Bitcoin Faces Death Cross as XRP Fails to Capitalize on Appeal Ruling

BITCOIN, RIPPLE KEY POINTS:

- Bitcoin Prices Struggle at 28k Hurdle Once More as Death Cross Pattern Adds to Uncertainty.

- Ripple Receives Positive News on Multiple Fronts but Still Fell Over 3% on Monday. Further Downside Ahead?

- Rumours Are that the SEC May Drop the Case Against Ripple Following the Recent Ruling, While the BIS has Added Ripple to its Taskforce for Cross Border Payments.

READ MORE: S&P 500, NAS100 Continue Advance on Dovish Fed Rhetoric

Bitcoin and Ripple have not enjoyed the best of weeks and for once this hasn’t had a lot to do with the Geopolitical situation in the middle east. There have been some developments particularly around ripple which are interesting but not really reflected in the price of XRPUSD as yet. Ripple also has had to deal with the resignation of CFO Kristina Campbell who joined Maven Clinic as its CFO. The move however seems to be a cordial one with as Campbell took to Linkedin to thank the Ripple team for making the past few years memorable.

Download the DailyFX Guide on Navigating Crypto Markets with insights and tips. Get the Guide Now.

Recommended by Zain Vawda

Get Your Free Introduction To Cryptocurrency Trading

FEDERAL COURT DENIES INTERLOCUTORY APPEAL BY SEC

XRP had enjoyed a decent enough Q3 even if it failed to hold onto the gains made post the decision by Judge Torres. A lot of this was down to news that the SEC was to launch an interlocutory appeal, which seemed to have dampened the spirits of XRP bulls.

On Monday, October 3 the Federal Court denied the SEC request to certify its interlocutory appeal. Judge Torres stated that to grant the SEC’s request for a certification, she would have to find, among other matters, a controlling question of law for which there was a “substantial ground” for a difference of view. However, this was not the case here, she claimed.

However, the decision by Judge Torres has failed to capitalize on the decision with Ripple falling around 3.2% yesterday. This also could have been down to the broader risk-off sentiment which drove markets early on Monday.

Another reason why the drop off in XRP is particularly interesting is down to the recent decision by the Bank of International Settlement to add Ripple to its interoperability taskforce. This means that Ripple is now a part of the taskforce established for cross border payments. This should have been a huge positive for the payment service provider but has not yet materialized in the price of XRPUSD.

Looking at the crypto fear and greed index and we have seen a recovery over the past month from fear to neutral which is a slight positive for crypto markets as a whole.

Source: FinancialJuice

READ MORE: HOW TO USE TWITTER FOR TRADERS

There is a belief among many in the crypto space that with the ruling last week by Judge Torres the SEC could choose to drop their case. Given the disdain showed toward the crypto industry by the SEC i wouldn’t hold my breath and will rather wait for an official announcement on the matter.

