EUR/USD and EUR/JPY Prices and Outlooks

EUR/USD and EUR/JPY Prices, Charts, and Analysis

Recommended by Nick Cawley

Get Your Free EUR Forecast

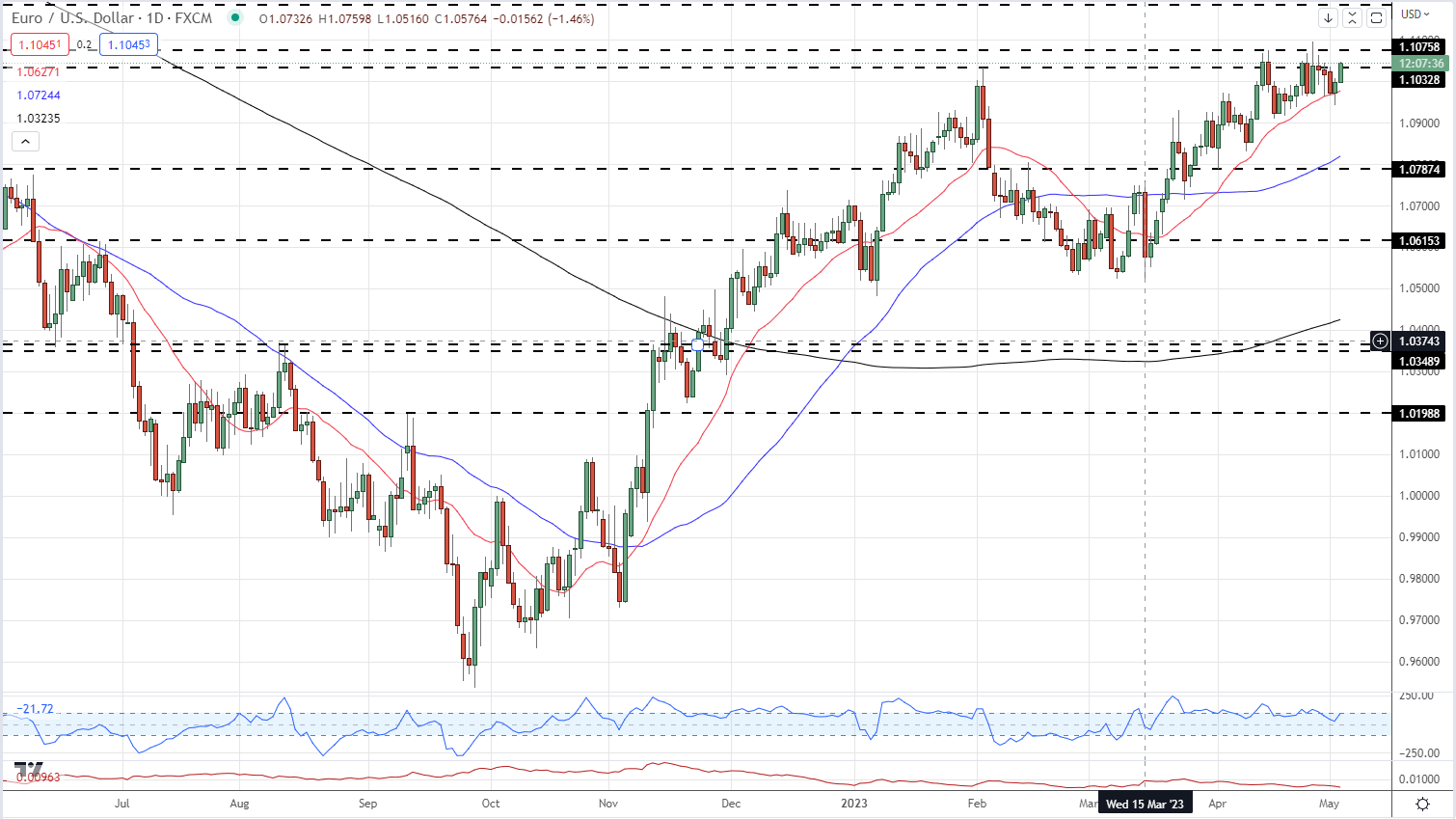

The FOMC rate decision and press conference tonight (18:00 and 18:30 GMT) and the ECB decision and press conference tomorrow (12:15 and 12:45 GMT) will decide EUR/USD’s fate over the coming weeks and months. The market currently expects a dovish 25bp hike by the Fed, with the US central bank pressing the pause button on further hikes, and a neutral/hawkish 25bp hike by the ECB with the promise of further hikes in the months ahead if data continues to confirm that inflation remains sticky and uncomfortably high.

Euro Preps for Data Heavy Week with ECB and Fed in Focus

US Dollar’s Direction Hinges on Fed’s Policy Outlook, US Labor Market Data

For all market-moving events and economic data releases, see the real-time DailyFX Calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The daily EUR/USD chart shows the pair stuck in a short-term trading range with support and resistance seen at 1.0910 and 1.1096 respectively. Volatility, using the CCI indicator, remains at, or close to, a multi-week low, while all three moving averages, especially the 20-day moving average, remain supportive. Volatility is likely to pick up over the rest of the week and either support or resistance, maybe both, will likely come under pressure.

