Bitcoin (BTC/USD) Pops Above $35k Before a Pullback, More Upside Ahead?

BITCOIN, CRYPTO KEY POINTS:

- iShares Bitcoin ETF Listed and then Delisted from the DTCC… What Does This Mean?

- MicroStrategy Bitcoin Bet of $4.7B Back in the Green. Average Price of Around $29520.

- Retracement May be in Order Following Extended Upside Rally with RSI in Overbought Territory.

- To Learn More AboutPrice Action,Chart Patterns and Moving Averages,Check out the DailyFX Education Series.

READ MORE: Bitcoin Breaks Psychological 30k Level as Spot ETF Approval Hopes Grow

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

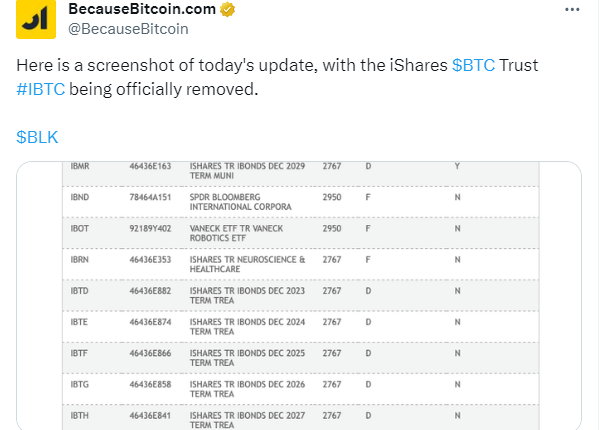

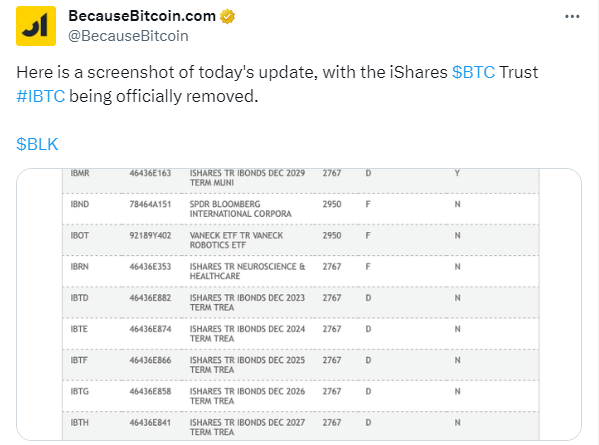

BITCOIN SPOT ETF DEVELOPMENTS

Bitcoin prices surged overnight following my update yesterday on news that the iShares Bitcoin Trust had been listed on the DTCC (Depositary Trust & Clearing Corporation, which clears Nasdaq trades). This is part of the process to bring the ETF to market prompting speculators to ramp up their bullish bias.

The impact saw BTCUSD pop above the $35k briefly today before a pullback. It then emerged that the iShares Bitcoin Trust had been removed from the DTCC. This development saw a $1000 drop in Bitcoin prices with BTCUSD dropping to around the $33500 mark before steadying somewhat.

The world's largest cryptocurrency has hovered between the $33500 and $34000 handle ever since. I actually think a pullback here may be a good thing as it would provide for a larger move to the upside if the spot Bitcoin ETF is finally approved.

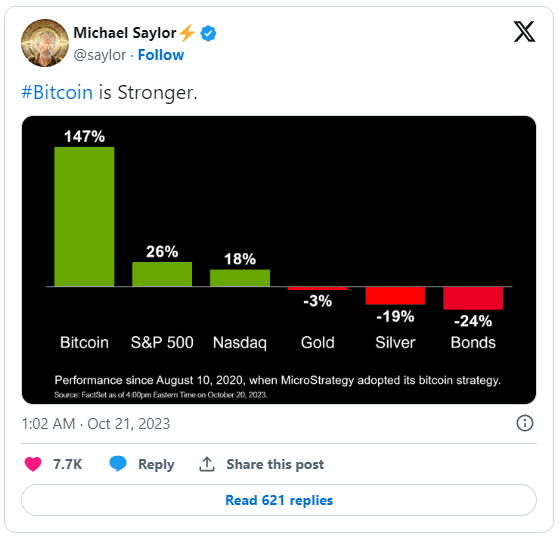

MICROSTRATEGY IN THE GREEN ONCE MORE ON $4.7B BITCOIN BET

Crypto markets are on the up at the moment and this has benefitted companies in the industry as well. News came through yesterday that the MicroStrategy Bitcoin investment is profitable once more putting Michael Saylor back in the news. The Company’s stash was deeply in the red in late 2022 but 2023 has brought renewed hope as the spot Bitcoin ETF approval gains traction. Mr Saylor who is now executive Chairman of MicroStrategy tweeted an interesting graphic on October 21 as well which indicated the performance since August 10, 2020, when MicroStrategy adopted its Bitcoin strategy. Since the tweet Bitcoin has risen around 12.25% and was up around 15% when it peaked above the $35000 mark today.