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

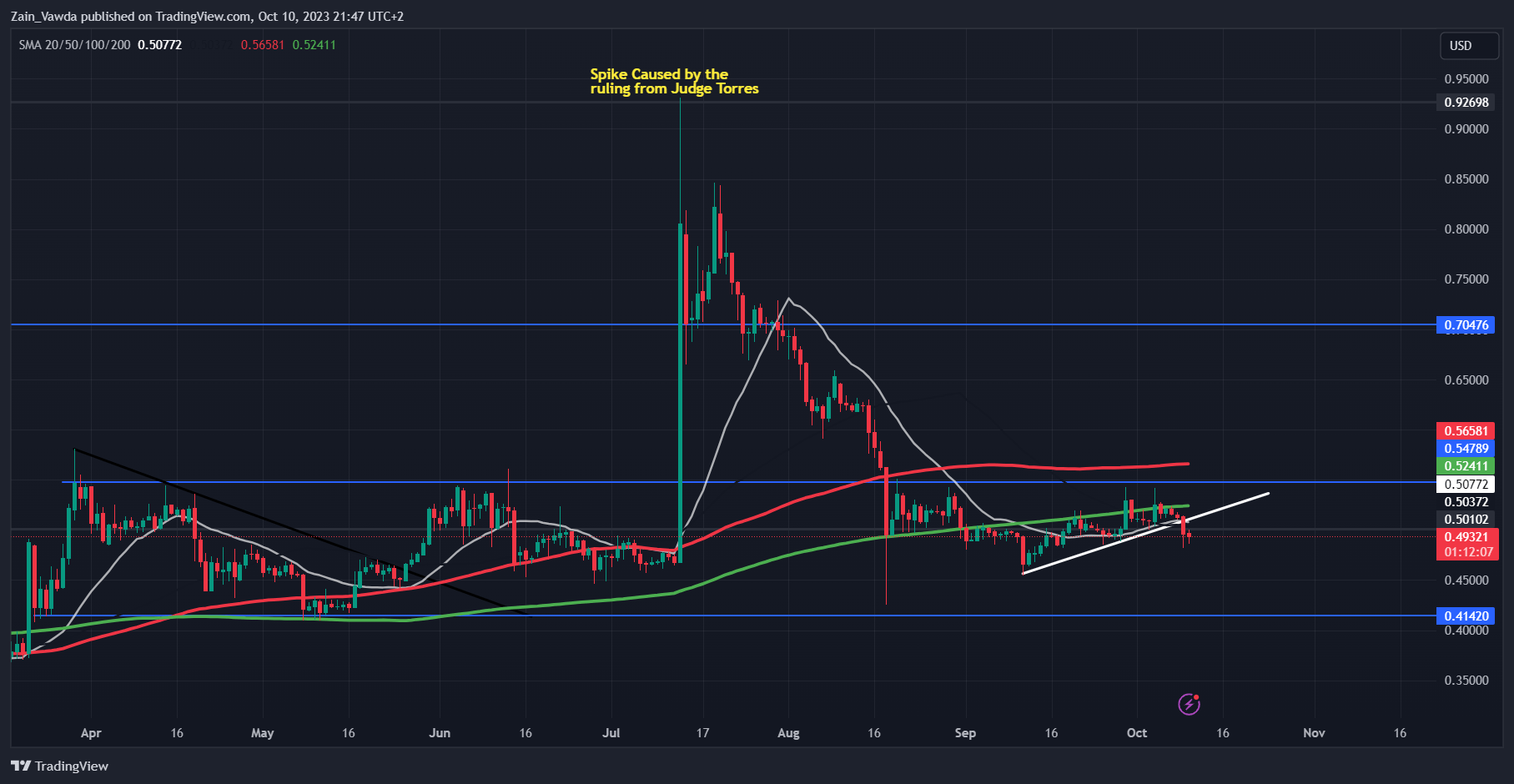

TECHNICAL OUTLOOK ON RIPPLE

XRP has been on a steady decline since the spike in July after the initial ruling by Judge Torres. This week however has seen break the ascending trendline which had been in play since September 11.

A retest of the 0.45 mark appears to be on the cards in the near term while a visit to the key support area around the 0.41 mark also gains traction. A really interesting couple of weeks ahead for Ripple and definitely one I will be keeping a close eye on.

XRPUSD Daily Chart, October 10, 2023.

