Bears are lurking below 0.6150 ahead of NFP

- NZD/USD's resistance between 0.6120 and 0.6150 could lead to a downside extension in failures below the area.

- All eyes are on the US NFP event.

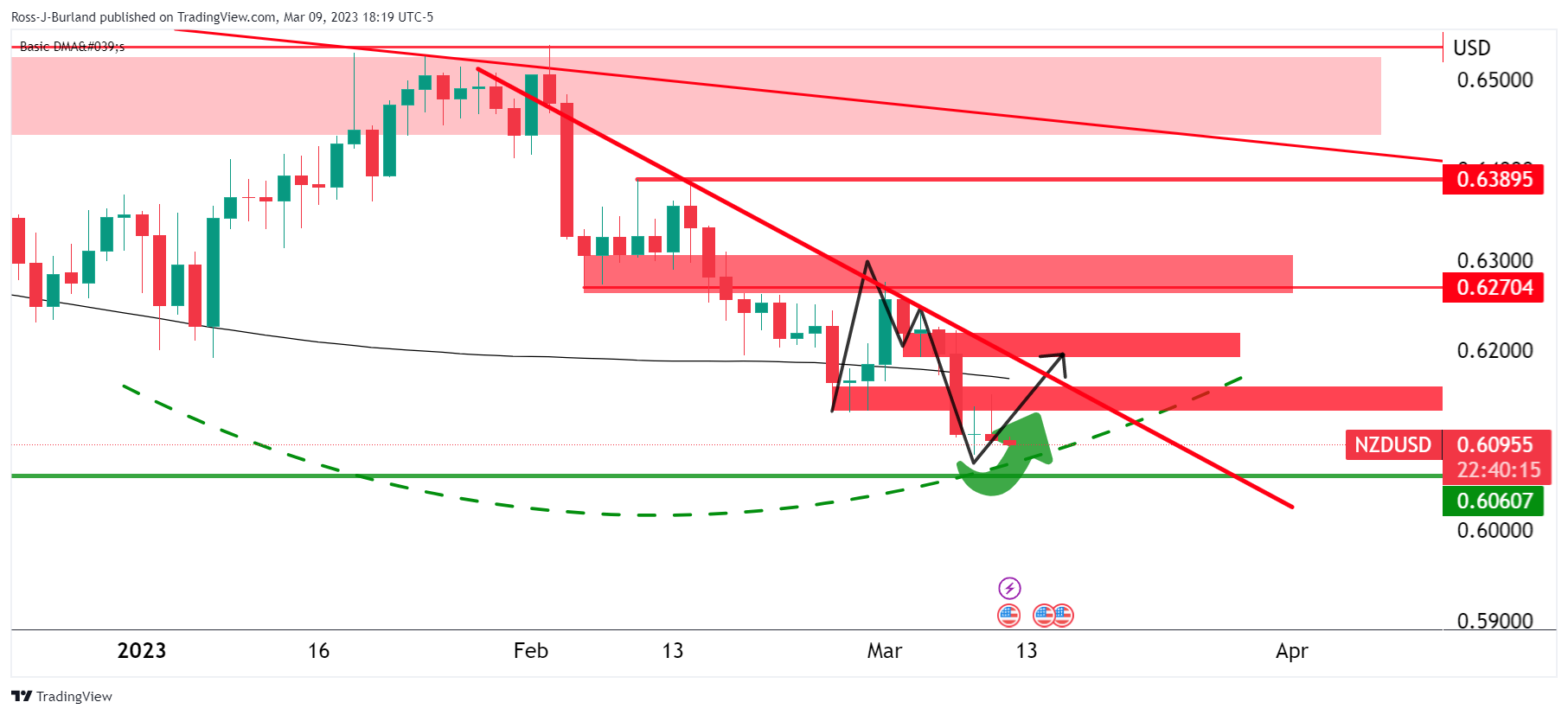

NZD/USD is gliding bid ahead of key US Nonfarm Payroll data tonight while the USD DXY has turned soft ahead of the event putting some wind under the Bird's wings. The following illustrates a corrective bias ahead of the event but bearish overall.

NZD/USD daily charts

The daily chart's inverse head and shoulders are compelling, but the price remains on the front side of the dominant bear trend still and there are bearish under tones while below 0.6270.

In the meanwhile, there are prospects of a fuller test of the dynamic resistance in line with the 200-DMA and neckline of the M-formation.

With that being said, 0.6150 near the 38.2% Fibonacci that meets the dynamic resistance could prove a tough nut to crack.

NZD/USD H1 chart

On the lower time frames, such as the hourly, the 0.6120s could prove to be resilient also and lead to a downside extension in failures below the level.

Comments are closed.