Bulls Eye Retest of 100-Day MA Ahead of a Busy Week

EUR/USD PRICE FORECAST:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

READ MORE: Euro Forecast: EUR/USD on Thin Ice Before Fed Decision, ECB Unlikely to Tip Scales

EUR/USD has had a mixed start to what is setting up to be a blockbuster week for markets in general. The Euro lost ground in the Asian session before a rebound ahead of the European open and continued strength since leaves the pair trading at 1.0775 at the time of writing.

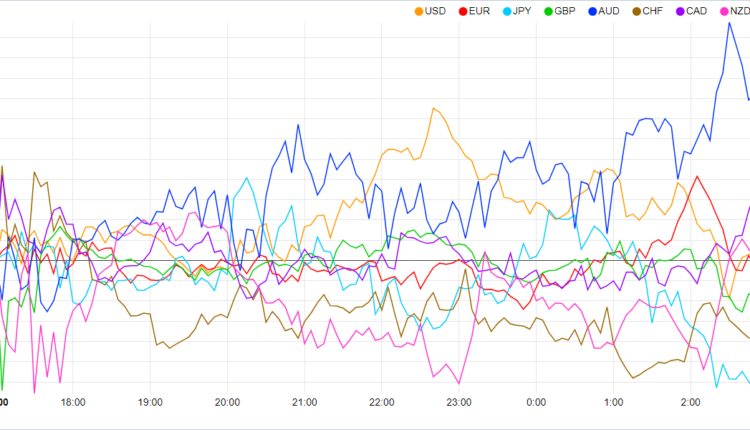

Currency Strength Chart: Strongest – AUD, Weakest – JPY.

Source: FinancialJuice

WEEK AHEAD, US CPI AND CENTRAL BANK MEETINGS

Looking at the Dollar Index (DXY) and the currency strength chart above we can see the US Dollar is currently hovering in the middle of the pack with my expectation that the Dollar will hold the high ground ahead of tomorrow's US CPI release. EUR/USD is likely to remain at the mercy of the DXY until markets digest the data out this week which could provide a clearer direction for the pair as we head toward Q3. A hot CPI print from the US tomorrow could lend support to the greenback and push EUR/USD lower toward last week’s lows sub-1.0700.

European Central Bank (ECB) policymakers have maintained their hawkish rhetoric while markets continue to price in a pause from the Federal Reserve this week with a hike seen more probable in the July meeting. The fundamental dynamics at play in EUR/USD make the pair an interesting one at present with further upside favored as the Fed is expected to pause while the ECB continues to lag following a late start to its hiking cycle. Is Thursdays rally the start of the next leg to the upside or will we see a retest of the 1.0500 handle?

A quiet day on the calendar today or the calm before the storm if you like as major risk events start tomorrow. We could be in for a slow day as market participants look to position and take profit ahead of what could be defining week for the rest of 2023.

For all market-moving economic releases and events, see the DailyFX Calendar

Recommended by Zain Vawda

Traits of Successful Traders

TECHNICAL OUTLOOK AND FINAL THOUGHTS

Looking at EURUSD from a technical perspective and we could be at the starting of a new bullish leg to the upside. The strong area of support around the 1.0680-1.0700 area lined up perfectly with the 78.6% Fib retracement level while current price action is beginning to look promising on the daily chart. Price is currently trading just shy of the 100-day MA around the 1.0800 handle which could prove a tough hurdle to cross ahead of tomorrow's data release.

The current fundamental drivers are strong and this week’s data releases could shape the next move for EUR/USD. A strong CPI print tomorrow could see the dollar strengthen and facilitate a push back into the support area around the 1.0680 handle. The forward guidance from both the Fed and the ECB could give us a better picture as to the direction of EURUSD heading into Q3 and at this stage could hold more weight than the actual rate decisions.

Key Levels to Keep an Eye On

Support Levels

Resistance Levels

- 1.0800 (100-day MA)

- 1.0840

- 1.0900

EUR/USD Daily Chart – June 12, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA

IGCSshows retail traders are currently LONG onEUR/USD, with 58% of traders currently holding LONG positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are long suggests that EUR/USDmay fall.

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.