British Pound (GBP) Latest: GBP/USD and EUR/GBP Outlooks

GBP/USD Prices, Charts, and Analysis

- UK 2-year gilt yields continue to rally.

- Sterling may struggle against a hawkish ECB.

Recommended by Nick Cawley

How to Trade GBP/USD

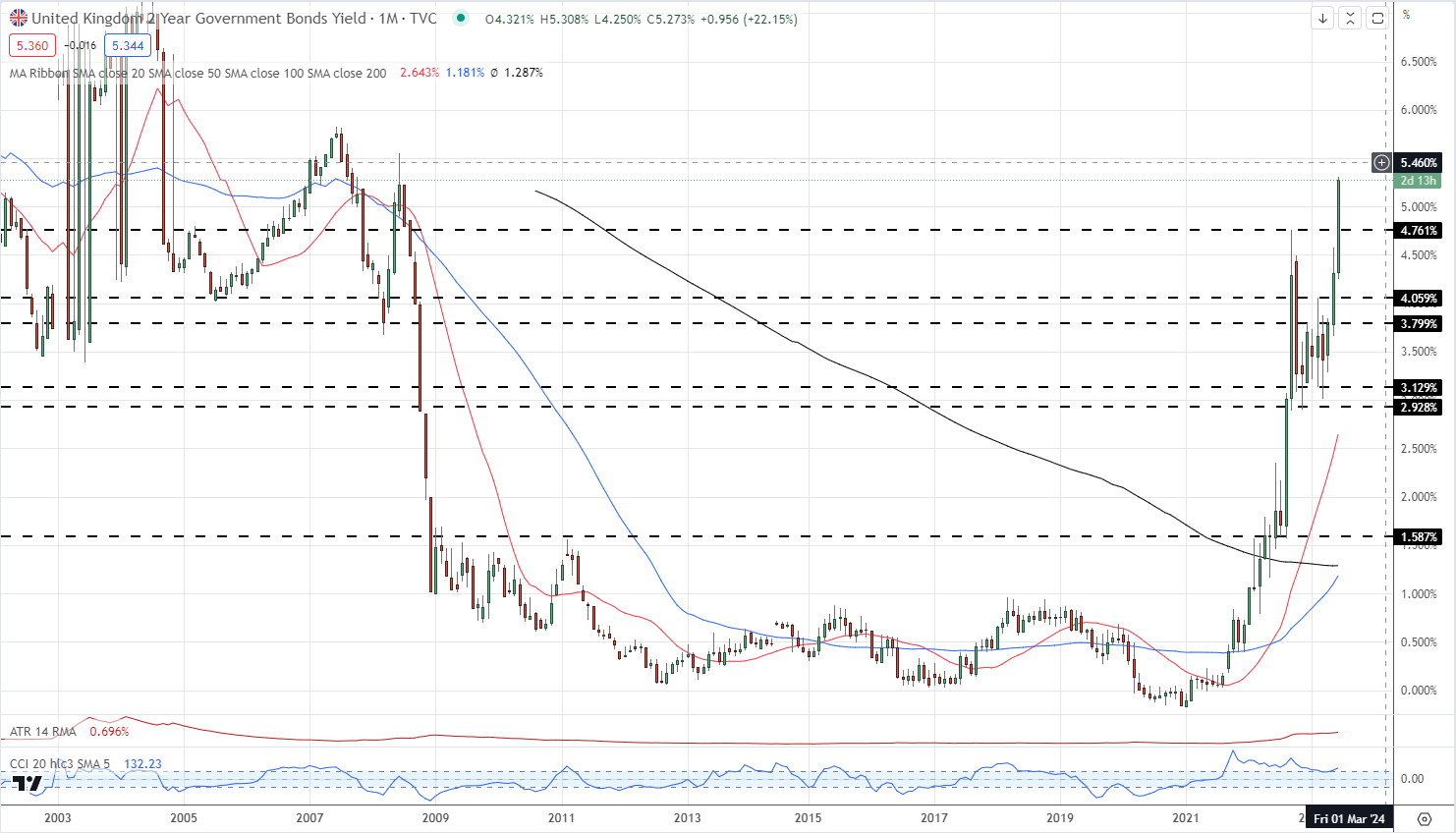

UK 2-year government bond (gilts) yields are hitting fresh multi-year highs as financial markets continue to price in higher interest rates for longer. The on-the-run 2-year hit a 5.30% yield high in early trade, its highest level since June 2008. A closely watched recession indicator, the 2s-10s gilt spread hit -91 basis points. The more negative the spread, the stronger the recession signal.

