Constellation Energy (CEG) riding the renewable energy bullish wave

Amid the global momentum toward sustainable energy, Constellation Energy (CEG) stands out as a dynamic player in the renewable sector. In this article, we explore CEG’s recent performance, analyze its technical structure, and highlight its promising potential for further growth.

Following its spinoff from Exelon Corporation (EXC) on February 1, 2022, Constellation Energy Corporation (CEG) commenced trading as an independent entity. Since then, CEG has actively participated in the stock market, experiencing a remarkable 160% increase.

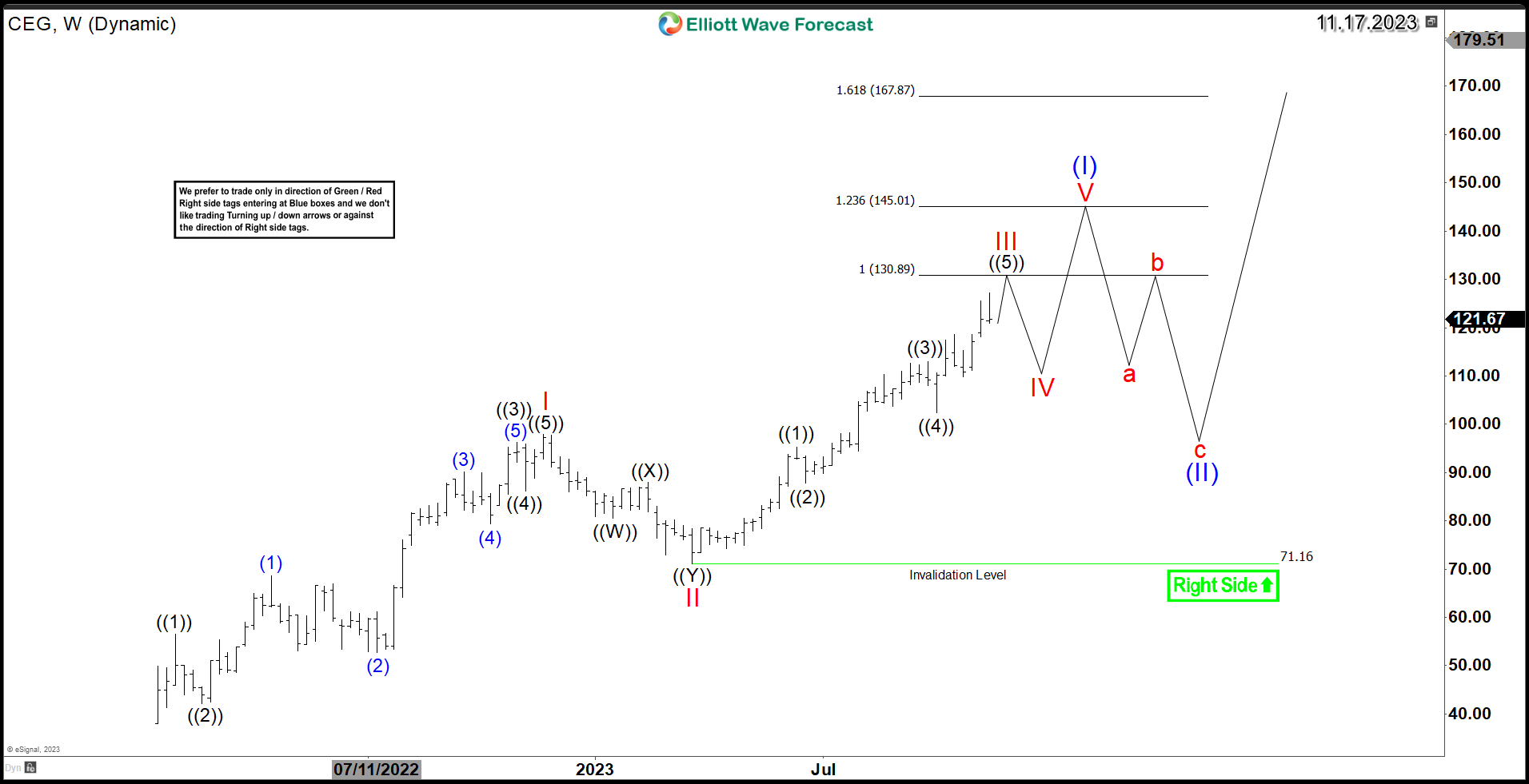

CEG Elliott Wave weekly chart 11.17.2023

The stock rally, which has been unfolding since last year, follows an impulsive structure. Currently, it remains within wave III, targeting the equal legs area between $130 and $145. Anticipate a 3-wave pullback in wave IV before another upward rally to complete wave V of wave (I).

The bullish structure is anticipated to provide support for the stock during the upcoming daily correction wave (II). This correction phase ideally presents a buying opportunity for long-term investors, as the stock is poised to resume its trend within another impulsive rally.

In summary, Constellation Energy Corporation (CEG) leads the charge in the renewable energy revolution. Its spinoff from Exelon Corporation (EXC) was a pivotal moment, propelling the stock into impulsive waves. Investors should keep an eye out for buying opportunities during corrective phases. With unwavering commitment to clean energy and a dynamic market presence, CEG shines as a beacon for long-term growth in our ever-evolving energy landscape.

Comments are closed.