EUR/USD and EUR/JPY Could Stand to Benefit This Week

Euro Analysis (EUR/USD, EUR/JPY)

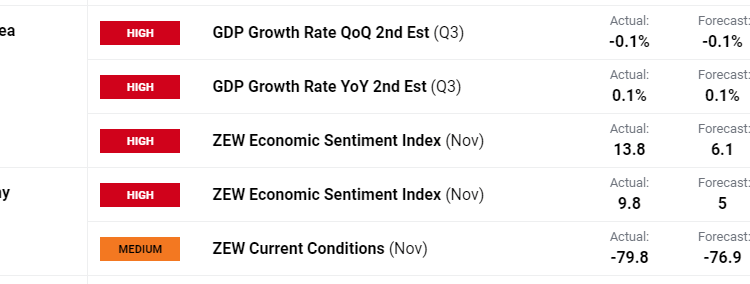

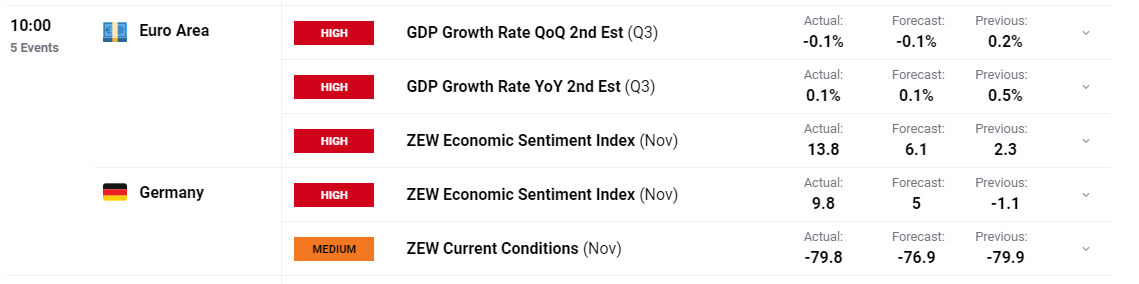

Second Data Estimate Points to Stagnant European Growth

Europe has been the center of pessimistic fundamental data in recent months as the global growth slowdown advances. Elevated interest rates are helping to constrain economic activity in order to bring down inflation but it remains a delicate balancing act as policy makers intend to avoid throwing the economy into a recession.

The euro area, according to two of the three estimates, contracted in Q3 of this year following a positive 0.2% expansion in Q2. However, the two quarters before that registered growth of 0% – highlighting the major headwinds for Europe.

