AW Instruction and description (basic functions) – My Trading – 2 March 2023

This manual describes the general characteristics of advisors:

AW ADX based EA -> MT4 VERSION / MT5 VERSION

AW CCI based EA -> MT4 VERSION / MT5 VERSION

AW Classic MACD EA -> MT4 VERSION / MT5 VERSION

AW Envelopes EA -> MT4 VERSION / MT5 VERSION

AW Ichimoku EA -> MT4 VERSION / MT5 VERSION

AW Momentum EA -> MT4 VERSION / MT5 VERSION

AW Three MA EA -> MT4 VERSION / MT5 VERSION

AW Parabolic SAR EA -> MT4 VERSION / MT5 VERSION

AW RSI based EA -> MT4 VERSION / MT5 VERSION

Strategy:

All these products share a common job structure.

Expert Advisors trade on the signals of one standard classic indicator, the name of the indicator used is reflected in the name of each Expert Advisor.

Opening orders:

Orders are opened according to the indicator signals, each EA has different signals. You can find a detailed description of the signals of a particular EA and the method for opening orders in the description of the selected EA. In the description of each adviser there is a brief description of the strategy for opening orders. Indicator settings are adjusted in the Expert Advisors input settings in the “SIGNALS” section.

For full-fledged work of the adviser, the trader does not need to connect the indicator separately, since the indicator is already built into the adviser. However, indicator labels and lines are not displayed graphically when the EA is running. This is done to save computer resources. If you want to display indicator lines and labels, then attach the indicator to the chart along with the EA. For the adviser to work, the indicator is configured inside the adviser.

That is, if you set an indicator to display labels and lines, make sure that the indicator inside the EA and the external indicator are configured in the same way.

Closing orders:

Orders are closed when the virtual Take Profit is reached.

If the price goes in the wrong direction, the EA uses the averaging mode. The baskets of orders are closed when the profit is reached, and an overlap can be used to close the first and last orders in the basket more quickly.

Possibilities:

-

Different trading strategies are available:

1. Two way trade:

If you use the opportunity to open OP_BUY and OP_SELL, then the adviser will trade in both directions.

In this case, upon receipt of bearish signals, the adviser will make a sale.

Upon receipt of bullish signals, the adviser will make a purchase.

2. One-way trading:

The EA can only trade on bullish signals or only on bearish signals.

If you select the “Allow to open OP_SELL orders ” mode, the EA will sell on bearish signals and ignore bullish signals.

When the “Allow to open OP_BUY orders” mode is enabled, the EA will buy on bullish signals, ignoring bearish signals.

-

Automatic Risk Management Adjustment:

The autolot function works based on two variables.

The first variable is “Enable Autolot calculation” – enabling or disabling the function of automatic calculation of opened positions.

The second variable is “Autolot deposit per 0.01 lots”. This means that for each volume specified in this variable there will be 0.01 lots for the opening volume of the first order.

For example: your deposit is 1000 dollars, in the variable “Autolot deposit per 0.01 lots” you specified 1000. This means that the first order in the basket of orders will be opened with a volume of 0.01 lots, as soon as your deposit increases and becomes 2000 dollars, then the volume the first order in the basket will already be 0.02 lots, and so on, with a deposit of $3,000, the volume of the first order will be 0.03.

If you specified 500 in the “Autolot deposit per 0.01 lots” variable, and your current balance is $1,000, then the first order will be opened with a volume of 0.02. Also, if your deposit subsequently decreases, then the volume of the first order will also decrease in accordance with the setting.

When enabling the autolot feature, the “Size of the order” variable will not work, as the volume of the first order will be flexible according to your deposit.

Overlap Algorithm – this is the overlap of the first order with the last one. This is a partial closure of a basket of orders in one direction. When using the overlap function, not the entire grid is closed, but only the very first unprofitable order. The first and last orders are closed using the profit of the most recent order from the grid. Thus, the total number of orders decreases, as well as the volume of open lotage. This type of closing allows you to partially close the grid overcoming a smaller distance in points.

Overlapping the first order with the last one works when the entire position is unprofitable. If when the TakeProfit level of the first+last orders is reached, the entire position will be in positive territory, then the EA will not overlap, since it is possible to close the entire position.

If, upon reaching the TakeProfit level of the first + last orders, the entire position is in the red, the EA will close the first and last orders.

-

Closings by virtual take profit :

Expert Advisors have a built-in virtual TakeProfit, such TakeProfit is used not for each individual order, but for a basket of orders in one direction from the breakeven price. Virtual TakeProfit is not visible to the broker.

TakeProfit is measured in points, make sure that the size TakeProfit was greater than the spread on the used instrument. The smaller the value, the faster the EA will be able to close open positions, but the smaller the profit from each closure.

When an EA is removed from the chart, the virtual TakeProfit is removed along with the EA, as it is part of the EA. Virtual TakeProfit is visually visible only on the chart to which the Expert Advisor6 is attached, that is, it will not be displayed in the mobile terminal, or in the terminal launched elsewhere.

– Order multiplier. When used, each subsequent order in the order grid will be larger than the previous one by this factor.

When using a small volume of orders (for example, 0.01) and a small volume of the multiplication factor, the system also takes into account the number of orders, which allows high-quality multiplication when it is impossible to increase orders after basic normalization.

For example: the variable ” Size of the first order” uses the value 0.01, and the variable “ Multiplier for average orders” uses the value 1.3.

Then: the first order in the basket will be opened with a volume of 0.01, then the second order will be opened with a volume of 0.01 * 1.3 = 0.01, since 0.013 is an invalid value for the terminal. In this case, the third order will have a volume of: 0.013 * 1.3 = 0.02, i.e. using mathematical rounding rules.

