BoC considered need for rates to stay higher longer to return inflation to 2% target

The Bank of Canada´s Governor Tiff Macklem said in an opening statement before the House of Commons Standing Committee on Finance that the central bank considered the need for rates to stay higher longer to return inflation to 2% target.

Macklem said he expects prices to come down further after official data showed Canada's annual inflation rate had eased to 4.3% in March from 5.2% in February.

“Annual CPI inflation was down to 4.3% in March, led by falling goods price inflation, and we see further declines ahead. That's good news,” Macklem told a parliamentary committee.

USD/CAD update

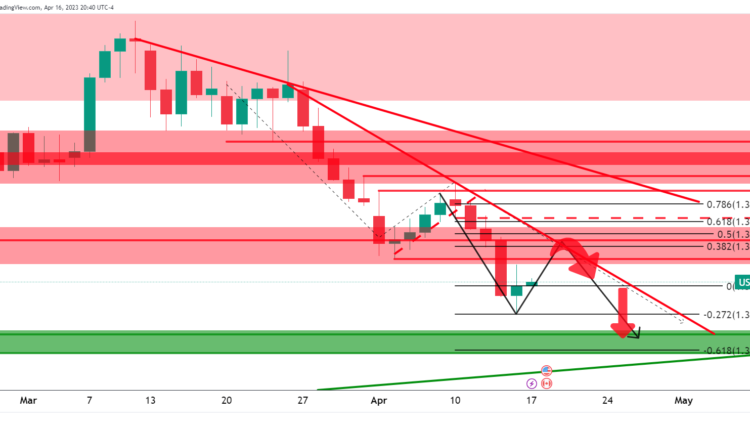

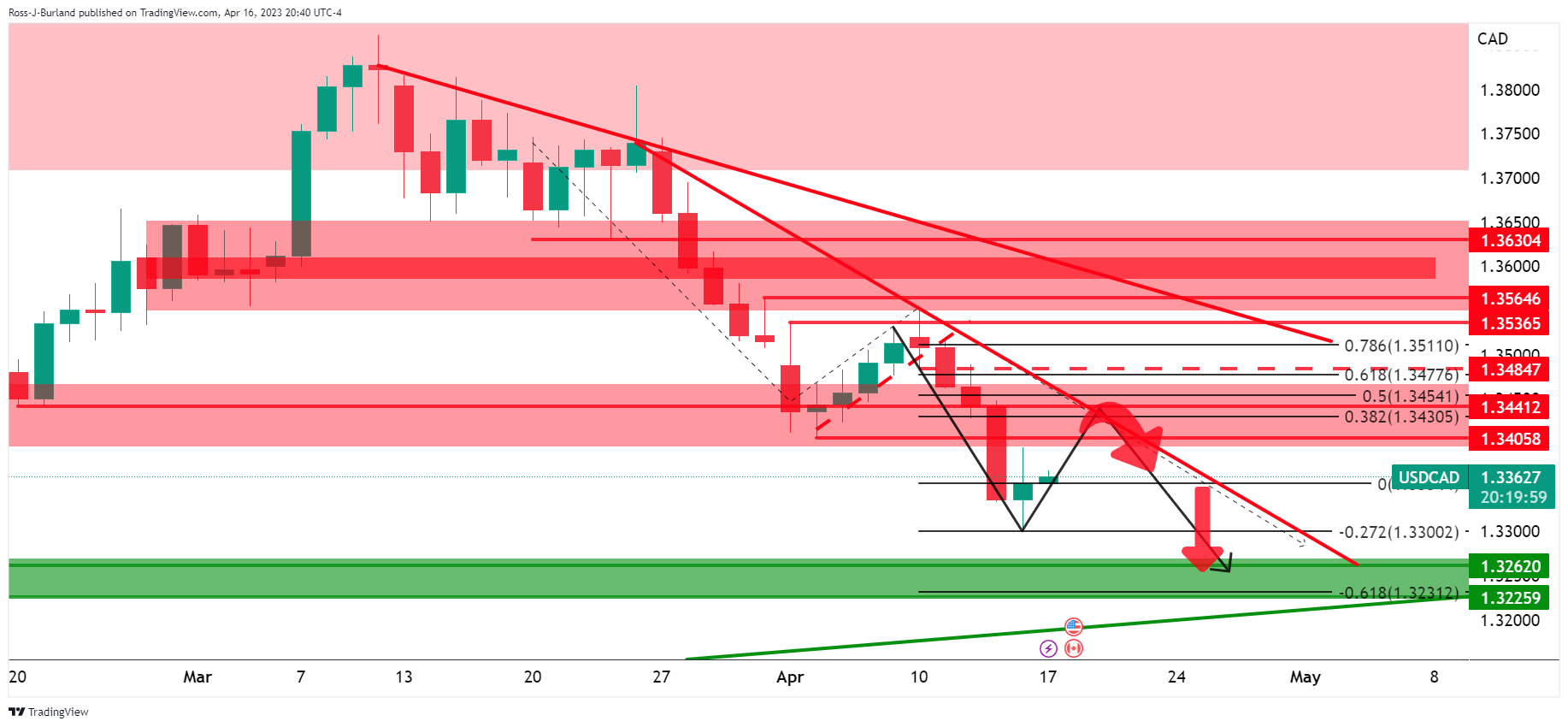

As per the prior analysis, USD/CAD Price Analysis: All eyes on the US Dollar as price corrects in bear trend, whereby the focus was on1.3406 meeting the micro trendline resistance and coming in close to the 38.2% Fibonacci retracement area near 1.3430, the market is developing as follows:

Prior analysis:

Update:

We have seen a move towards the targetted area and there are still prospects of the 38.2% Fibonacci that would be a firm test of the micro trendline.

Comments are closed.