Copper Rebound Gains Pace After the PBoC Lowered Chinese Borrowing Costs

Copper News and Analysis

- China lowers short-term lending rates to support economic recovery

- Industrial metals like copper benefitted from a lift in sentiment as prices rose

- FOMC remains the most impactful item on the economic calendar this week

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Learn the number one mistake traders make and avoid it

China Lowers Short-Term Lending Rates to Support Recovery

The People’s Bank of China (PBoC) lowered the 7-day reverse repo rate to 1.9% which previously stood at 2% in its latest attempt to support the economy’s recovery. Given this show of support, it wouldn’t be too far of a stretch to see the One-Year Medium-Term Lending Facility (MLF) and the Loan Prime Rate (LPR) edge lower too.

Signs of waning demand for industrial metals from China, has led to the overall decline in copper prices for the majority of 2023. The timing of China’s reopening, after an extended period of targeted lockdowns to curb the spread of Covid, happened at an unfortunate time as major economies entered a period of below trend growth as interest rates remain relatively high.

Copper Technical Analysis

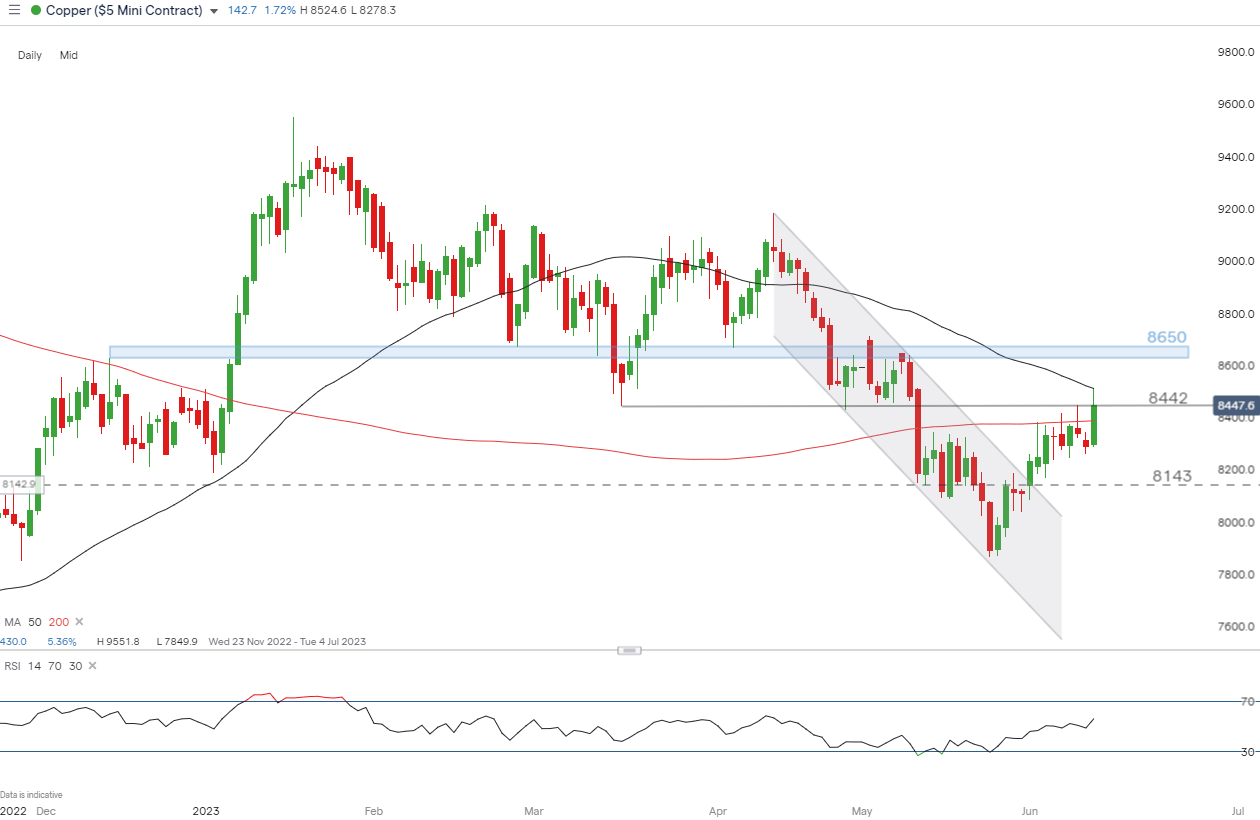

The copper chart below highlights the channel in which copper prices accelerated to the downside on worse than anticipated Chinese data. Economic data out of the region has essentially been ‘mixed' with some decent and other rather disappointing figures. For example, the version of manufacturing PMI revealed that the largest sector in the Chinese economy currently experiences a contraction while the Caixin version re-entered expansionary territory with new orders reaching a 2-year high.

The current retracement of the April decline picked up momentum after the news broke in the early hours of the morning but the bullish rise appears to be finding resistance at the 50 simple moving average – which corresponds to the high of the day – and the prior swing low at 8442, where prices reside at the time of writing.

The nearest zone of resistance above the aforementioned levels, appears at 8650 while support comes in at 8143, followed by the yearly low around 7867.

Copper Daily Chart

Source: IG, prepared by Richard Snow

FOMC to Decide on a Rate Hold and Updates Economic Projections

Tomorrow, we find out of the Fed has decided to keep rates on hold, with a view to hike in July. This remains the consensus view as markets price in a 94% chance of a rate skip tomorrow – up from around 80% witnessed before the lower CPI number was released this morning. The Fed has the unenviable task of avoiding another rate hike but expressing a hawkish view to keep markets from pricing in more rate cuts. Nevertheless, a ‘skip' on rate hikes favors the commodity, much like it would gold. A slightly weaker dollar may also add to the copper retracement.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.