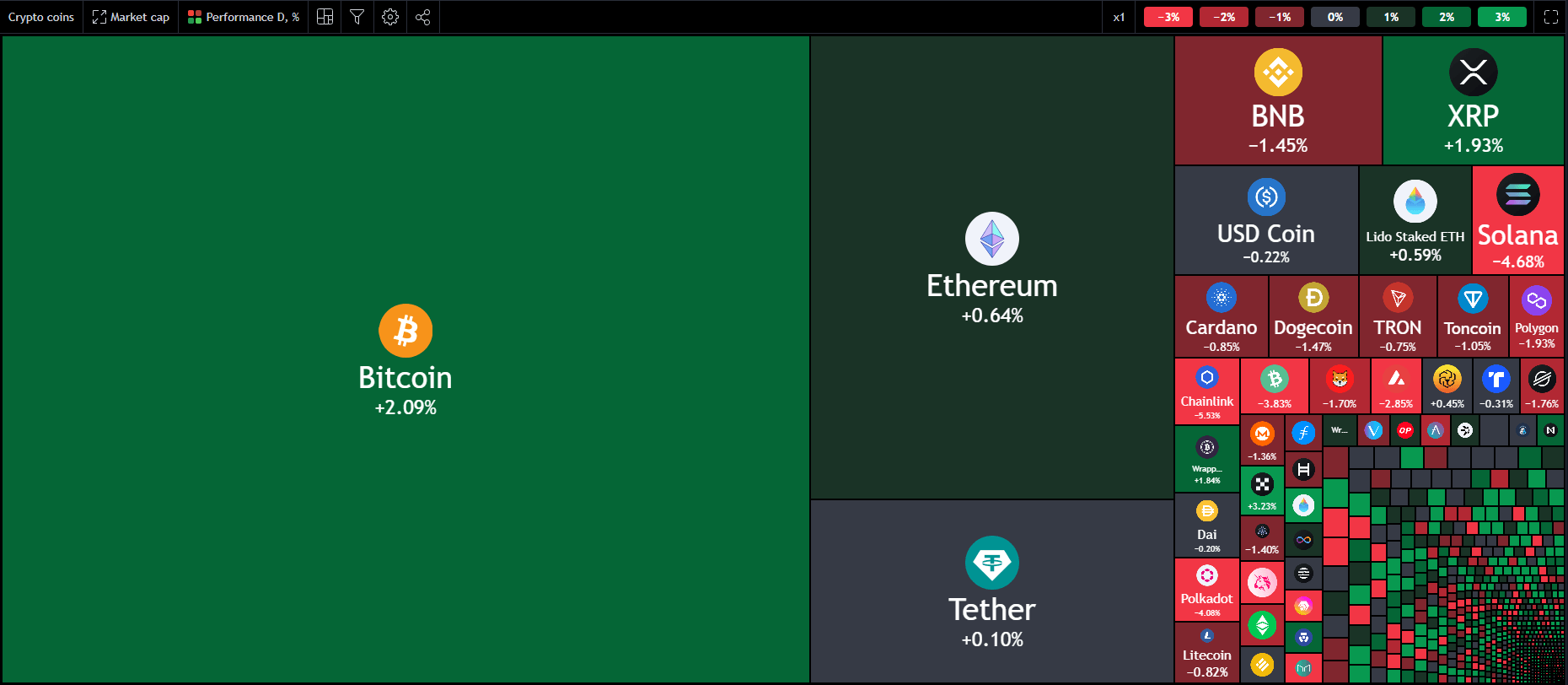

A look at the Crypto heatmap and we can see the dominance of Bitcoin on this recent bull run. We have not seen similar gains for other major names such as Ripple and Ethereum. It will be interesting to gauge the potential knock-on effect should the Bitcoin ETF finally receive approval.

