Bank of Japan Monetary Policy Statement: April 28 Preview

Heads up, yen traders!

The BOJ is gearing up to make its monetary policy statement later this week, and it’ll be Governor Kazuo Ueda’s debut as the central bank head honcho.

Here’s what you should know if you’re planning on trading this top-tier catalyst.

Event in Focus:

Bank of Japan Monetary Policy Statement

When Will it Be Released:

April 28, Friday: approximately 3:00 am GMT, 4:00 am London, 11:00 pm (April 27) New York, 12:00 pm Tokyo

Expectations:

As new Governor Ueda has mentioned in his recent speeches, the current ultra-easy monetary policy is appropriate for now, given the latest round of inflation data.

However, it’s also important to note that the Tokyo CPI figures are coming just ahead of the actual BOJ meeting, so any major surprises may still prompt a shift in policy bias.

A few days back, Ueda emphasized that BOJ’s half-year, one-year, and one-and-a-half year inflation forecasts “must be quite strong and close to 2%” before considering YCC changes.

Also, don’t forget that the quarterly BOJ Outlook Report is also lined up for Friday. These contain updated economic forecasts, which should provide some clues on whether or not the central bank is prepping for YCC adjustments in June.

Relevant Japanese Data Since Last BOJ Statement:

🟢 Arguments for Tighter Monetary Policy / Bullish JPY

April flash manufacturing PMI improved from 49.2 to 49.5, reflecting slower pace of contraction but still short of estimated 49.9 figure

March national core CPI held steady at 3.1% year-over-year vs. expectations of a dip to 3.0%

March BOJ core CPI came in hot at 2.9% y/y (2.6% y/y forecast) vs. 2.7% y/y previous

February retail sales improved from 5.0% year-over-year to 6.6% vs. projected 5.9% gain

February tertiary industry activity posted another 0.7% month-over-month gain vs. estimated 0.4% uptick, chalking up two consecutive upside surprises

🔴 Arguments for Looser Monetary Policy / Bearish JPY

March producer price index fell from 8.3% year-over-year to 7.2% as expected, marking third straight month of declines

February average cash earnings increased by 1.1% year-over-year, up from earlier 0.8% gain, real wages down for eleventh month in a row but at a slower pace

February household spending rebounded by 1.6% year-over-year vs. estimated 4.9% increase, suggesting feeble consumer activity

February BOJ core CPI declined from 3.1% year-over-year to 2.7% while Tokyo core CPI dipped from 3.3% to 3.2%

Previous Releases and Risk Environment Influence on JPY

Mar 10, 2023

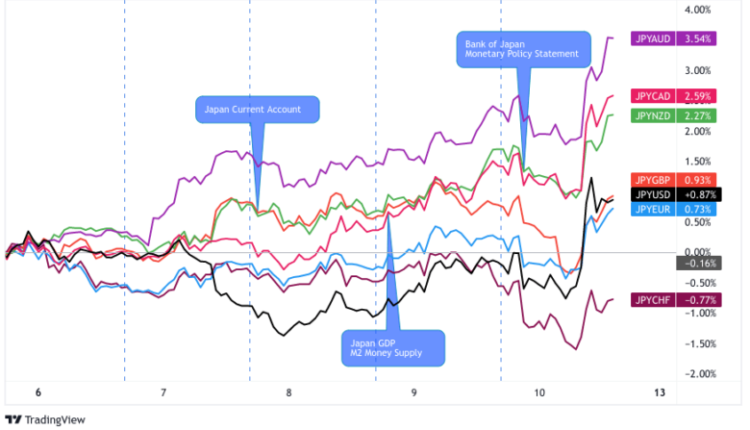

Overlay of Inverted JPY Pairs: 1-Hour Forex Chart

Action / results: BOJ kept monetary policy unchanged as expected, as officials voted unanimously to maintain the yield curve control in place.

Governor Kuroda did not seem inclined to ruffle feathers, as he gears up for transition to Ueda’s leadership.

Risk environment and Intermarket behaviors: Hawkish central bank commentary kept global bond yields supported for the most part of the week, spurring a decline for risk assets like equities and commodities.

Jan 18, 2023

Overlay of Inverted JPY Pairs: 1-Hour Forex Chart

Action / results: The Bank of Japan left policy and yield curve targets unchanged but cut its 2023 GDP forecast and left CPI forecast unchanged.

Some expected BOJ to tighten monetary policy further while inflation was accelerating in Japan, but we saw the complete opposite as BOJ Governor Kuroda reiterated that the they would not hesitate to ease policy if needed.

As a result, the yen quickly dipped on the news as traders took off some of their rate hike bets following the event. Note that the market was already trending lower heading into the event.

Risk environment and Intermarket behaviors: Markets were in risk-off mode around the middle of the week, following the downbeat U.S. retail sales release.

However, hawkish remarks from ECB policymakers and other central bankers managed to turn things around later on, triggering a selloff for safe-haven assets like the yen prior to the BOJ statement.

Price action probabilities

Risk sentiment probabilities: Markets seem to be in a cautious mood so far this week, as traders are holding out for another slew of top-tier data (Q1 advanced GDP and core PCE price index) from the U.S. economy.

Japanese yen scenarios

Base case: Traders were bracing for a somewhat dovish BOJ statement at the start of the week, but that seems to have shifted after the hot BOJ Core CPI release early during the Tuesday trading session. If we see a hot print from Tokyo CPI on Friday (just a few hours ahead of the BOJ statement), that could potentially mean sustained strength going into the meeting.

Since new Governor Ueda is just getting warmed up in the driver’s seat, he’s not likely to shake things up during his very first policy statement just yet. Unless we see a massively strong Tokyo CPI read on Friday, he’ll likely reiterate what he has been known to favor: easy monetary policy and his intention to maintain an accommodative stance.

If JPY continues to rally into the event, this scenario could lead to JPY to selloff into the weekend on both buyers taking profits and traders looking to play monetary policy divergences between the BOJ and the rest of the major central banks.

In this scenario, do some extra work on USD/JPY, EUR/JPY, and GBP/JPY for potential short JPY technical setups, especially if risk sentiment shifts to risk-on ahead of the weekend.

Alternative Scenario: This week’s CPI releases surprise to the upside AND the central bank upgrades their economic estimates, prompting policymakers to acknowledge that their easing efforts are bearing fruit and we hear that it’s high-time for unwinding some measures.

This could trigger a rally for the yen, which has been under downside pressure ever since word broke out that Ueda was to succeed former Governor Kuroda.

Upbeat forward guidance for potential YCC adjustments in the coming months could also bring some upside for the yen.

And if broad risk sentiment is leaning negative on the session, check out AUD/JPY, CAD/JPY, and NZD/JPY for short-term JPY short technical setups in case volatility remains high into the weekend.

Whatever scenario you come up with for JPY this week, remember that JPY does strongly, negatively correlate with broad risk sentiment (i.e., broad risk-off vibes tends to lift JPY and vice versa). So pay close attention to intermarket behavior when assessing your next move in JPY, especially if the BOJ statement fails to spark a big reaction from traders.

Comments are closed.