Bulls Renew Upside Rally, $1850 in Sight

GOLD PRICE, CHARTS AND ANALYSIS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

MOST READ: Euro Area Core Inflation Prints Fresh Record High, EUR/USD Steady

Gold (XAU/USD) FUNDAMENTAL BACKDROP

Gold prices continued their march higher this morning on the back of a softer US dollar and Treasury yields retreating from multi-day highs. Gold has enjoyed a stellar week and is on course to arrest a 4 week slide from the YTD high posted on February 2 of $1959.

The recent positive manufacturing data out of China including this morning’s Caixin composite and services PMI numbers coupled with positive developments regarding trade talks between the US and China have no doubt helped fuel the rally.

Recommended by Zain Vawda

Top Trading Lessons

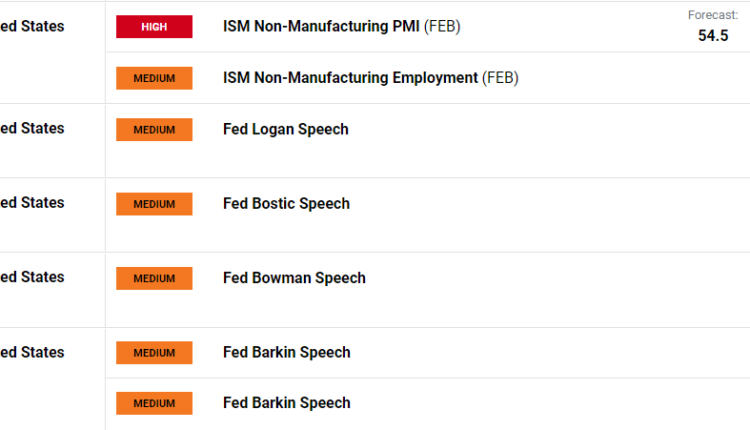

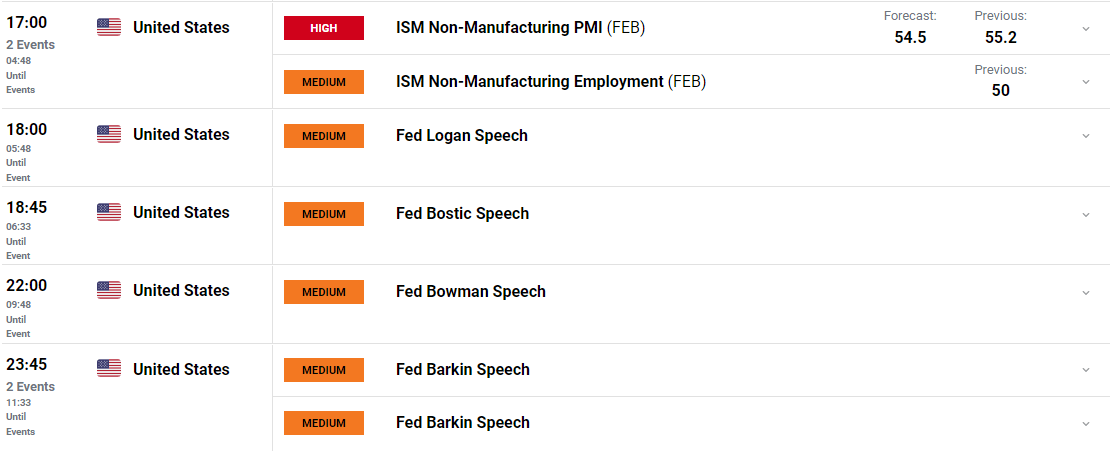

Later today we have US ISM services data out which is likely to drive any further moves for the precious metal on an intraday perspective. The services data has come in mixed over the past two months with the December number of 49.2 followed up by the January print of 55.2, todays print holds even more significance. It will provide a clear indication as to which print was the outlier over the holiday period and could provide further impetus for USD bulls and drag gold away from its multi week highs. Following the ISM data, we do have a host of Federal Reserve policymakers speaking with Bostic, Bowman, Logan and Barkin bringing the week to a close.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

