British Pound Set for Worst Month Since August 2022 as Upside Exposure Builds

British Pound, GBP/USD, Technical Analysis, Retail Trader Positioning – IGCS Update

- British Pound set for worst month since August 2022?

- Retail traders’ bullish exposure relentlessly building

- Will the exchange rate bounce off near-term support?

Recommended by Daniel Dubrovsky

How to Trade GBP/USD

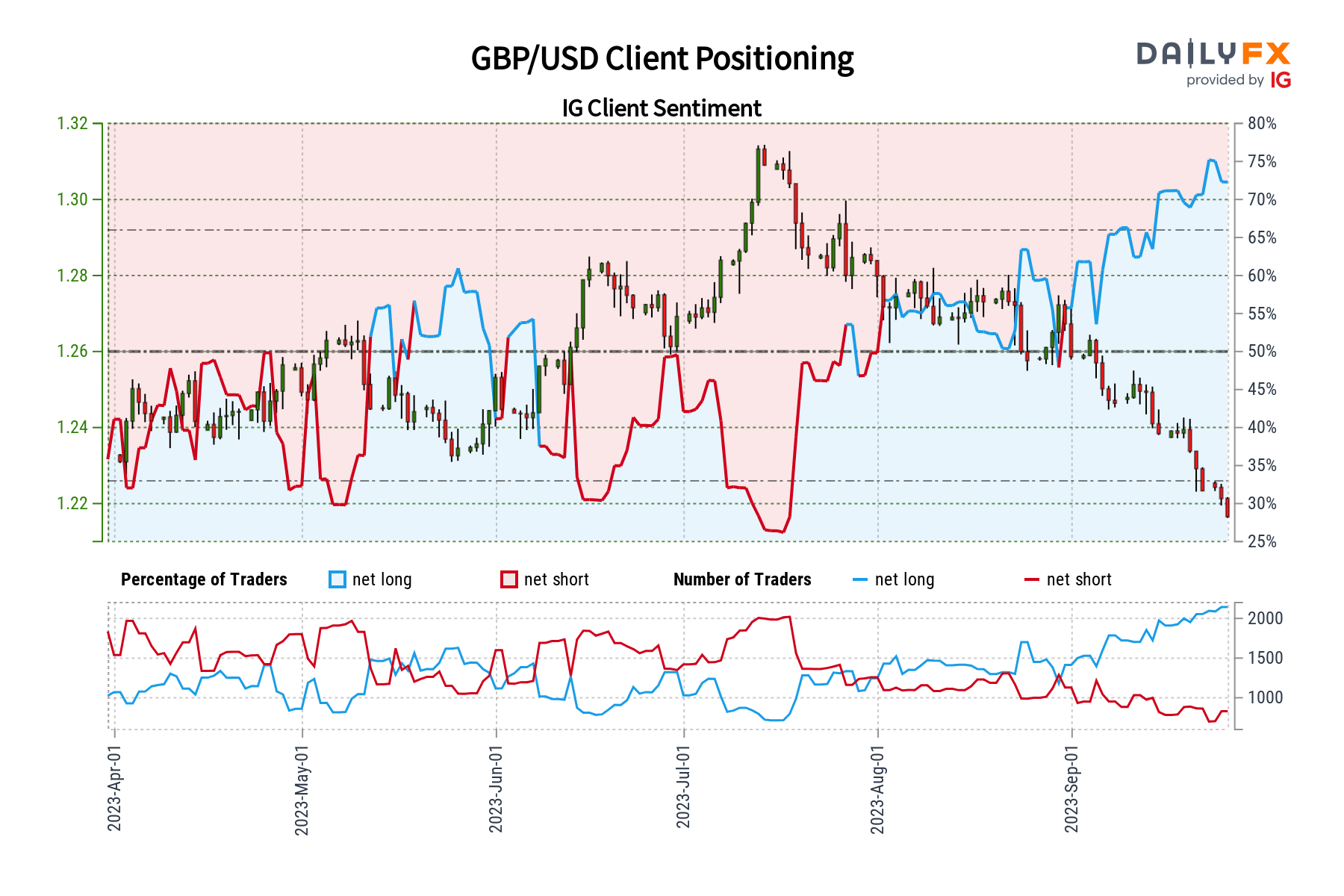

At over -4 percent, the British Pound is on course for the worst month against the US Dollar since August 2022. In response, retail traders have been relentlessly building bullish exposure. This can be seen by looking at IG Client Sentiment (IGCS), which often functions as a contrarian indicator. With that in mind, could further pain be in store for Sterling?

GBP/USD Sentiment Outlook – Bearish

The IGCS gauge shows that about 71% of retail traders are net-long GBP/USD. Since the vast majority of them are biased to the upside, this continues to offer a bearish outlook for the medium term. Meanwhile, upside bets have increased by 3.29% and 12.79% compared to yesterday and last week, respectively. With that in mind, the combination of overall positioning and recent changes offers a stronger bearish outlook.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -3% | 2% |

| Weekly | 14% | -9% | 7% |

British Pound Daily Chart

Looking at the daily chart below, GBP/USD has continued making downside progress in the aftermath of a bearish Head & Shoulders chart formation. Since then, prices have also confirmed a breakout under the 200-day Moving Average (MA) and the May low of 1.2308. Now, immediate support is the 78.6% Fibonacci retracement level of 1.209.

Breaking lower would open the door to potentially retesting the March low of 1.1804 and further reversing the uptrend that occurred from late last year until June of this year. Otherwise, a turn higher from here places the focus on the 1.2308 inflection point.

Recommended by Daniel Dubrovsky

The Fundamentals of Breakout Trading

Chart Created in Trading View

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

Comments are closed.