Bears take on key support structures, but bulls are lurking

- The hourly chart has the 1.3390s as the first support to break.

- Bears eye a 50% mean reversion where bulls might be compelled to move in again at a discount.

The Canadian Dollar weakened against the US Dollar on Friday and ended its run of weekly gains as the following charts will show.

Data from the US boosted the greenback and sank risk appetite, weighing on the high beta currencies, such as the CAD, as it could make it harder for the Federal Reserve to bring inflation under control. This underpins the technical bullish outlook with the price still on the front side of the dominant trendline:

The break of the near-term resistance, as the chart below shows, leaves prospects of an imminent move higher:

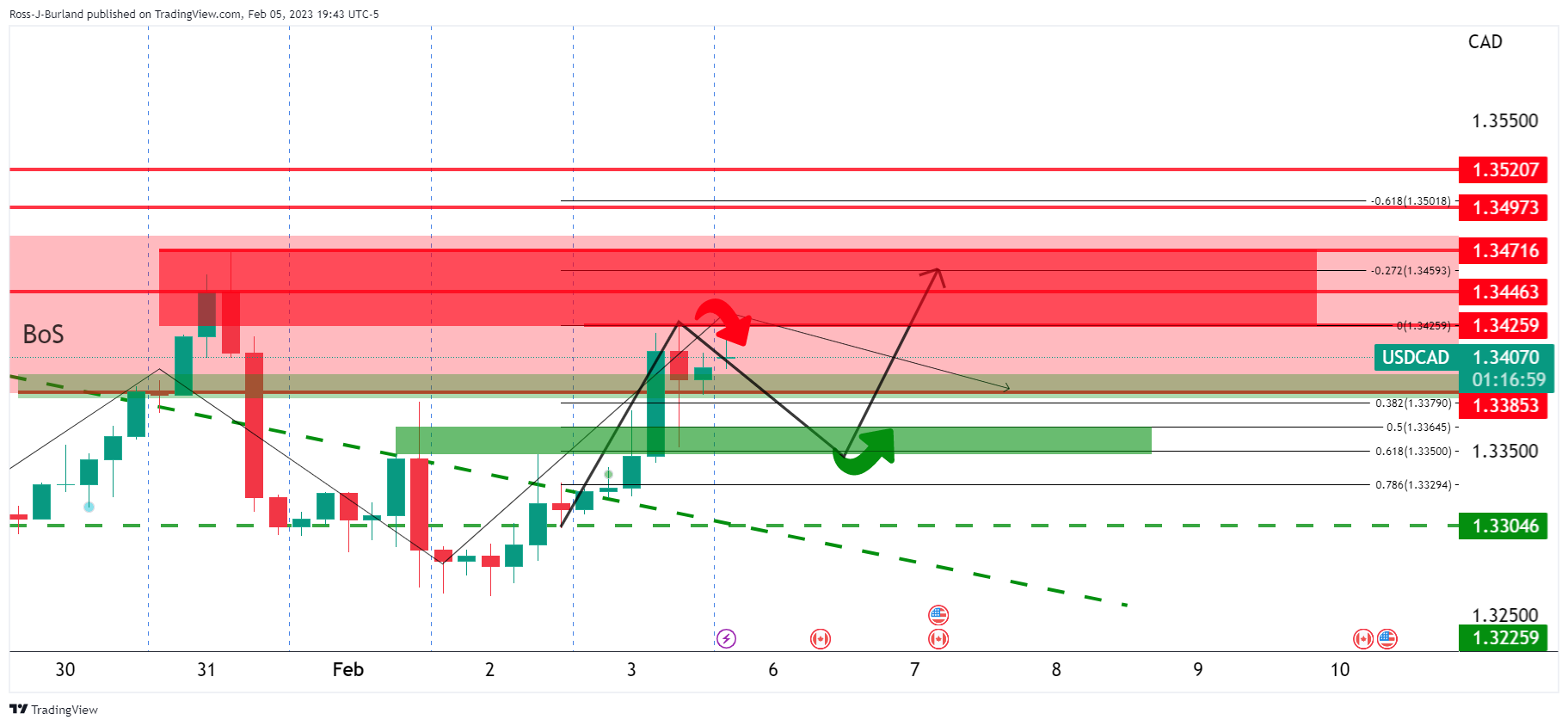

However, the W-formation leaves prospects of a restest to the downside first:

When moving to the lower timeframes, such as the 4-hour chart, the structure is clear and we need to get below this near-term support as follows:

The hourly chart has the 1.3390s as the first support to break which will put the hourly support line under pressure. If this were to break, we will be looking at a move below .13380 guarding a 50% mean reversion.

In doing so, the bulls could be compelled to move in at a discount considering the recent major breakout.

Comments are closed.