EUR Bid on USD Weakness as Vulnerabilities Remain

EUR/USD ANALYSIS

- Weak US dollar providing sustenance for EUR.

- ECB officials in focus today.

- EUR/USD hits overbought zone on RSI, is bullish momentum fading?

Elevate your trading skills and gain a competitive edge. Get your hands on the Euro Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

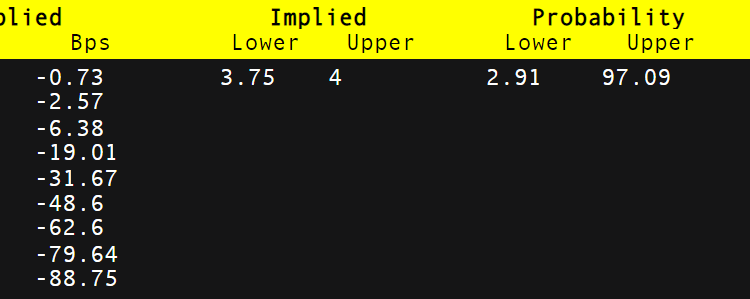

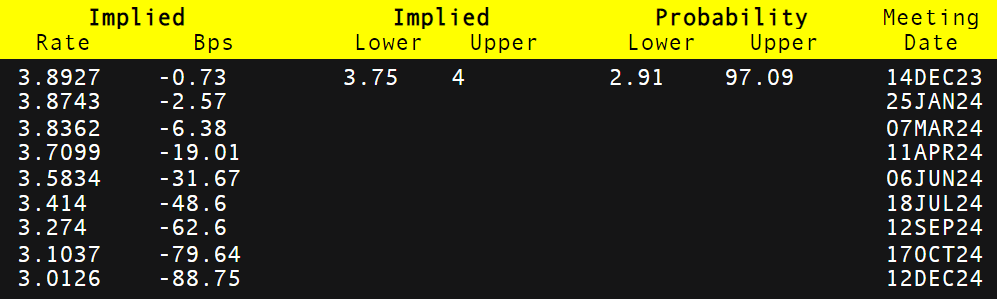

The euro has managed to maintain its upside against the USD this Monday after markets digest recent US and European economic data from last week. Both economies demonstrate slowing with the US a more recent addition, particularly via its labor data. From a European perspective, the inflation backdrop shows moderation in inflationary pressures that now have money markets expectant of the first European Central Bank (ECB) interest rate cut around April/June next year (refer to table below).

ECB INTEREST RATE PROBABILITIES

Source: Refinitiv

Despite the fact that ECB officials have been pushing back against this dovish narrative, forecasts have remain unchanged. Some quotes from the ECB’s Wunsch earlier this morning are shown below:

“Bets on rate reductions risk are prompting hike instead.”

“Markets are optimistic to rule out further hiking.”

“Rates should remain unchanged in December and January.”

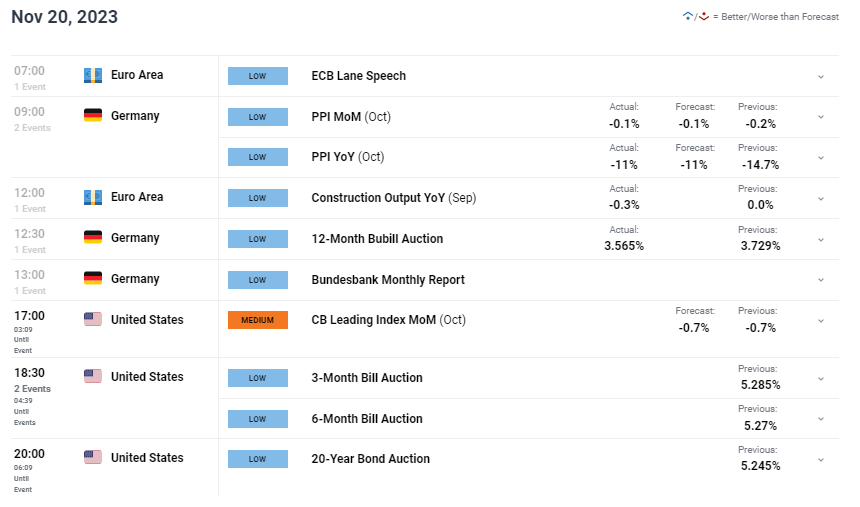

German PPI and euro area construction output statistics were (see economic calendar below) showed the weak economic state of the region which was reinforced by the Bundesbank monthly report that stated “the German economy continues to experience difficult economic conditions.” Although German PPI is less negative than the prior print, being a leading indicator for CPI could suggest further disinflation to come – a negative for the EUR.