UK 2-Year Gilt Yield Monthly Price Chart – June 28, 2023

For all market-moving events and data releases see the real-time DailyFX Calendar

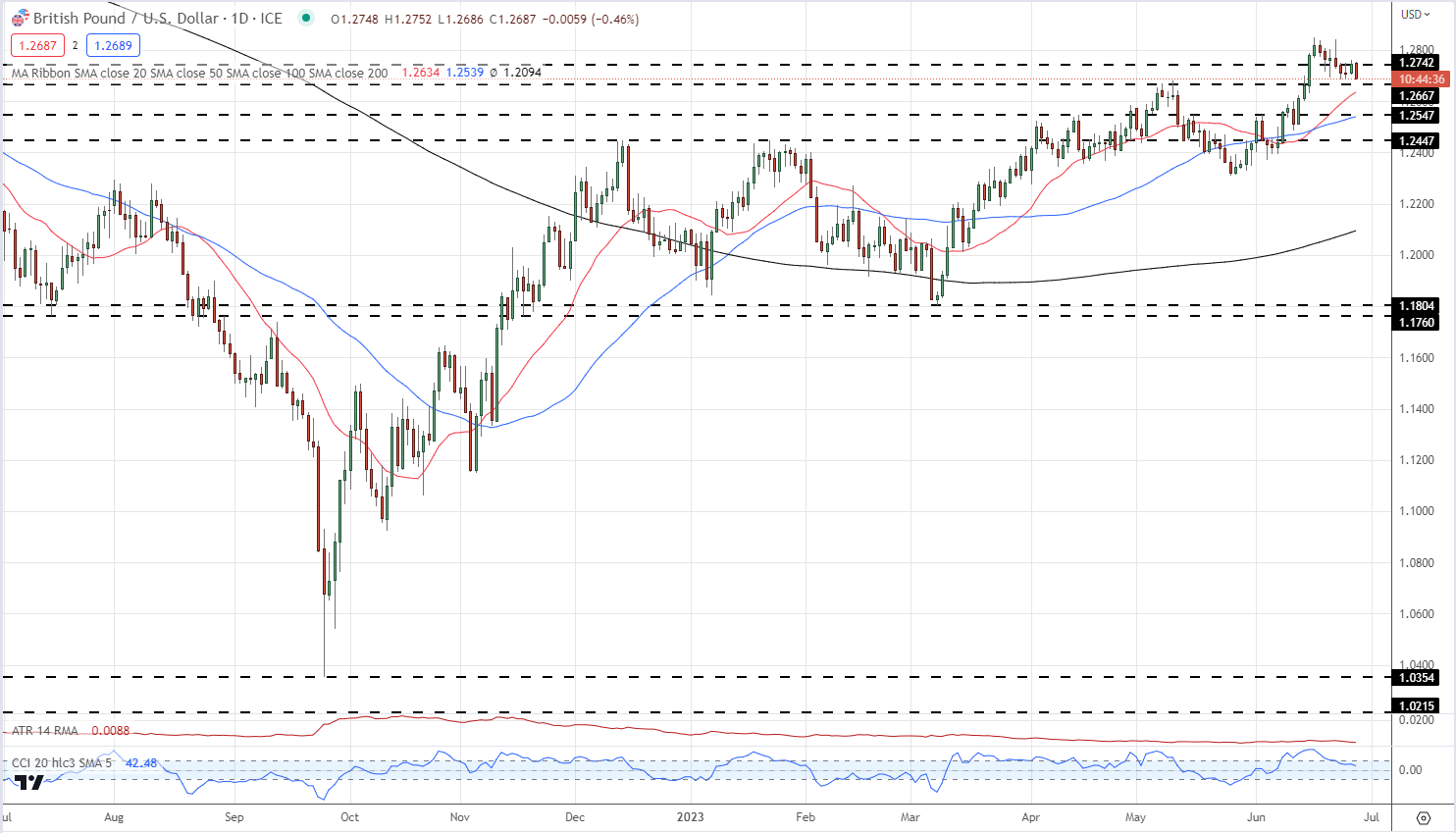

Sterling is trading on either side of 1.2700 against the US dollar with GBP/USD currently trapped in a small trading range. While Sterling is finding support from higher bond yields, the fear of an impending recession is capping any upside in GBP pairs. The US dollar on the other hand is under pressure from US interest rate expectations with the market pricing in just one more 25 basis point rate hike before the Fed pauses. Recent US economic data has proved to be slightly better than expected, adding to the belief that the US may avoid a recession.

Coming up later in today’s session, four of the world’s most important central bankers take the stage in Sintra, Portugal at this year’s ECB Forum. Christine Lagarde (ECB), Andrew Bailey (BoE), Jerome Powell (Fed), and Kazuo Ueda (BoJ) will likely give their views on domestic and global monetary policy.

GBP/USD is nearing short-term support at 1.2667, a level that guards 1.2547 and 1.247. To the upside, initial resistance is seen at 1.2742.