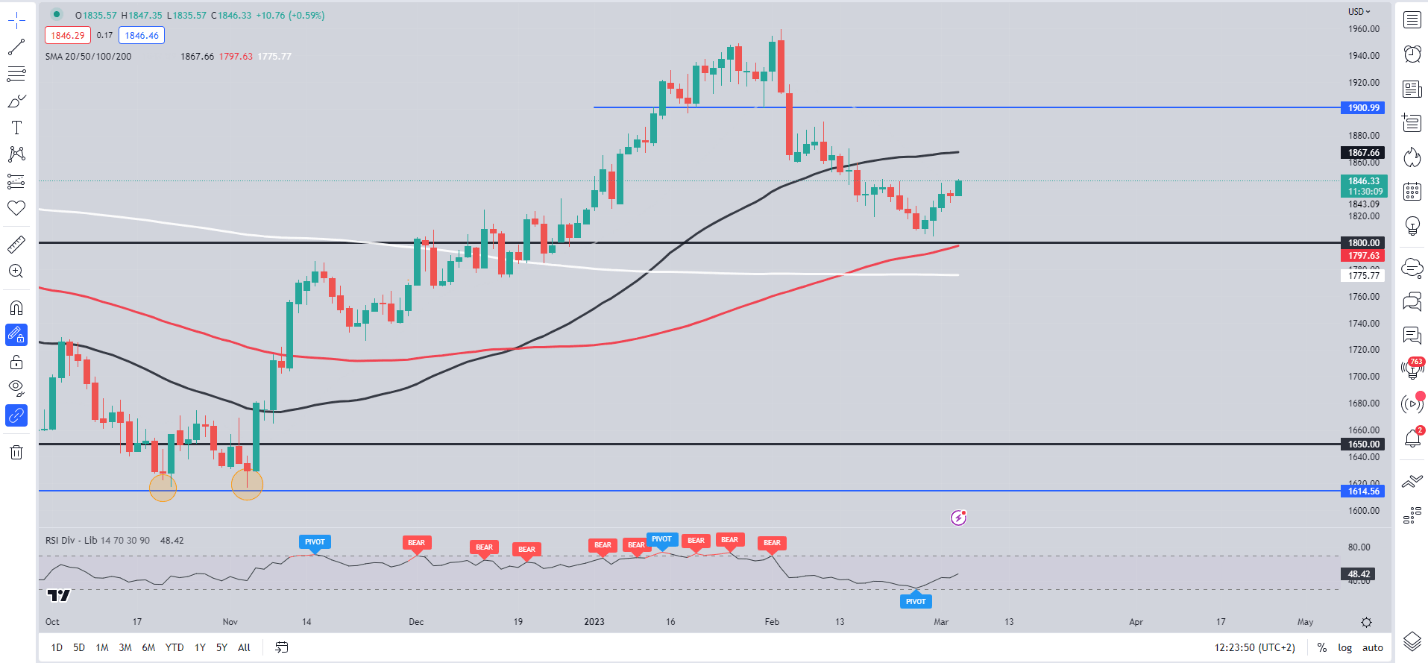

From a technical perspective, Gold has printed a fresh two week high this morning just short of the $1850 psychological level. There isn’t much in the way in terms of resistance with the next level of resistance lying around the $1866 handle which lines up with 50-day MA.

The weekly timeframe is on course for a bullish engulfing candle close a having bounced off the 50 and 100-day MA. A close above $1845 to end the week will no doubt leave gold bulls in a strong position heading into a big week of data with the NFP jobs report and testimony from Federal Reserve Chair Jerome Powell.

Gold (XAU/USD) Daily Chart – March 3, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA

IGCS shows retail traders are currently LONG on XAU/USD, with 70% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment and the fact that traders are LONG suggests that XAU/USD prices may fall.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.