On a more positive note, Chinese optimism has backed the euro today after recent positive Chinese data allowed for the PBoC to keep their LPR (1-year and 5-year) steady as prior stimulus measures seem to be improving the nations economy.

ECONOMIC CALENDAR (GMT+02:00)

Source: Refinitiv

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

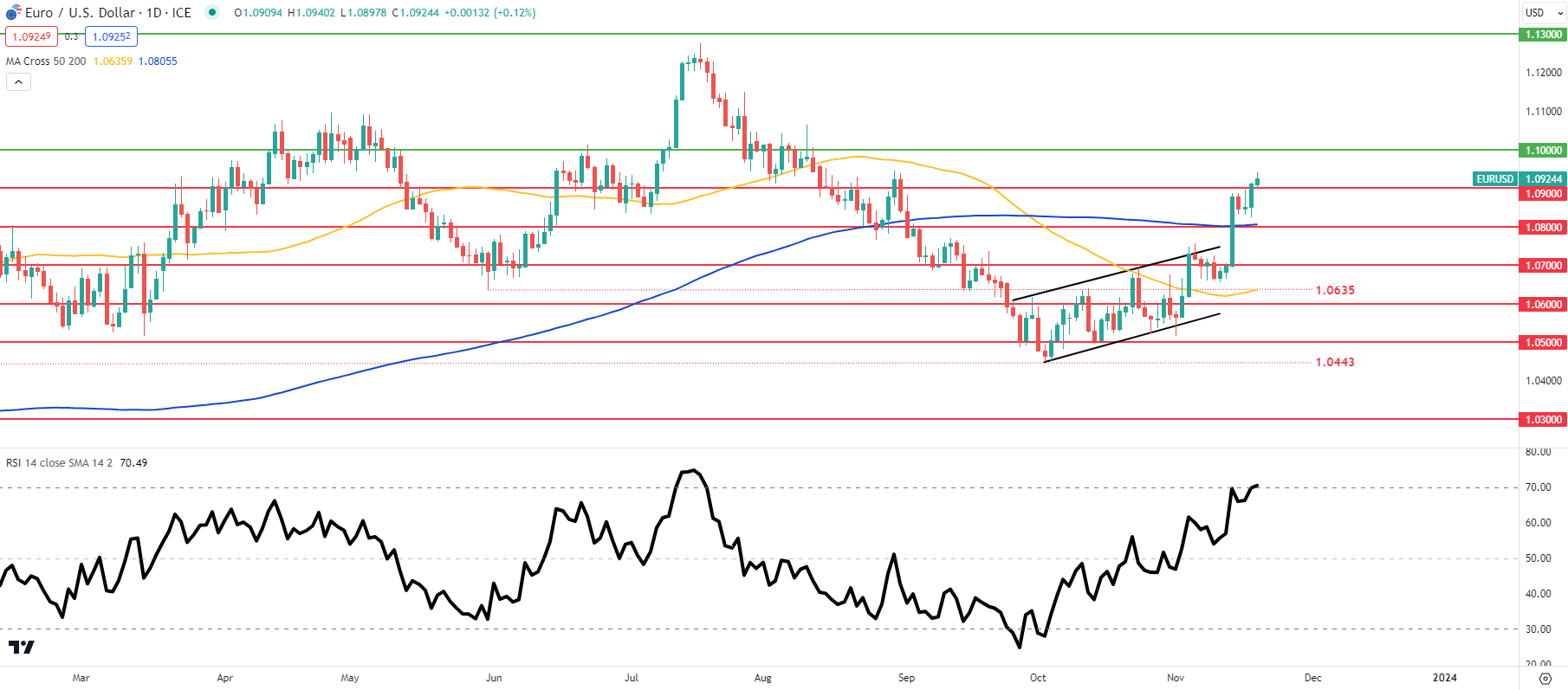

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD chart now trades above the 1.0900 psychological handle and the 200-day moving average (blue) respectively. That being said, bullish momentum may be short-lived as the Relative Strength Index (RSI) enters overbought territory and upcoming eurozone PMI’s are likely to disappoint. The pair may well trade back below 1.0900 by the week’s end.

Resistance levels:

Support levels:

- 1.0900

- 1.0800/200-day MA

- 1.0700

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently neither NET SHORT on EUR/USD, with 62% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.