Customize and filter live economic data via our DailyFX economic calendar

Recommended by Richard Snow

Introduction to Forex News Trading

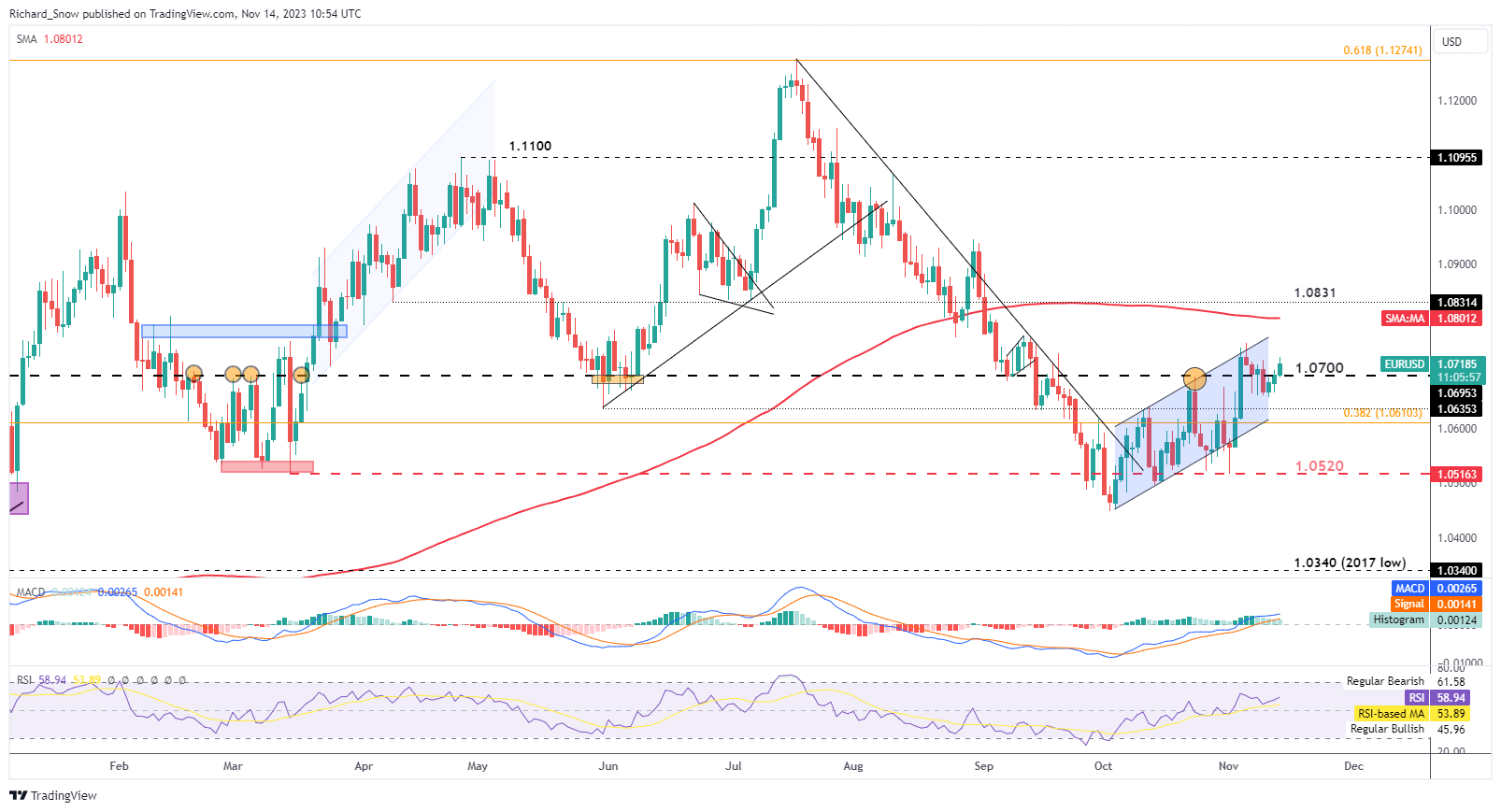

EUR/USD Rise Flatters the Fundamentally Depleted Euro

EUR/USD attempts to trade higher whiles within the ascending channel, having risen above the significant 1.0700. The recent softening of US data positions EUR/USD in the prime position should we see weaker CPI and retail sales data this week. Headline inflation is expected to slow while core is anticipated to remain sticky but retail sales could provide the most impact of the two if consumer spending declines sharply. The impressive Q3 surprise was driven to some extent by healthy consumption and consumer spending and any change in this trend could add to pessimistic forecasts in the US for Q4, sending the dollar lower.

The 200-day SMA and 1.0831 are the next levels of interest to the upside with 1.0700 as the immediate level of support, although, 1.0520 is a more significant support level.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Elevate your trading skills and gain a competitive edge. Get your hands on our bespoke EUR/USD trading guide today for unique insights around the most liquid currency pair on the planet:

