Cluster Support in Play after Breakdown. More Pain Ahead?

NASDAQ 100 OUTLOOK:

- Nasdaq 100 breaks down, falling to its lowest level since late May after breaching a key floor

- For sentiment to improve, cluster support in the 14,150/13,930 range must hold at all costs

- This article analyzes the key technical levels worth watching on the NDX in the coming days.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: British Pound Outlook: GBP/USD Bounded by Fibonacci Support & Trendline Resistance

The Nasdaq 100 broke down after breaching technical support located in the 14,600 area. This bearish development intensified the decline, pushing the technology index to its lowest level since late May and into correction territory, characterized by a pullback of more than 10% but less than 20% from its recent high.

Mixed earnings from heavy hitters, such as Alphabet and Meta, coupled with elevated U.S. Treasury yields across the curve, have contributed to the prevailing atmosphere of pessimism, creating an unfavorable environment for risk assets.

Positive economic data hasn't succeeded in boosting the mood. While activity remains extremely resilient today, investors are forward-looking and deem that the economy won’t be able to sustain its performance for much longer, especially with the Fed hell-bent on keeping rates high for an extended period as part of its fight against inflation.

If you're in search of a more comprehensive view of U.S. equity indices, our Q4 stock market trading guide is packed with great insights. Download it now!

Recommended by Diego Colman

Get Your Free Equities Forecast

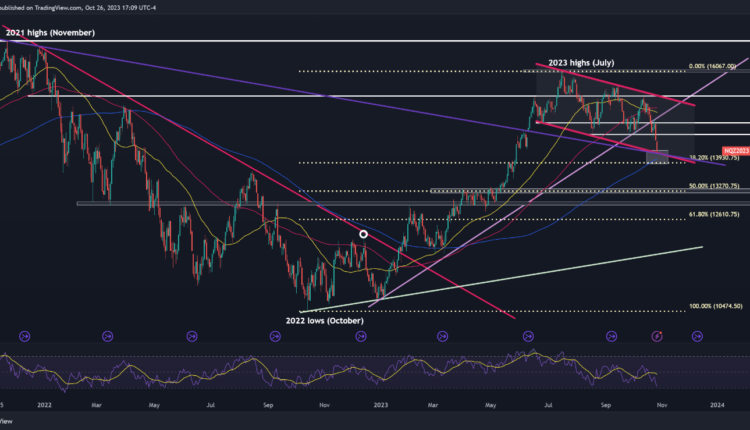

Taking a look at price action, the Nasdaq 100 has fallen towards an area of cluster support that extends from 14,150 to 13,930, where the lower boundary of the short-term descending channel aligns with the 200-day simple moving average and the 38.2% Fibonacci retracement of the Oct 2022/Jul 2023 rally.

For sentiment to improve, it is imperative for confluence support in the 14,150/13,930 range to hold firm. Any failure to maintain this critical zone could trigger a large selloff, potentially taking the equity benchmark towards 13,270, which coincides with the 50% retracement of the move discussed above.

In the event that dip buyers return and spark a bullish turnaround, initial resistance lies at 14,600. Upside clearance of this key ceiling could reignite upside momentum and set the stage for a move higher to 14,860. On further strength, the market focus will transition to 15,100.

Looking for actionable trading ideas? Download our top trading opportunities guide loaded with interesting technical and fundamental strategies!

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

NASDAQ 100 TECHNICAL CHART

Nasdaq 100 Futures Chart Created Using TradingView

Comments are closed.