Consumer Confidence Sinks as Recession Headwinds Grow, USD Gains on Risk-off Mood

US CONSUMER CONFIDENCE KEY POINTS:

- April consumer confidence sinks to 101.3, well below consensus estimates of 104.00

- The slump in the headline index can be attributed to a sharp pullback in the survey’s expectations component

- U.S. Dollar (DXY) extends gains despite disappointing data amid risk-off sentiment

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: S&P 500 Forecast: MSFT, GOOGL, AMZN and META Earnings to Guide Markets

A popular gauge of U.S. consumer attitudes worsened more than expected in April after a small rebound at the end of the first quarter, a sign that Americans are beginning to take a more pessimistic view of the economy amid stubbornly high inflationary pressures, elevated interest rates and growing recession risks.

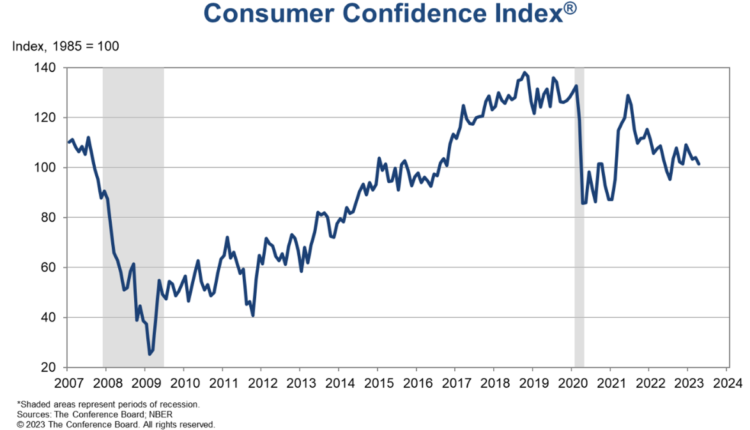

According to the Conference Board, consumer confidence fell to 101.3 this month from a downwardly revised reading of 104.00 in March, clocking in below consensus estimates calling for a more modest pullback to 104.5. When sentiment deteriorates, families tend to cut back on spending. This can become a problem for the economy, given that household consumption is the main driver of U.S. gross domestic product.

Source: Conference Board

Looking at the survey’s individual components, the present situation indicator, based on the assessment of current business and hiring conditions, rose modestly to 151.1 from 148.9 in the previous period, but the expectations index, which tracks short-term prospects for income, the business environment, and the labor market, took a nosedive, plunging to 68.1 from 74.00.

Focusing on the expectations index, readings below the 80 level tend to be associated with recessions, so a print of 68.1 is quite alarming and suggests that the country may be headed for a downturn later this year, especially if spending begins to downshift rapidly in the coming months.

All things considered, consumer confidence's results point to deteriorating economic conditions and cloudy skies on the horizon. This may prompt the Fed to embrace a less aggressive stance sooner than anticipated to contain downside risks from spreading/materializing.

In theory, a monetary policy pivot should be bearish for the U.S. dollar unless market turbulence intensifies and sparks flight to safety episodes, in which case, the greenback will stand to benefit. This appears to be the case Tuesday, with the U.S. dollar index extending gains after underwhelming economic data.

Recommended by Diego Colman

Forex for Beginners

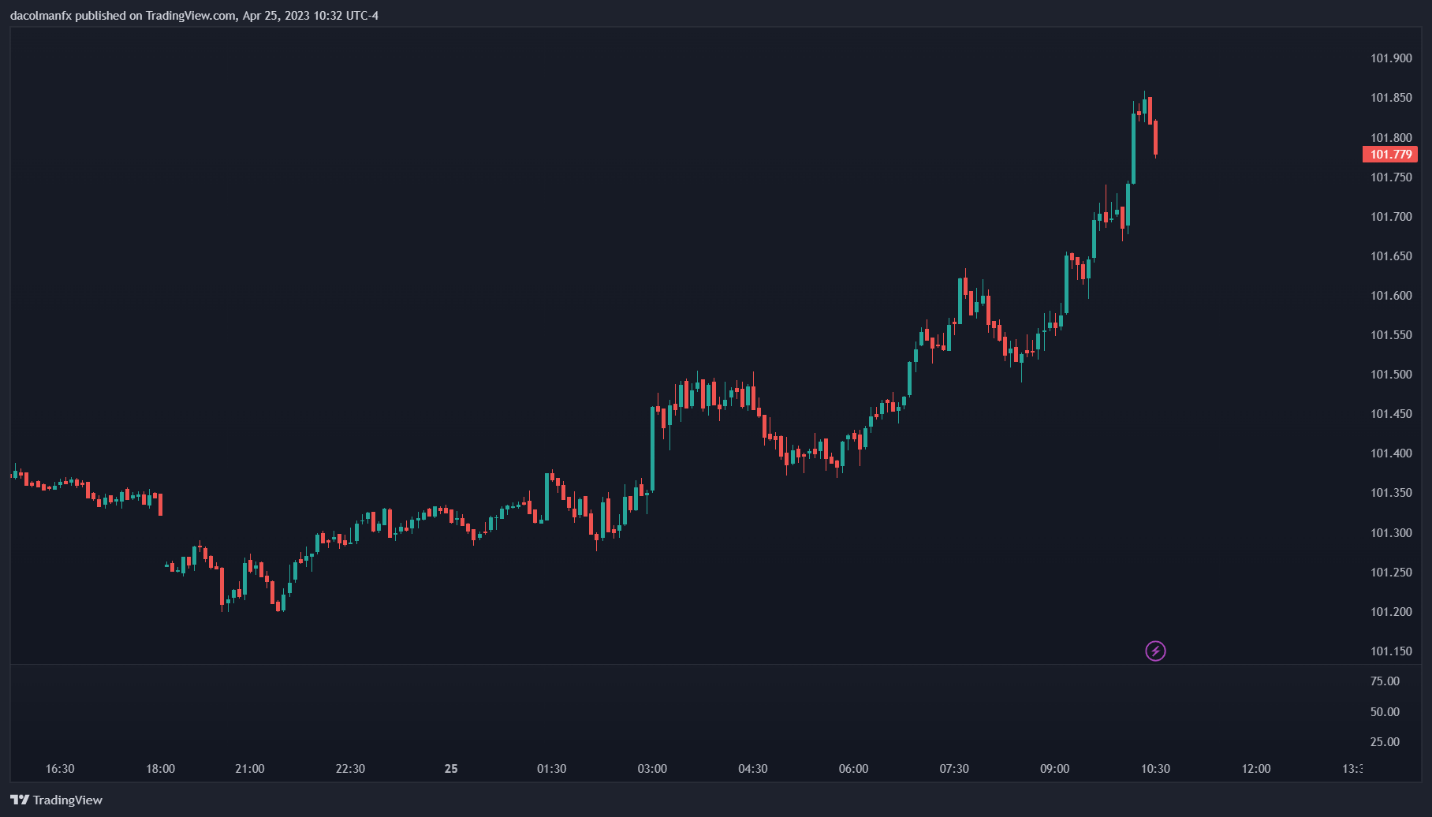

US DOLLAR (DXY) 5-MINUTE CHART

Source: TradingView

Comments are closed.