Recommended by Richard Snow

How to Trade EUR/USD

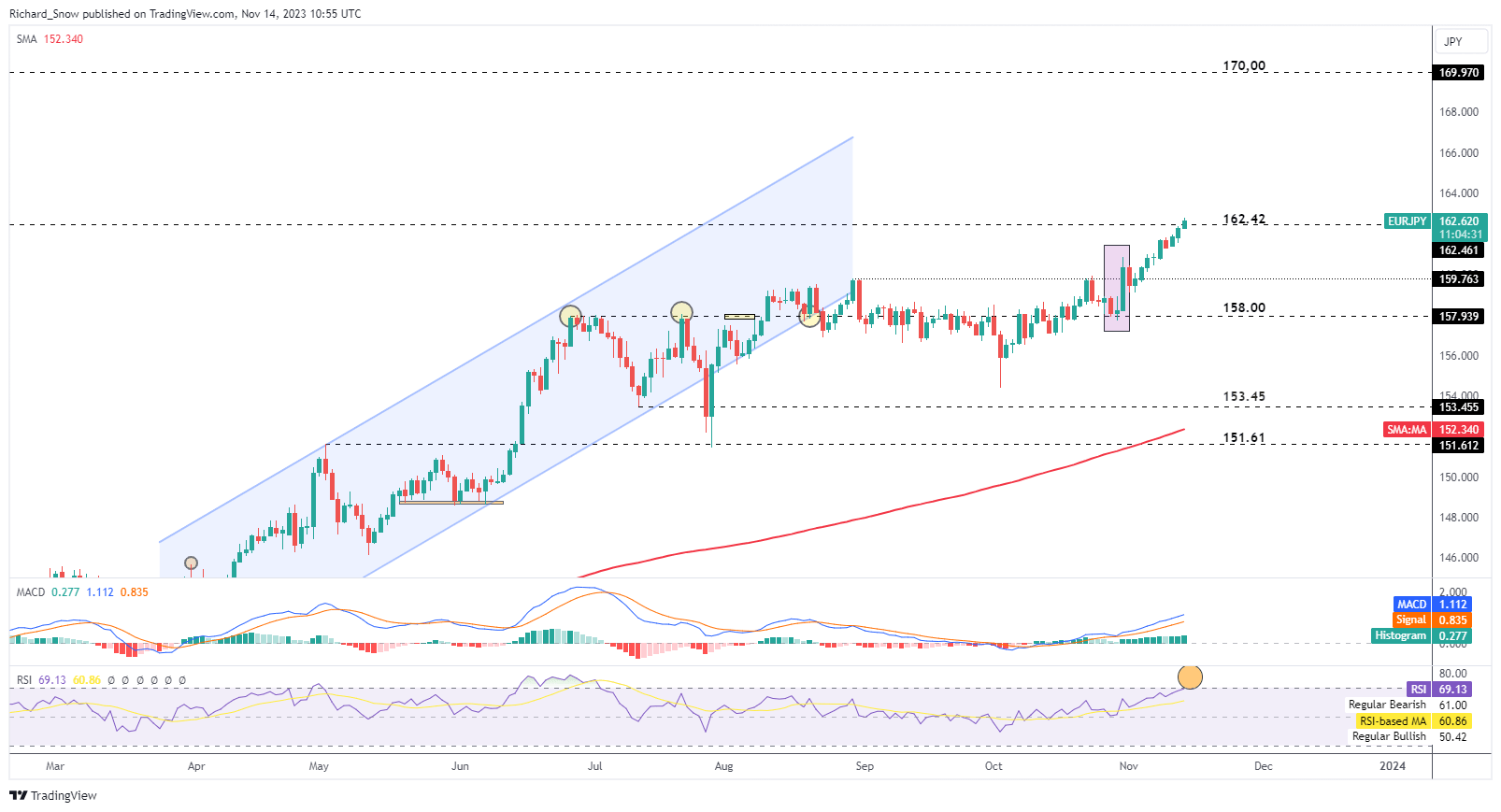

EUR/JPY climbs Past Resistance but FX intervention threat re-emerges

EUR/JPY has quietly gone about its business, rising higher day by day as the yen fails to appreciate despite the BoJ allowing greater flexibility for higher yields. The rise in the pair has more to do with the weak yen than arguments behind a bullish case for the euro.

Stagnant GDP growth in Europe continues to tell the story of a challenging internal and external environment. Perhaps the one positive is that ZEW sentiment data has turned more positive but it is a very small silver lining. The futures market now anticipate the possibility of ECB rate cuts as early as April next year despite ECB officials fiercely reluctant to even consider talking about the matter.

EUR/JPY trades above 162.42 and now opens up the next level of resistance at 170.00. Support lies at the prior swing high of 159.75 with a more established level of support at 158.00. FX intervention talk has re-emerged after this latest spate of yen weakness but markets appear to have grown weary of incessant jawboning. Nevertheless, keep an eye out for updates around the BoJ asking banks for FX quotes as this preceded prior intervention efforts.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.