Bears eye a low-hanging fruit opportunity

- EUR/USD bears on the front side of the bearish trendline.

- Bears look to the low-hanging fruit for the week ahead.

EUR/USD is back to flat on the day after moving between a range of 1.1107 and 1.1145. What will be key for the Euro is whether or not some of the dovish risks in next week's Federal Reserve meeting materialize. With both central banks expected to hike by 25bps, statements and pressers will be key next week. as for the charts, the following illustrates prospects of a move into low-hanging fruit towards the 1.1020s.

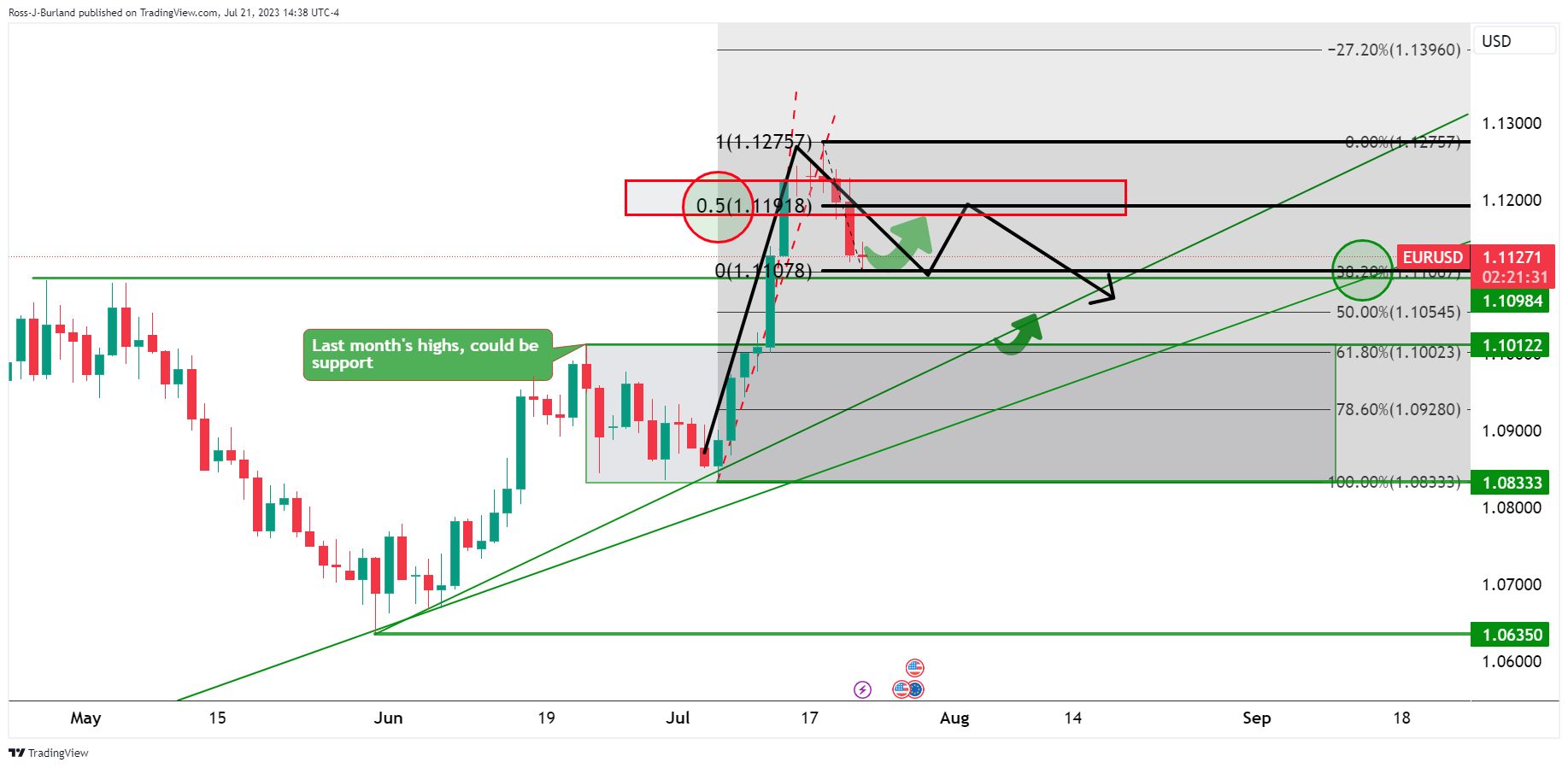

EUR/USD daily charts

The 50% mark of the range is important and bears could stay committed below here near 1.1190/00.

