ECB Hikes by 25 bps, Hints Rates Have Peaked

ECB Hikes by 25-bps, Hints at Reaching Terminal Rate

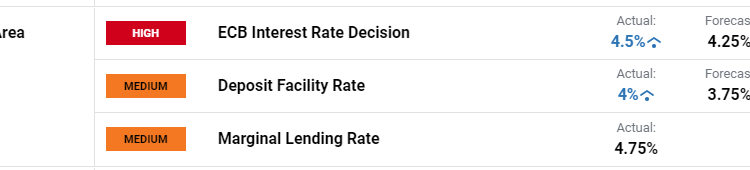

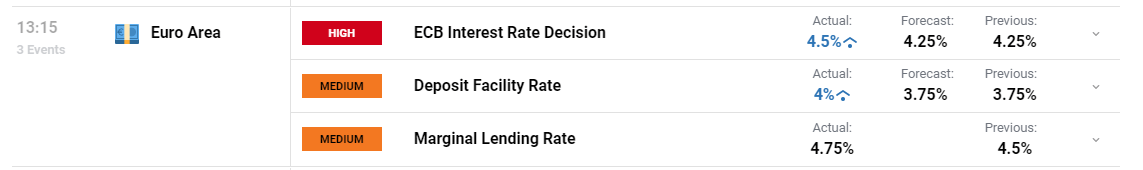

The ECB voted to raise all three interest rates, seeing the deposit facility up to 4%. The decision was taken after the committee’s assessment of the inflation outlook, incoming data and strength of monetary policy transmission necessitated a hike.

Customize and filter live economic data via our DailyFX economic calendar

The central bank has a sole mandate, price stability – meaning that the breaking news of rising inflation forecasts for 2024 ahead of the meeting had swayed the consensus in favour of a hike today.

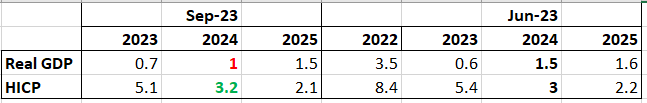

Staff Projections Confirm Rising HICP in 2024 and Forecast Worsening Growth Outlook

Source: ECB staff projections

Recommended by Richard Snow

Trading Forex News: The Strategy

Factors Influencing Future ECB Decision Making

Arguments against further hikes – Recession risk:

- Worsening sentiment indicators (ZEW econ sentiment, PMI data – manufacturing in Germany)

- Credit market – falling demand for new loans from both individuals and businesses

- Stubborn inflation is explained in part by (base effects) the three months of Germany’s stimulus rolled out in the summer of 2022 (cheap train tickets and lower taxes on gasoline)

Arguments for maintaining tight monetary policy – Lingering inflation concerns:

- Stubborn inflation (base effects) of Germany’s stimulus last summer adds uncertainty around upside surprised in inflation

- High wage growth, currently at 5% YoY in Q2

- ECB’s latest consumer expectations showed a minor lift in inflation expectations

- Recent rise in oil could represent a challenge to prior progress on inflation

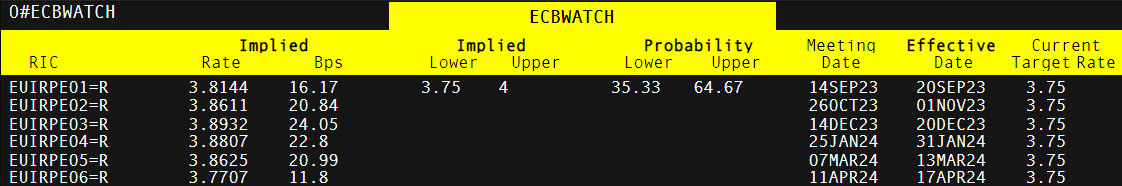

Ahead of the announcement, markets fully prices in a rate hike before the end of the year and got it straight away. With just 8 bps of tightening anticipated, it appears markets believe the ECB has reached the terminal rate – something the statement alluded to but there can be little doubt journalists will ask Christine Lagarde for confirmation on this at the press conference.

Markets receive the full 25-bps hike that was anticipated before year end

Source: Refinitiv, prepared by Richard Snow

Immediately after the announcement the euro sold off, particularly in EUR/USD as both US PPI and retail sales surprised to the upside 15 minutes after the ECB statement was released.

EUR/USD 5-Min Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade EUR/USD

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.