Dreadful German PMI Pushes EUR/USD Below 1.11

EUR/USD TALKING POINTS & ANALYSIS

- German PMI’s a cause for concern for the eurozone.

- ECB under pressure to revisit rate forecasts.

- 1.10 next up for bears.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

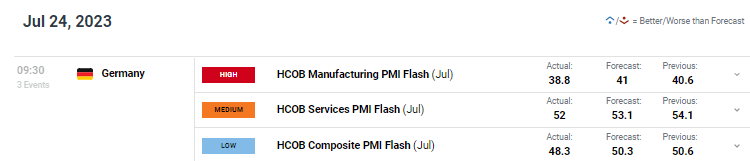

The euro’s recent struggles got worse this morning after German HCOB PMI data (see economic calendar below) missed on all fronts with manufacturing contracting further while services (the country’s major GDP contributor) slipping to 52 but remaining within expansionary territory. Germany being the largest eurozone economy, serves as a proxy for the region and with similar figures reflected by the French release, EZ data to come will likely echo this sentiment. Some important commentary from the report includes (Source: S&P Global):

- “Services new business falls for the first time in six months.”

- “There is an increased probability that the economy will be in recession in the second half of the year.”

- “The composite index moved into sub-50 contraction territory for the first time since January.”

- “The pace of employment growth across the German private sector slowed sharply in July.”

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EUR/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

The upcoming European Central Bank (ECB) interest rate decision this week will need to consider this data and the swift slowdown in economic data. Although I do not expect a change in current market pricing (refer to table below) that favors a 25bps hike with almost 100% certainty, subsequent guidance thereafter may begin on a dovish trajectory that could expose the euro further.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

EUROPEAN CENTRAL BANK INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily EUR/USD price action above has maintained its bearish course now below the 1.1096/1.1100 zone ahead of the highly anticipated ECB rate decision. With more scope for a dovish repricing from the ECB relative to the Fed, the pair may well extend its downside towards the 1.1000 psychological support handle.

Resistance levels:

Support levels:

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently SHORT on EUR/USD, with 65% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning we arrive at a short-term downside bias.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.