Bullish Momentum Wilts After Fake Breakout. Now What?

GOLD PRICE OUTLOOK:

- Gold’s rally loses momentum after prices fail to sustain a key technical resistance’s breakout

- Improving sentiment reduces demand for safe-haven assets, preventing XAU/USD from powering higher

- However, market turbulence could soon resurface if the Fed fails to convince investors this week that the worst is over in terms of financial instability

Recommended by Diego Colman

Get Your Free Gold Forecast

Most Read: US Dollar Outlook Hinges on Fed’s Next Steps. Will the FOMC Hike or Pause?

Gold (XAU/USD) rallied in overnight trading, briefly hitting ~$2,015, its highest mark in over a year, but gains fizzled out during the New York session, with the precious metal flatlining around the $1,975 level despite broad-based U.S. dollar weakness in the FX space.

In recent days, gold has been partly boosted by risk-off mood triggered by fears that the turmoil in the U.S. and European banking sector could lead to financial Armageddon, but those concerns appear to be abating on Monday.

It is too early to say that the crisis of confidence has been resolved, but recent measures taken by various central banks and other government authorities around the world have helped to reduce runaway panic, curbing the risks of contagion for now.

In the U.S. the Fed has adopted emergency actions to shore up troubled banks in need of liquidity following the collapse of SVB and SBNY. In Europe, Swiss regulators at the eleventh hour this weekend brokered a deal for UBS to acquire its beleaguered and long-time rival Credit Suisse, a move that was applauded by global investors.

With sentiment on the mend, defensive assets could lose some of their appeal, preventing gold prices from extending their recent advance. However, if the banking system upheaval were to increase again, XAU/USD could pick up strong bullish momentum in the blink of an eye to power higher and challenge its 2022 highs just a touch below $2,080.

We’ll have more clues about the near-term outlook on Wednesday when the Fed announces its March monetary policy decision. There are many doubts among retail traders, but one thing is clear: if policymakers fail to convince markets the worst is over in terms of financial instability, gold prices’ next leg higher could be just around the corner.

| Change in | Longs | Shorts | OI |

| Daily | 16% | 2% | 9% |

| Weekly | -12% | 30% | 3% |

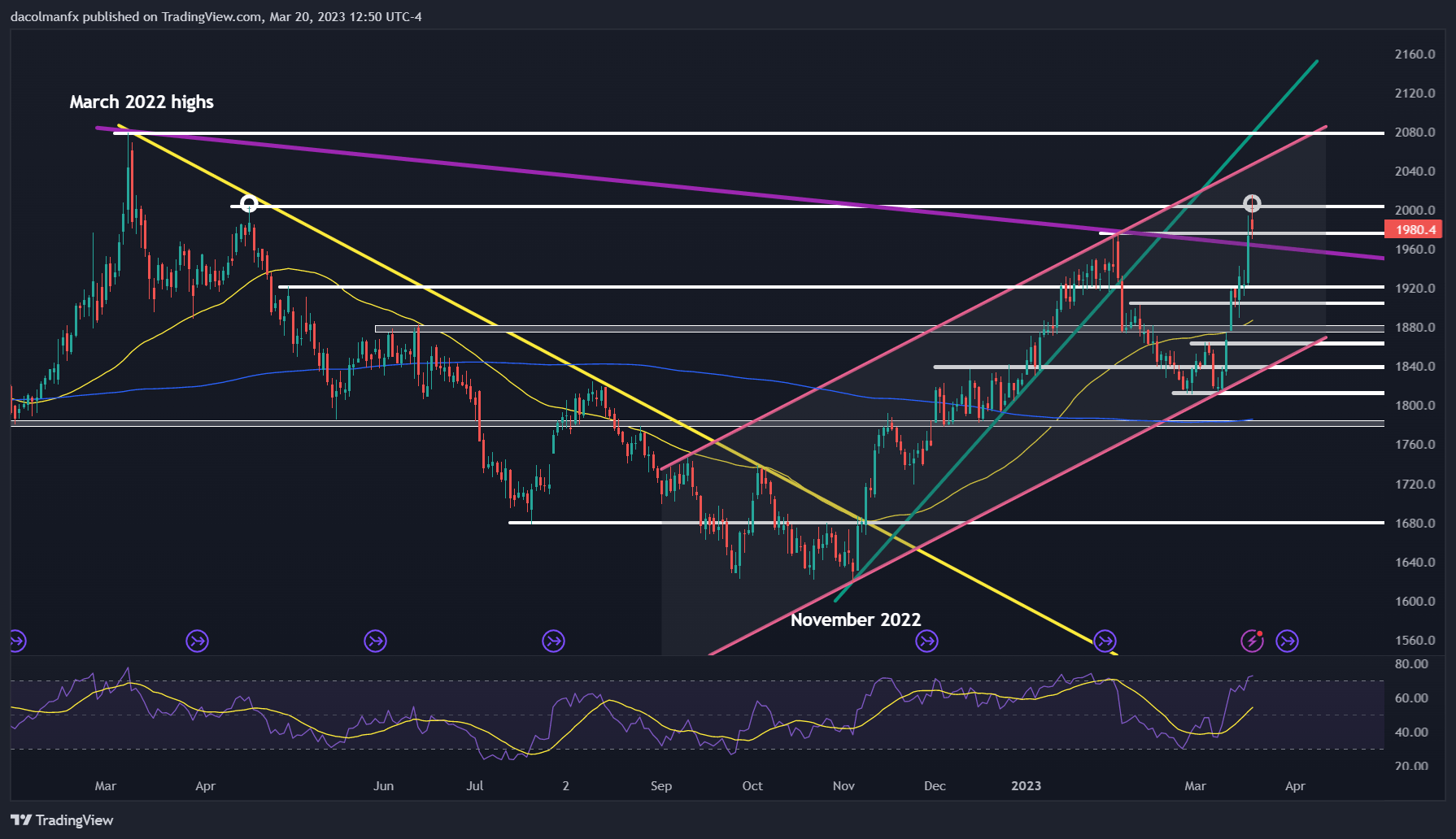

GOLD PRICE TECHNICAL ANALYSIS

Gold rallied and briefly pierced the $2,000/$2,005 area on Monday, but the breakout was not sustained, with prices slipping below that region over the course of the day, a rejection that may trigger some profit-taking but is unlikely to invalidate the metal’s bullish bias. If the reversal scenario plays out, initial support rests at $1,975/$1,965, followed by $1,920. On the flip side, if bulls regain decisive control of the market, the first ceiling to keep an eye on lies at $2,000/$2,005. If this barrier is taken out on daily closing prices, we could see a move towards channel resistance at $2,050, followed by a retest of last year’s swing high.

Recommended by Diego Colman

How to Trade Gold

GOLD PRICES TECHNICAL CHART

Gold Futures Chart Prepared Using TradingView

Comments are closed.