Dow and Dax Fail to Extend Wednesday’s Bounce, but Nasdaq 100 Holds above Support

Article by IG Chief Market Analyst Chris Beauchamp

Dow Jones 30, DAX 40, Nasdaq 100 Analysis and Charts

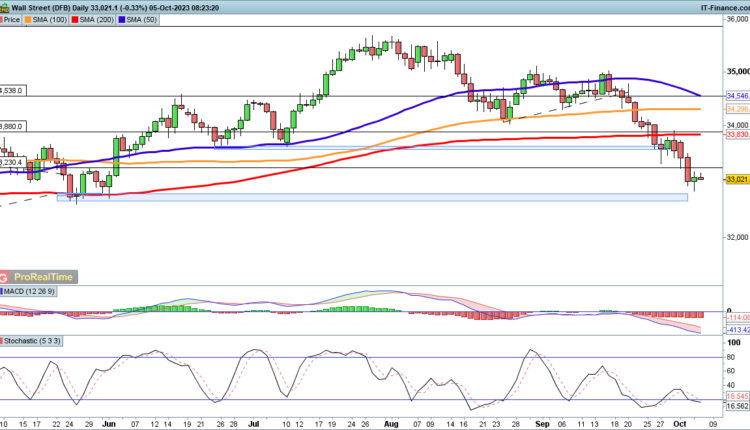

Dow fails to build on Wednesday’s recovery

The index rallied off its lows yesterday, after heavy losses on Tuesday and Wednesday.Bulls now need to push the price back on above 33,230 to indicate that a low might be in. This might then allow the index to push on toward the 200-day simple moving average (SMA).

Intraday charts show the downtrend of the past month remains intact, and a lower high appears to be forming around 33,130. Continued declines target the May lows around 32,670.

Dow Jones 30 Daily Chart

Download our Brand New Q4 Equity Outlook

Recommended by IG

Get Your Free Equities Forecast

Nasdaq 100 holds above key support

Wednesday saw the index test the 14,500 level for the second time in a week.Once more the buyers showed up to defend this level. But for a more durable low to be in place we would need to see a pushback above 14,900. This might then open the way to trendline resistance from the July highs.

A daily close below 14,500 revives the bearish view and puts the price on course to 14,230, and then down to the 200-day SMA.

Nasdaq 100 Daily Chart

Recommended by IG

Building Confidence in Trading

DAX 40 bounce fizzles out

Like other indices, the Dax managed to rally off its lows on Wednesday, but early trading on Thursday has not seen much bullish follow-through.Additional declines target the 14,750 area, the lows from March, while below this the 14,600 highs from December 2022 come into play as possible support.

A close back above 15,300 might help to indicate that a low has formed for the time being.

DAX 40 Daily Chart

What Makes a Successful Trader?

Recommended by IG

Traits of Successful Traders

Comments are closed.