BoE Hikes by 50bps, GBP Pounded After Dovish MPC Report

POUND STERLING TALKING POINTS

- GBP on offer after BoE’s 50bps rate hike.

- Wording in MPC report less aggressive than prior releases.

- Pullback on GBP/USD on the cards.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBP FUNDAMENTAL BACKDROP

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

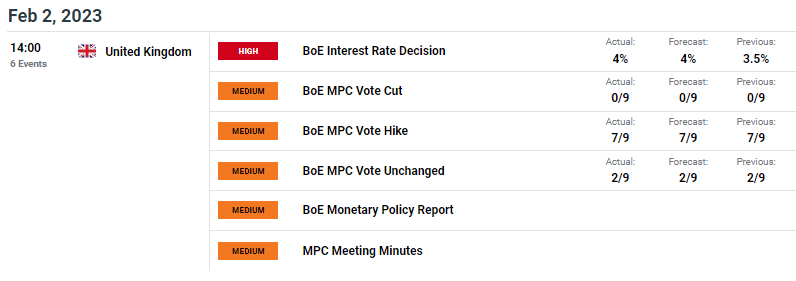

The Bank of England’s (BoE) has expectedly hiked interest rate by 50bps this Thursday with a vote split of 7 in favor of a rate hike while the BoE’s Tenreyro and Dhingra opted to keep rates unchanged as was the case in the December meeting. The split does not show much in the way of the Monetary Policy Committee (MPC) altering their prior outlook which was a possibility considering the fact that the UK economy is showing signs of weakness in certain areas.

The MPC removed their prior forceful narrative to hike rates on the back of inflationary pressures however, they did cite inflation risks “are skewed significantly to the upside”. The most hawkish statement produced by the report states that “if there is more persistent price pressures then only will further tightening be required”. This has been largely received by market participants as a less aggressive outlook leaving the pound on offer post-release.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

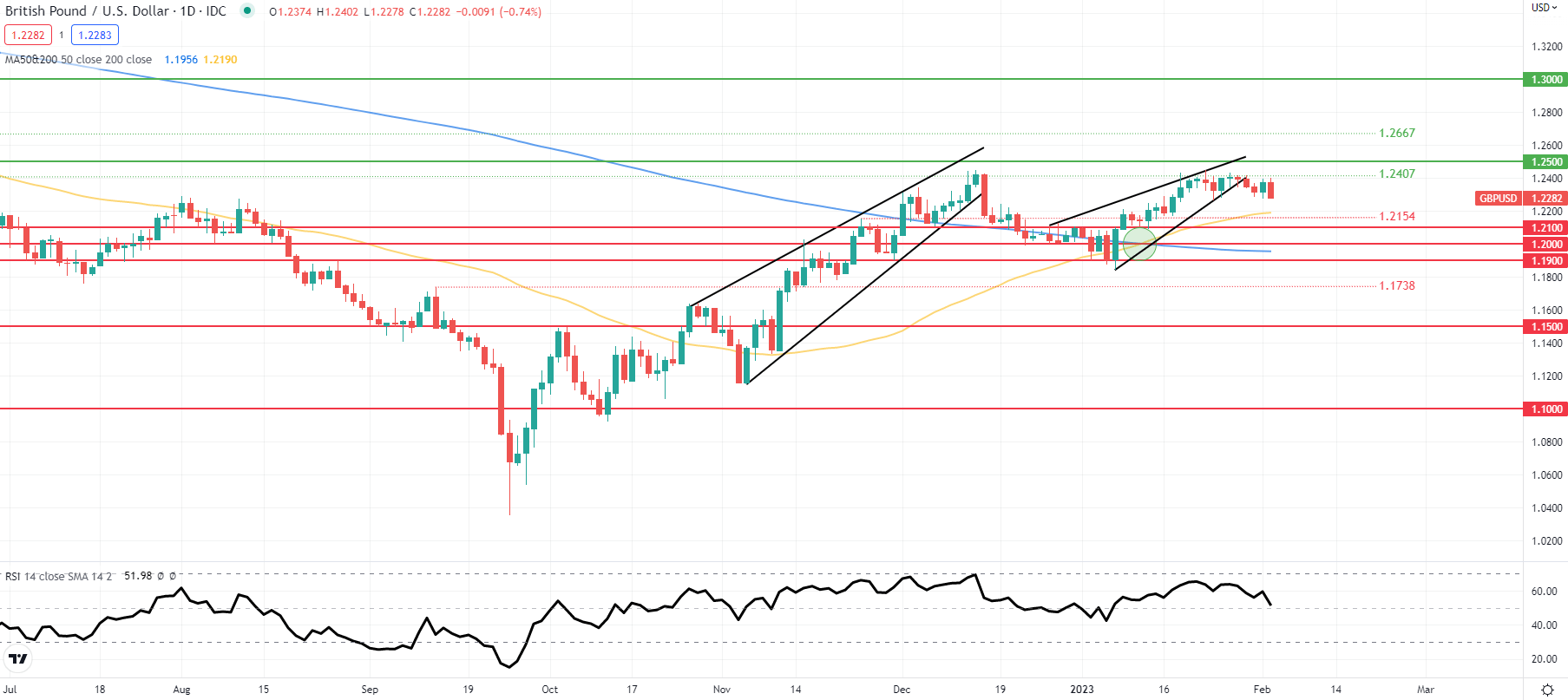

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily GBP/USD chart showed a pound sell-off immediately after the announcement was made possibly hinting at the markets perception of a BoE pivot or pause. The 50-day MA now comes into consideration around the 1.2200 psychological support handle while the Relative Strength Index (RSI) shows declining upside momentum.

Key resistance levels:

Key support levels:

CAUTIOUS IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently MIXED on GBP/USD, with 50% of traders currently holding short/long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term mixed disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.