).

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

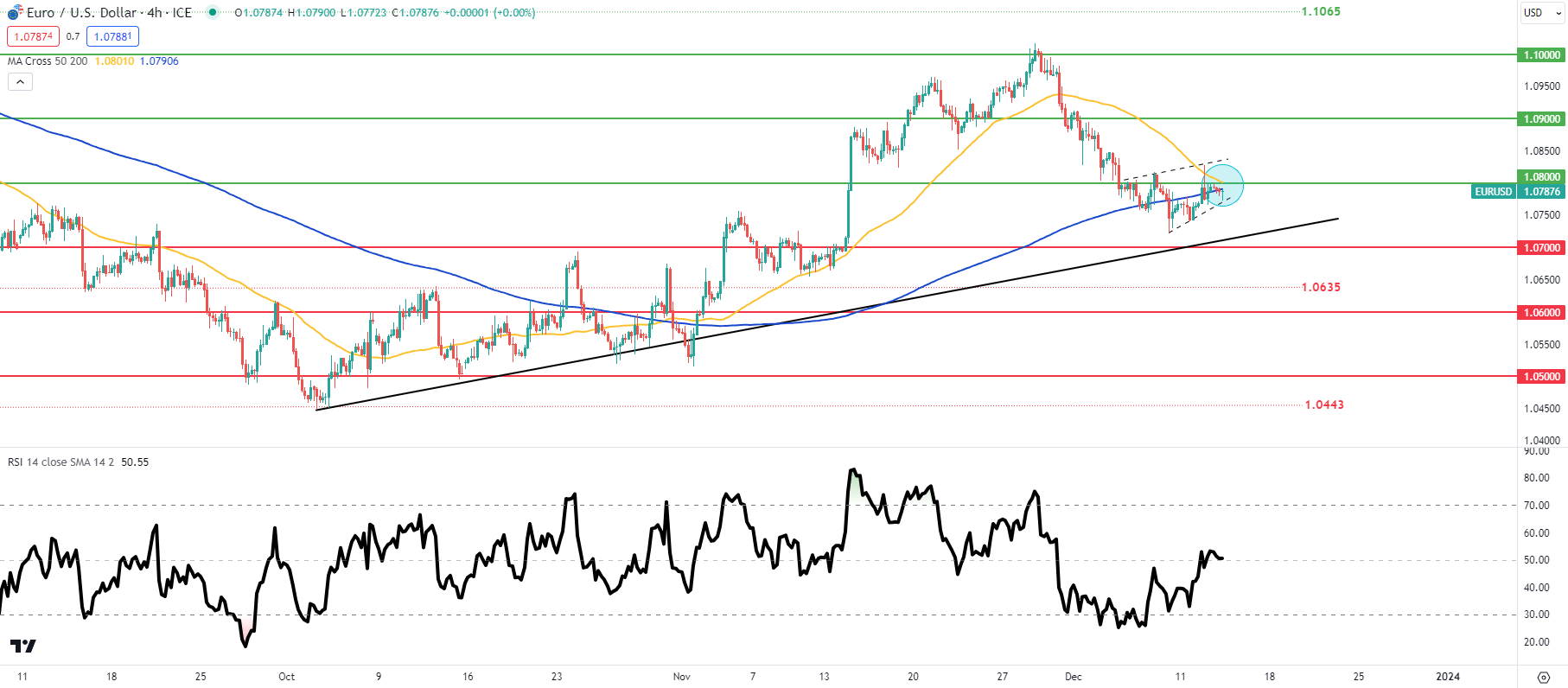

EUR/USD 4-HOUR CHART

Chart prepared by Warren Venketas, IG

The 4-hour EUR/USD chart above shows two potential bearish indications including a rising wedge pattern as well as a looming death cross (blue). That being said, the Relative Strength Index (RSI) on both short and longer term time frames remain around the midpoint 50 level, suggestive of hesitancy by EUR/USD traders. Fundamental and technical analysis as outlined above seems to favor the downside short-term, with the long-term trendline support (black) the first port of call for bears.

Resistance levels:

- 1.0900

- Wedge resistance

- 1.0800/50-MA (4-hour)

Support levels:

- 200 MA (4-hour)

- Wedge support

- Trendline support

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently neither NET LONG on EUR/USD, with 55% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

| Change in | Longs | Shorts | OI |

| Daily | 5% | 0% | 3% |

| Weekly | 1% | -5% | -2% |

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.