Crucial Takeaways from the FED, BoE and ECB

Major Central Bank Roundup and Analysis

- Fed: The Fed still has questions around softer inflation but markets call its bluff

- Bank of England hints at a rate pause but keeps the door open to further hikes if required

- A unified ECB calls for multiple 50 bps hikes after this one as core inflation refuses to budge

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Traits of Successful Traders

The Fed Still has Questions around Softer Inflation but Markets Call its Bluff on Rate Hikes

Decision: 25 bps hike (in line with consensus)

The Fed voted in favor of a downshift and hiked interest rates by 25 basis points at Wednesday’s FOMC meeting. This was the latest development in the fight against multi-decade high inflation as policy setters prepare to end the aggressive ascent in the benchmark interest rate to a level that is deemed to be ‘sufficiently restrictive’.

So where is that level? Jerome Powell mentioned in the press conference that the committee is yet to decide where the policy rate will land up but remains open to “ongoing increases”, which Powell expanded on by stating that “ we’re talking about a couple more rate hikes to get to appropriately restrictive stance”. This suggests another 25 bps hike in March and then in May too which would bring the Fed Funds rate to 5.00 – 5.25% – aligning with the Fed’s December median dot plot projections of 5.1%.

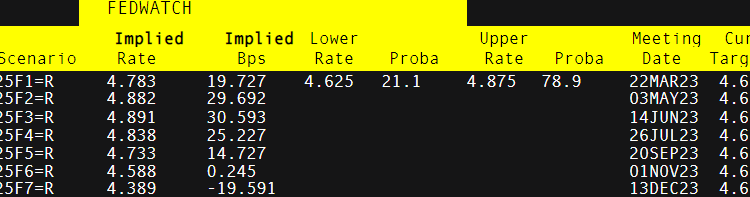

However, markets don’t agree. In fact, the Fed’s admission that, “inflation has eased somewhat but remains elevated” was all it needed to double down on dovish bets that the Fed won’t hike above 5% and even seeing the first rate cut in the second half of the year according to the implied rate below, derived from Fed Funds futures.

Implied Probabilities of the Fed Funds Rate

Source: Refinitiv prepared by Richard Snow

Market Implications

Risk appetite surged after the release of the statement and what initially appeared as a promising break of the long-term trendline resistance in US equities, is now shaping up for a trend reversal as the S&P 500 touched a 20% advance off its October low – a sign of a technical bull market.

S&P 500 Daily Chart Showing 20% Advance off the Low

Source: TradingView, prepared by Richard Snow

The move appears to defy concerns around a recession in the US, which is yet to be dismissed despite US GDP data posting two successive quarters of growth for Q3 and Q4. US yields and the dollar edged lower and appear susceptible to further declines despite forward guidance of higher rates ahead. Smaller rate hikes but rate hikes, nonetheless.

Bank of England Hints at a Rate Pause but Keeps the Door Open to Further Hikes

Decision: 50 bps hike (in line with broad consensus)

The Bank of England continues to be a reluctant hiker, more so than its peers, which is understandable considering the dire economic projections and the threat of double-digit inflation. The monetary policy committee (MPC) removed previous language in its report that was suggestive of further rate hikes at the time, language like “it will respond forcefully” on rates and that “further increases in bank rate may be required” – suggesting a possible pause which sent sterling lower.

GBP/USD Daily Chart Showing Signs of a Pullback

Source: TradingView, prepared by Richard Snow

Some good news, or should I say ‘less bad news’ is that the Bank foresees a shallower economic contraction over a shorter time horizon than before. However, this does not allow the Bank more license to hike but merely serves as a silver lining for the contracting economy.

Market Implications

The news of a possible pause sent UK Gilt yields lower across multiple classifications (mainly the 2 and 10-year yields), putting a halt on a rather impressive recovery in GBP/USD from the low levels witnessed during the brief term of the Liz Truss government. All the above considered things do not look good for sterling but that tends to prop up the local FTSE 100 index which continues to benefit from its lack of tech stocks and composition which comprises of mining and oil stocks which continue to enjoy outsized profits.

UK 10-Year Gilt Yield (Daily Chart)

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Building Confidence in Trading

A unified ECB calls for multiple 50 bps hikes after this one as core inflation refuses to budge

Decision: 50 bps hike (in line with consensus)

The ECB’s governing council members wasted no time to communicate the 50-basis point hike announced yesterday in the lead up to the meeting and thus it was no surprise when the news broke. For anyone questioning the degree to which the ECB is looking to hike going forward, this was made abundantly clear as ECP President Christine Lagarde echoed the need to continue to hike rates aggressively.

It was also decided that the Bank needed to start pulling back from its stimulatory bond buying programmes at a responsible pace and repeated the December guidance that a proportion of maturing instruments will not be reinvested, otherwise known as tapering.

Not long after the meeting, the infamous ‘ECB sources’, which are anonymous leaks of some members in the council who wish not to be named, suggested a preference for a terminal rate of 3.5% (one percentage point above the current level).

Market Implications

A somewhat more resilient economy in Europe has witnessed a sharp turnaround in sentiment and optimism, which, when combined with a rising interest rate differential with the US, bodes well for continued euro advancement. German bund yields have recently been rising as US yields continue to head lower.

EUR/USD Daily Chart Attempting to Build on a Bullish Continuation

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.