EUR/USD H4 chart

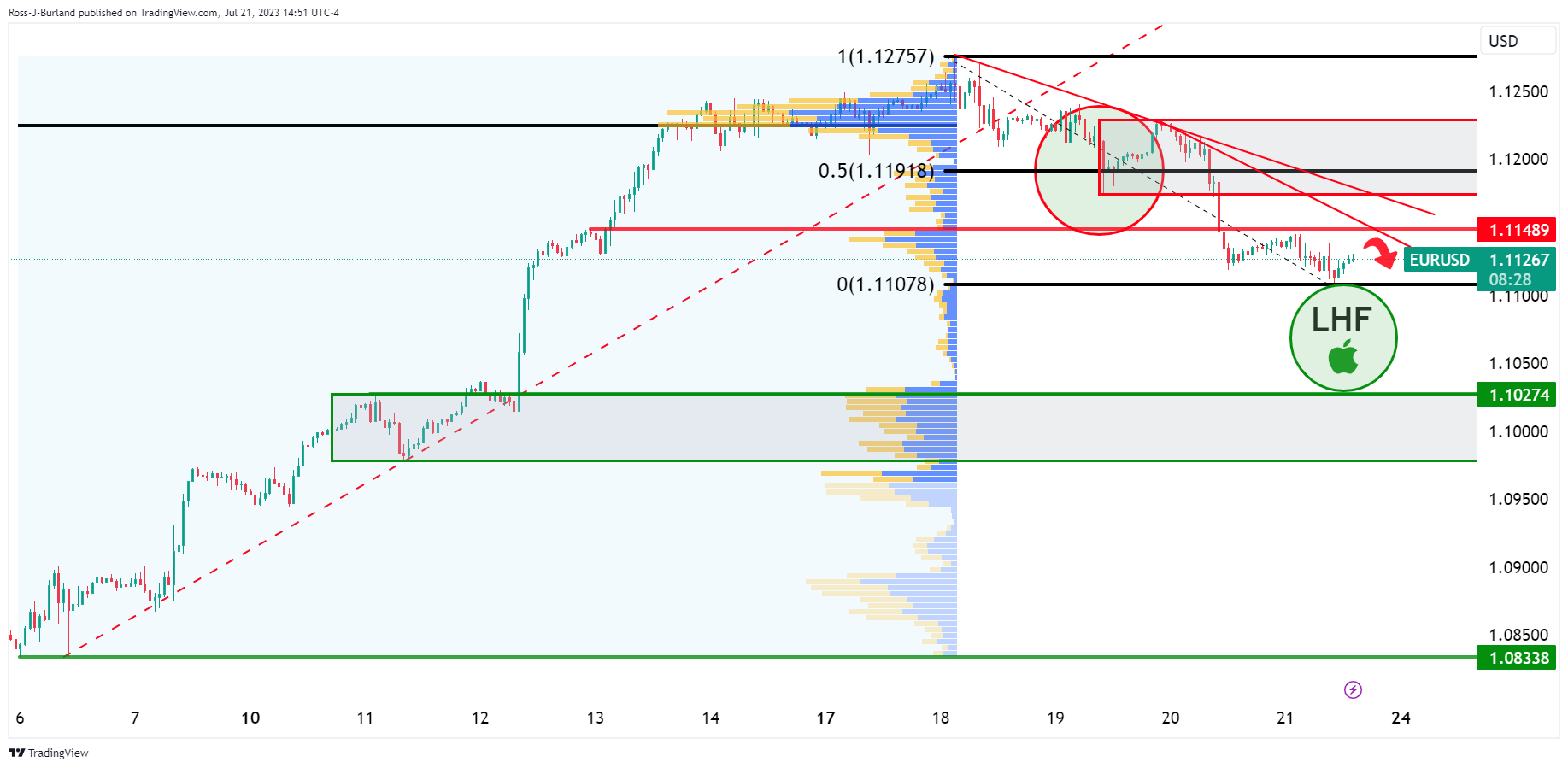

EUR/USD H1 chart

The 1.1150 is also a key area as we zoom in, so a commitment there will be heavily bearish for the open next week if bears stay frontside of the trendlines.

Comments are closed.