GBP/USD Daily Price Chart – June 28, 2023

| Change in | Longs | Shorts | OI |

| Daily | -1% | -5% | -3% |

| Weekly | 9% | -3% | 2% |

GBP/USD Retail Traders are Net-Short Cable

Retail trader data show 42.31% of traders are net-long with the ratio of traders short to long at 1.36 to 1.The number of traders net-long is 1.47% higher than yesterday and 28.14% higher than last week, while the number of traders net-short is 1.84% lower than yesterday and 7.45% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net short.

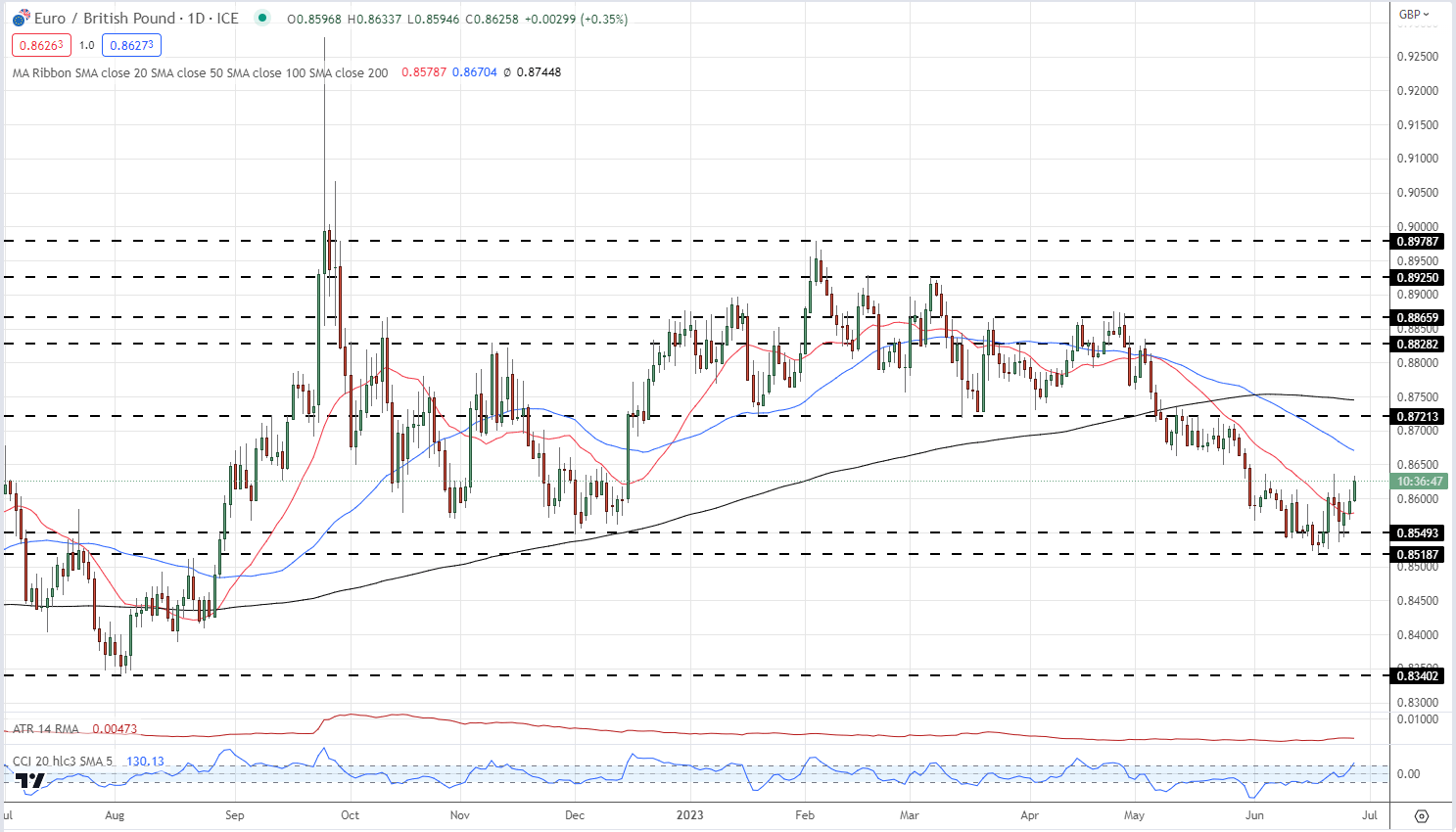

The ECB is set to hike rates at its next policy meeting and will continue to do so if recent central bank commentary is to be believed. ECB President Lagarde, and other board members, have been on the wires recently saying that they will continue to tighten monetary policy to bring inflation under control. This ramping up of hawkish rhetoric has underpinned the single currency against a range of other G7 countries.

EUR/GBP is pushing higher, after a multi-week sell-off, and is nearing its best level in a month. The pair has broken, and opened, above the 20-dma, and currently eyes the 50-dma at 0.8670.

EUR/GBP Daily Price Chart – June 28, 2023

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.