Source: TradingView

READ MORE: HOW TO USE TWITTER FOR TRADERS

Recommended by Zain Vawda

Get Your Free Introduction To Cryptocurrency Trading

TECHNICAL OUTLOOK AND FINAL THOUGHTS

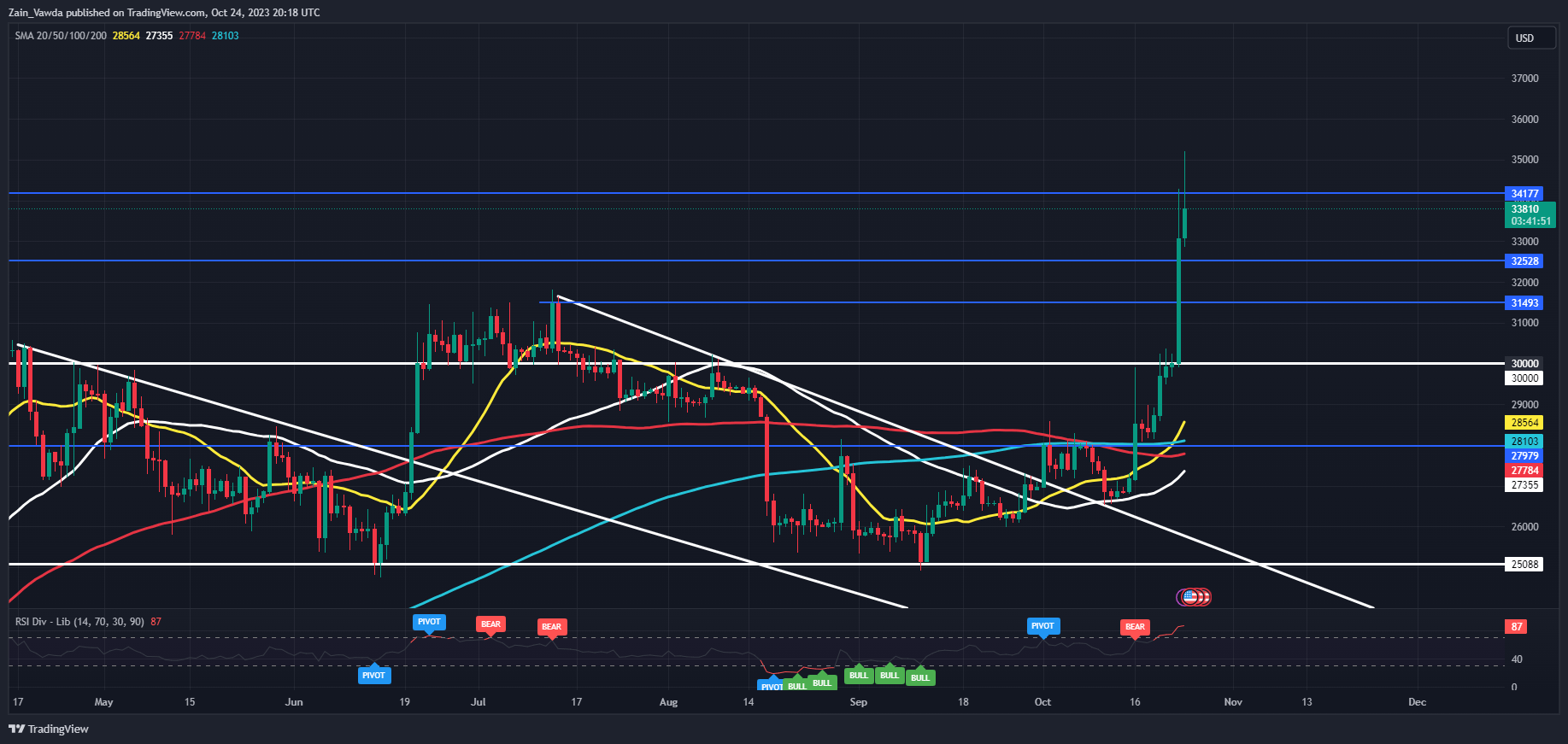

From a technical standpoint BTCUSD has put in an impressive rally over the last 2 weeks. The fact that the rally has been so expansive leads me to believe that a pullback may be forthcoming soon which might actually be a positive for Bitcoin. This could allow bulls better pricing ahead for potential longs of the Spot ETF decision.

The 14-day RSI is currently in overbought territory also hinting at the potential for a pullback with resistance at the $34177 mark. A daily candle lose above faces the hurdle of the psychological $35000 mark which could prove a tough nut to crack if we do not have a retracement first.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

BTCUSD Daily Chart, October 24, 2023.

Source: TradingView, chart prepared by Zain Vawda

If you're puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls that can lead to costly errors.

Recommended by Zain Vawda

Traits of Successful Traders

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.