Commodity Prices Reinforce Aussie While USD Slips

AUD/USD ANALYSIS & TALKING POINTS

- Australian building permits data dismissed by markets.

- Upcoming data this week will dictate AUD/USD.

- AUD/USD falling wedge breakout may be cut short this week.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar extends its gains from last week as risk sentiment improves post-NFP. AUD /USD will be influenced by two key announcements including US CPI and Australia’s Federal budget for 2023. Treasurer Jim Chalmers will be under the spotlight with focus on the cost of living package intended to aid in buffering the impact of inflationary pressures.

Today’s data centered around Australia’s housing markets but with mixed data, the AUD largely dismissed the release and reacted to a weaker greenback. In addition, Australia’s major commodity exports inched higher involving wheat, iron ore and gold to name a few. Considering many markets are on holiday today, liquidity is likely to remain thin with low volumes. If no surprise announcements or data come through, AUD/USD price action should remain relatively rangebound and influenced by technical factors.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

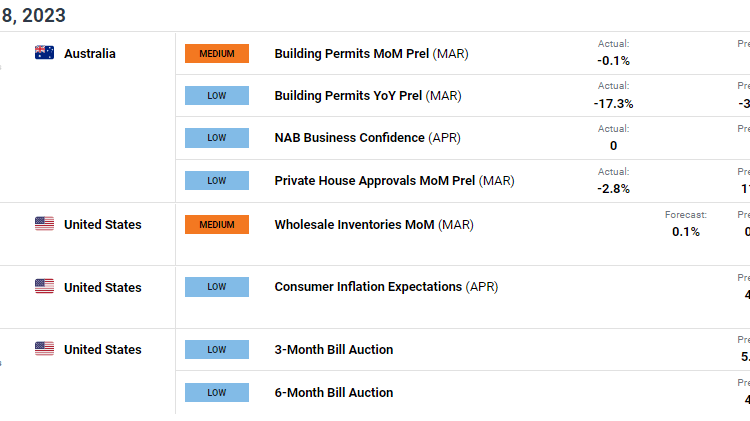

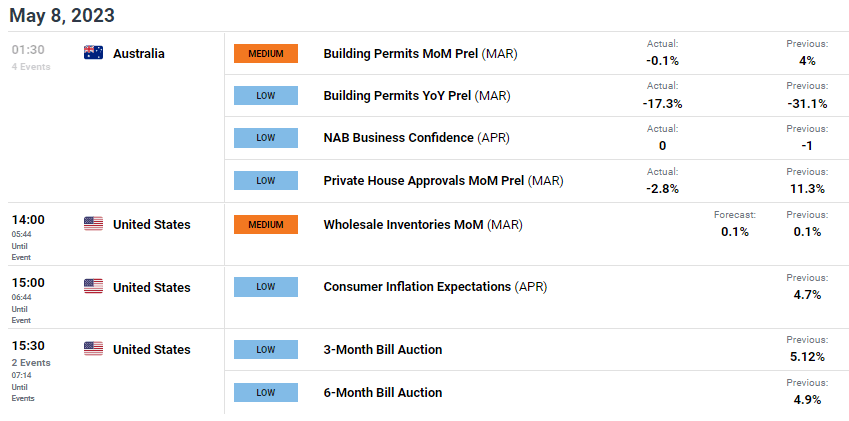

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

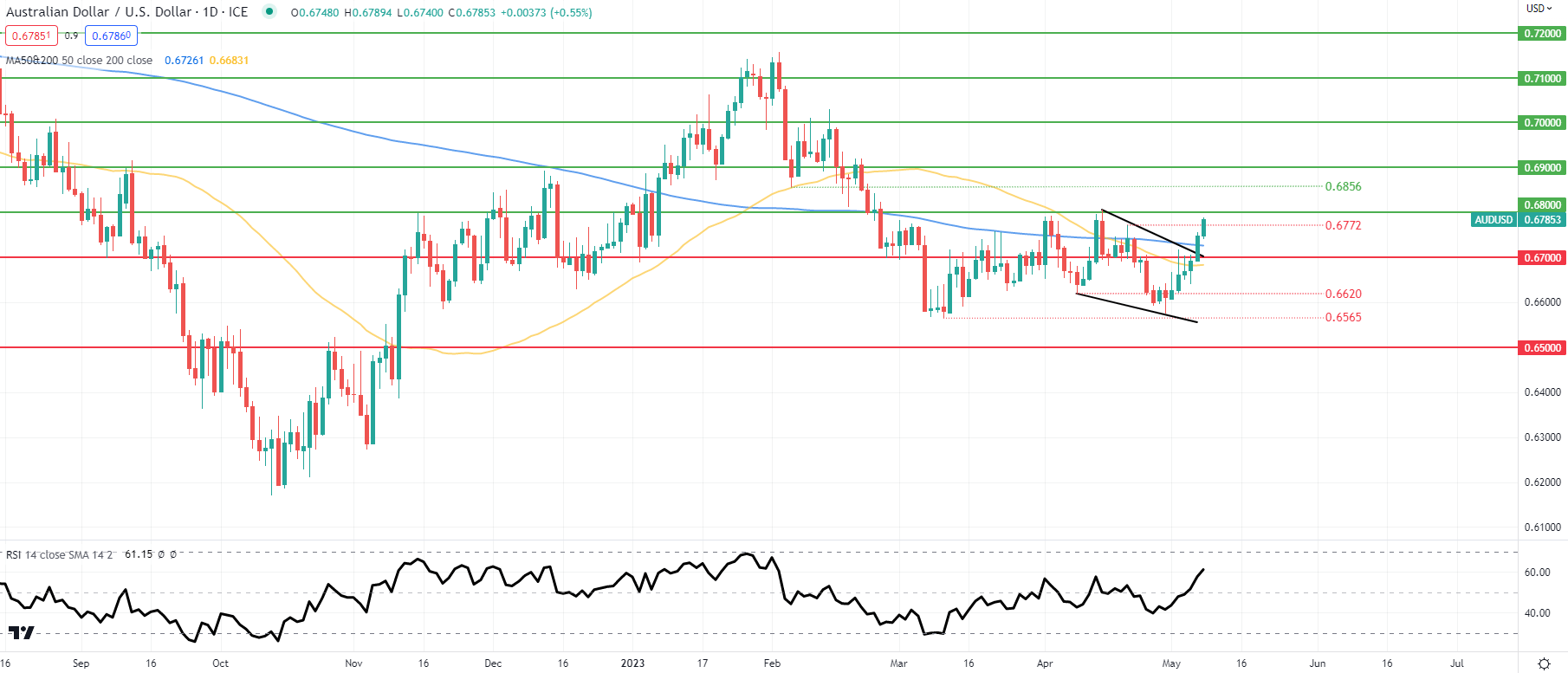

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The recent falling wedge pattern (black) breakout on the daily AUD/USD chart may have room for further upside but if US CPI comes in hotter than expected, bears may jump back into the market and target the 200-day MA (blue) once more.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently LONG on AUD/USD, with 51% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment resulting but due to recent changes in long and short positioning, we arrive at a short-term bullish disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.