EUR/USD Daily Price Chart – May 3, 2023

Charts via TradingView

Recommended by Nick Cawley

How to Trade EUR/USD

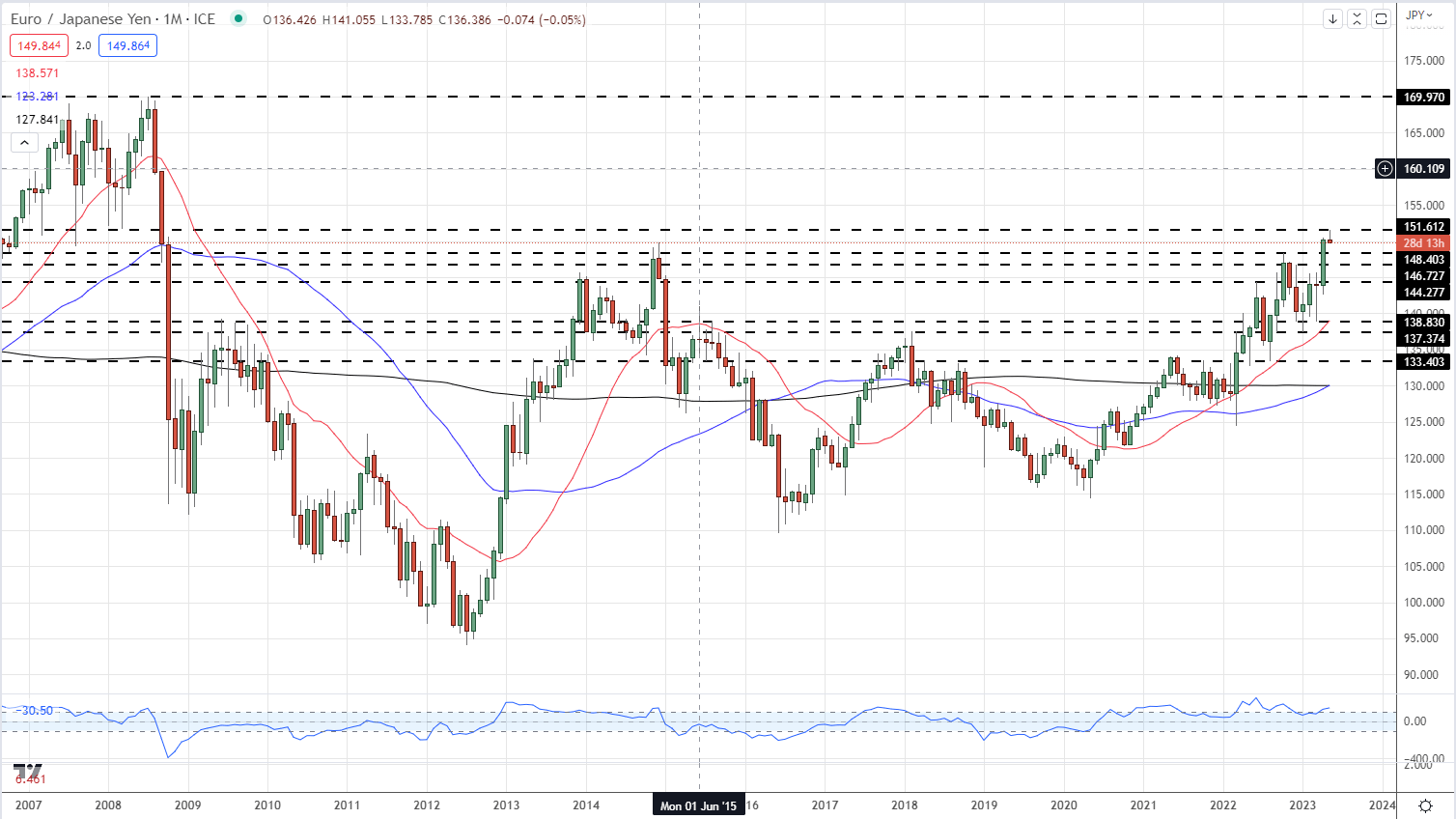

EUR/JPY is being driven by a different driver with the Bank of Japan’s continued loose monetary policy weighing on the Japanese Yen. The new BoJ governor Kazuo Ueda said last Friday that the central bank would keep Japanese interest rates at ultra-low levels and maintain the current yield control policy. With Euro Area interest rates set to rise, the rate differential will widen between the two currencies, forcing EUR/JPY higher. On the flip side, the Japanese Yen may continue to pick up a safe haven bid, driven by continued turmoil in the US Regional Banking sector. After three bank failures already – First Republic Bank, Silicon Valley Bank, and Signature Bank – PacWest Bancorp is now under heavy selling pressure and maybe the next cab off the rank.

On Tuesday, EUR/JPY hit its highest level (151.61) since March 2008. If this high is taken out again, there is very little in the way of resistance before the 160 level which coincides with the March 2008 monthly high.

EUR/JPY Monthly Price chart – May 3, 2023

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.