Source: TradingView, chart prepared by Zain Vawda

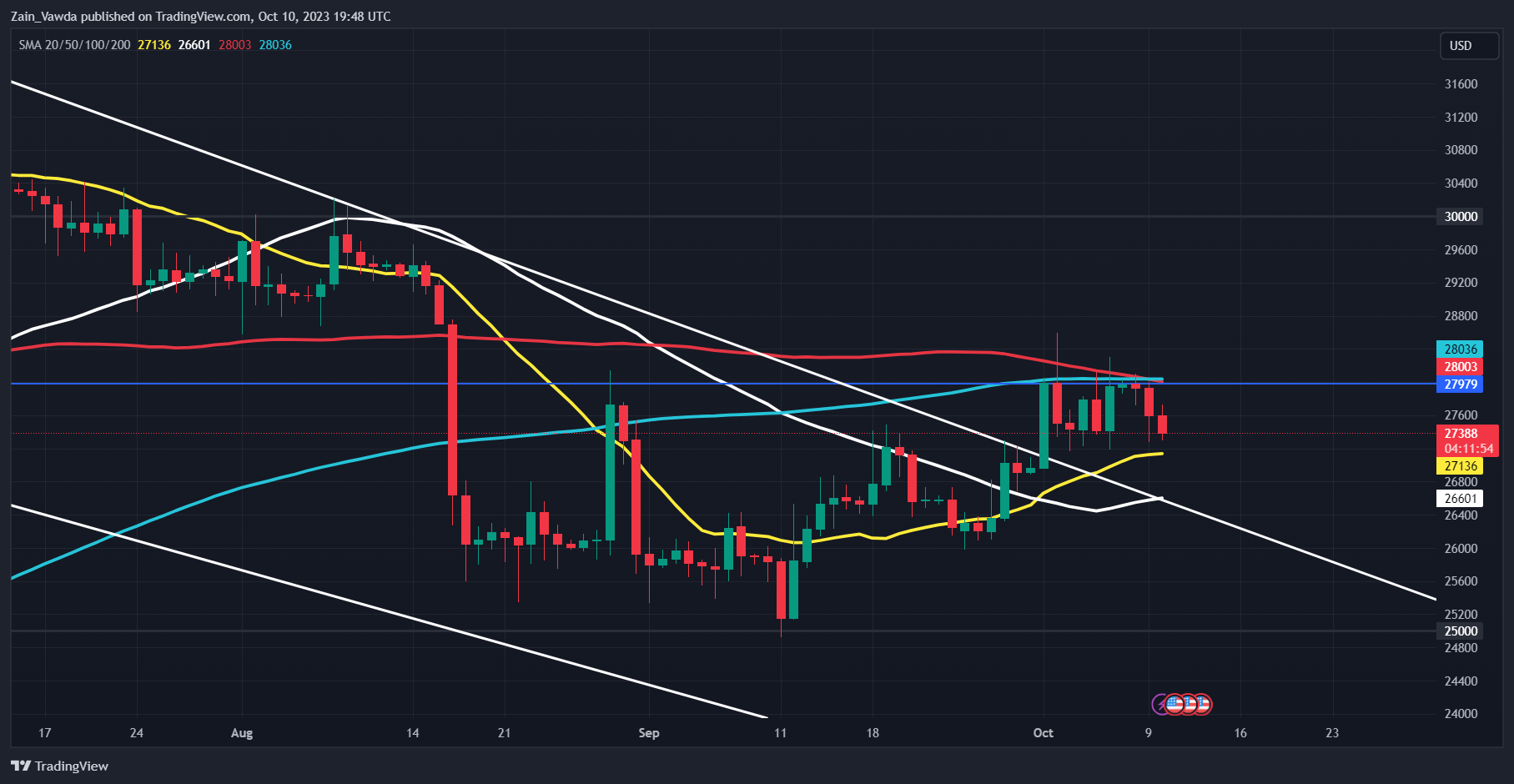

TECHNICAL OUTLOOK ON BTCUSD

From a technical standpoint BTCUSD has once again failed at the 28k mark which remains a key area of resistance further strengthened by the presence of the 100 and 200-day MA. Price is currently stuck between the MAs with 20 and 50-day MAs resting just below the current price providing a modicum of support.

What is more worrying for me personally is that we have just had a death cross pattern with the 100-day MA crossing below the 200-day MA hinting at the potential for further downside. BTCUSD does remain vulnerable below the 28k and more importantly the psychological 30k mark. As long as we fail to see a sustainable move above these levels a retest of the 25k mark or lower remains a real possibility.

BTCUSD Daily Chart, October 10, 2023.

Source: TradingView, chart prepared by Zain Vawda

Elevate your trading skills and gain a competitive edge. Get your hands on the Bitcoin Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

Recommended by Zain Vawda

Get Your Free Bitcoin Forecast

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.