It is undesirable to use values less than “1” without having a good knowledge of the operation of pyramiding order processing systems.

The variable regulating the minimum step between orders is measured in points.

The function is regulated by the variable “Allow to open new orders after close” – If “True” is selected, the EA will open orders after closing the previous ones. If “false” is selected, the EA will not be able to open new orders after closing the previous ones.

- Restriction for opening orders of the current candle:

Depending on the aggressiveness of the trader, the possibility of opening more than one order per candle can be adjusted using the “Maximum 1 order per candle” variable.

When selected in a variable “ Maximum 1 order per candle ” of the “false” option, the EA will open new orders, as soon as there is a signal to open, more orders will be opened. With sharp workshop fluctuations, this option can be dangerous, as a large number of orders can be opened in a short time.

Or for safer operation, the EA can only open one order per candle. Thus, the number of orders will be limited, this option is safer in case of sharp price fluctuations. For this option in the variable “ Maximum 1 order per candle ” must be set to “true”.

A number of protective functions are built into the advisers to prevent opening orders when the limits specified by the trader are reached.

Protective functions include variables:

“Maximum slippage in points”, ” Maximum spread in points” – if the specified limits are exceeded, the signals for opening new orders will be ignored by the EA.

“Maximum number of orders” – when the specified volume of orders in the basket of one direction is reached, no further orders will be opened.

“Maximum size of orders” – when the specified volume for one order is reached, further orders will not increase , but will remain a fixed volume for the upper value.

Expert Advisors have a built-in ability to send notifications when positions are closed.

You can receive notifications in three ways:

Receiving push notifications on the trader's mobile phone,

Receiving an email to the email address specified in the terminal,

Getting an alert in a trader's trading terminal.

Notifications are only sent when positions are closed.

Panel Description:

In the input moved you can adjust the font size in the panel. If necessary, the panel of advisers can be disabled in the input settings. The panel illuminates with a red outline

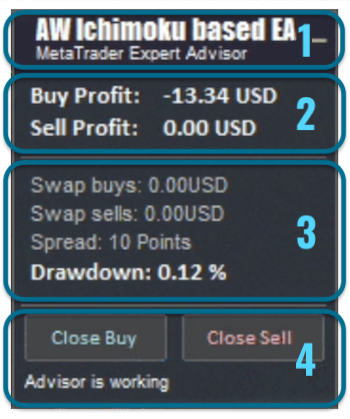

1) At the top of the panel is the name of the adviser, and a button to minimize the panel.

2) Further data on the status of the profit of the current open positions of the adviser. Separately, the data of Sell and Buy orders of the direction is displayed.

3) Below is information about the spread in points, accrued broker swaps in each direction, in the deposit currency. And also in this block, information about the drawdown as a percentage of the deposit for all open positions of the adviser.

4) In the lower block there are buttons for closing all buy orders and all sell orders. And also the state of the adviser is displayed at the bottom.

Additionally, if the EA does not work, for example, if autotrading is disabled, then the panel border is highlighted in red.

Input variables:

MAIN SETTINGS

Size of the first order – Volume to open the first order

1 Enable Autolot calculation – Use automatic lot calculation.

Autolot deposit per 0.01 lots – Deposit amount per 0.01 lots when using autolot

SIGNALS – this section is different for every Expert Advisor. Detailed information describing the variables in this section can be found in the product description.

GRIDS SETTINGS

Minimum step between average orders – Step between orders, measured in points

Multiplier for average orders – Multiplier for orders. Each subsequent order in the order grid will be larger than the previous one by this coefficient

TAKE PROFIT SETTINGS

Size of Virtual TakeProfit (In points) – The size of the virtual TakeProfit. Calculated for the current group of orders from the breakeven price

2 Use overlap last and first orders – Use the overlap of the first order with the last

Use overlap after that number of orders – Use overlap after the given number of open orders

PROTECTION SETTINGS

Maximum slippage in points – Maximum allowable slippage in points for opening and closing orders

Maximum spread in points – Maximum allowable spread for opening orders

Maximum number of orders – The maximum allowable number of orders of the same type

Maximum size of orders – The maximum volume for one order. Measured in lots

Maximum 1 order per candle – Open only one order per candle

ADVISOR SETTINGS

Orders Magic number – MagicNumber of EA orders

Comments of the EA's orders – Comment for EA's orders

Allow to open OP_BUY orders – Allow to open OP_BUY orders

Allow to open OP_SELL orders – Allow to open OP_SELL orders

Allow to open new orders after close – Ability to allow opening orders after closing previous ones.

Show panel of advisor – Ability to show or hide the advisor panel

Font size in panel – Adjust the font size on the panel

NOTIFICATIONS SETTINGS

Send push notifications when closing orders – Notifications to the mobile version of the terminal when closing orders

Send mails when closing orders – Sending letters to an email address when closing orders

Send alerts when closing orders – Sending pop-up notifications on the terminal when orders are closed

Buy an advisor right now:

AW ADX based EA -> MT4 VERSION / MT5 VERSION

AW CCI based EA -> MT4 VERSION / MT5 VERSION

AW Classic MACD EA -> MT4 VERSION / MT5 VERSION

AW Envelopes EA -> MT4 VERSION / MT5 VERSION

AW Ichimoku EA -> MT4 VERSION / MT5 VERSION

AW Momentum EA -> MT4 VERSION / MT5 VERSION

AW Three MA EA -> MT4 VERSION / MT5 VERSION

AW Parabolic SAR EA -> MT4 VERSION / MT5 VERSION

AW RSI based EA -> MT4 VERSION / MT5 VERSION

AW Trading Software

Telegram channel: https://t.me/AWSoftware

Comments are closed.