BoJ’s Dovishness Puts USD/JPY Channel Breakout in Play

USD/JPY FORECAST:

- Monetary policy divergences between the Federal Reserve and the Bank of Japan will continue to weigh on the outlook for the Japanese yen

- The U.S. dollar retains a constructive profile for now

- This article looks at USD/JPY key levels to watch in the coming days

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Euro Forecast: EUR/USD on Breakdown Watch, EUR/GBP Stuck in No Man’s Land For Now

Both the Federal Reserve and the Bank of Japan held their September monetary policy meetings this past week. For starters, the Fed maintained a hawkish bias, indicating that it may deliver additional tightening this year and forecasting that interest rates will remain high for longer. For its part, the BoJ adhered to its longstanding ultra-loose stance, refraining from signaling any imminent changes in its strategy.

This pronounced divergence in monetary policy between these two central banks has created a landscape that favors the US dollar's strength for now. This means that the yen may find itself inclined towards further depreciation in the near term, albeit with some moderation, as on-and-off talk of FX intervention by the Japanese government may deter speculators from precipitating excessive weakness.

If you are puzzled by trading losses, download our guide to the “Traits of Successful Traders” and learn how to overcome the common pitfalls that can lead to missteps.

Recommended by Diego Colman

Traits of Successful Traders

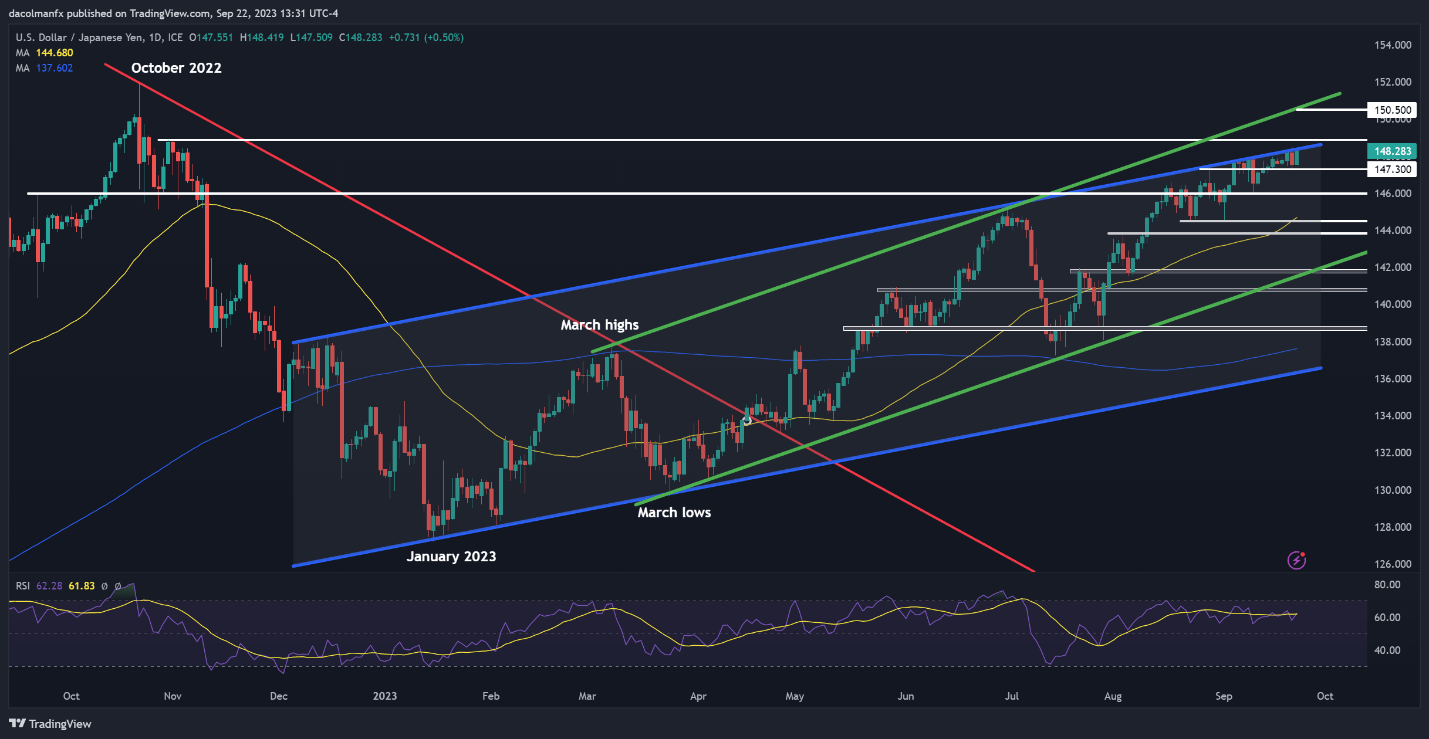

From a technical standpoint, USD/JPY rallied on Friday on BoJ’s dovish position, pushing past the 148.00 handle but falling short of breaching the upper boundary of a rising channel in effect since December 2022, presently positioned at 148.50. While taking out this barrier could prove challenging for buyers, a successful breakout could spark a strong upward pressure, exposing 148.80, followed by 150.50.

In the event of an unexpected shift in market sentiment in favor of sellers and price rejection from current levels, the first line of support is observed at 147.30, succeeded by 145.90. Should bearish impetus persist, there is a possibility of a retracement towards 144.55, which currently sits slightly below the 50-day simple moving average.

Take your trading game to the next level with a copy of the yen's outlook today! Seize the opportunity to access exclusive insights into potential market-moving factors for USD/JPY!

Recommended by Diego Colman

Get Your Free JPY Forecast

USD/JPY TECHNICAL ANALYSIS

USD/JPY Chart Prepared Using TradingView

Comments are closed.