Australian dollar Price Setups: AUD/USD, AUD/JPY, EUR/AUD, AUD/SGD

Australian Dollar Vs US dollar, Japanese Yen, Euro, Singapore dollar – Price Action Setups:

- AUD is looking vulnerable against some crosses.

- Risk appetite takes a back seat amid the growing view that US interest rates could stay higher for longer.

- What are the key levels to watch?

Recommended by Manish Jaradi

How to Trade AUD/USD

The Australian dollar is looking vulnerable against some of its peers as risk appetite takes a back seat amid the growing view that US interest rates could stay higher for longer.

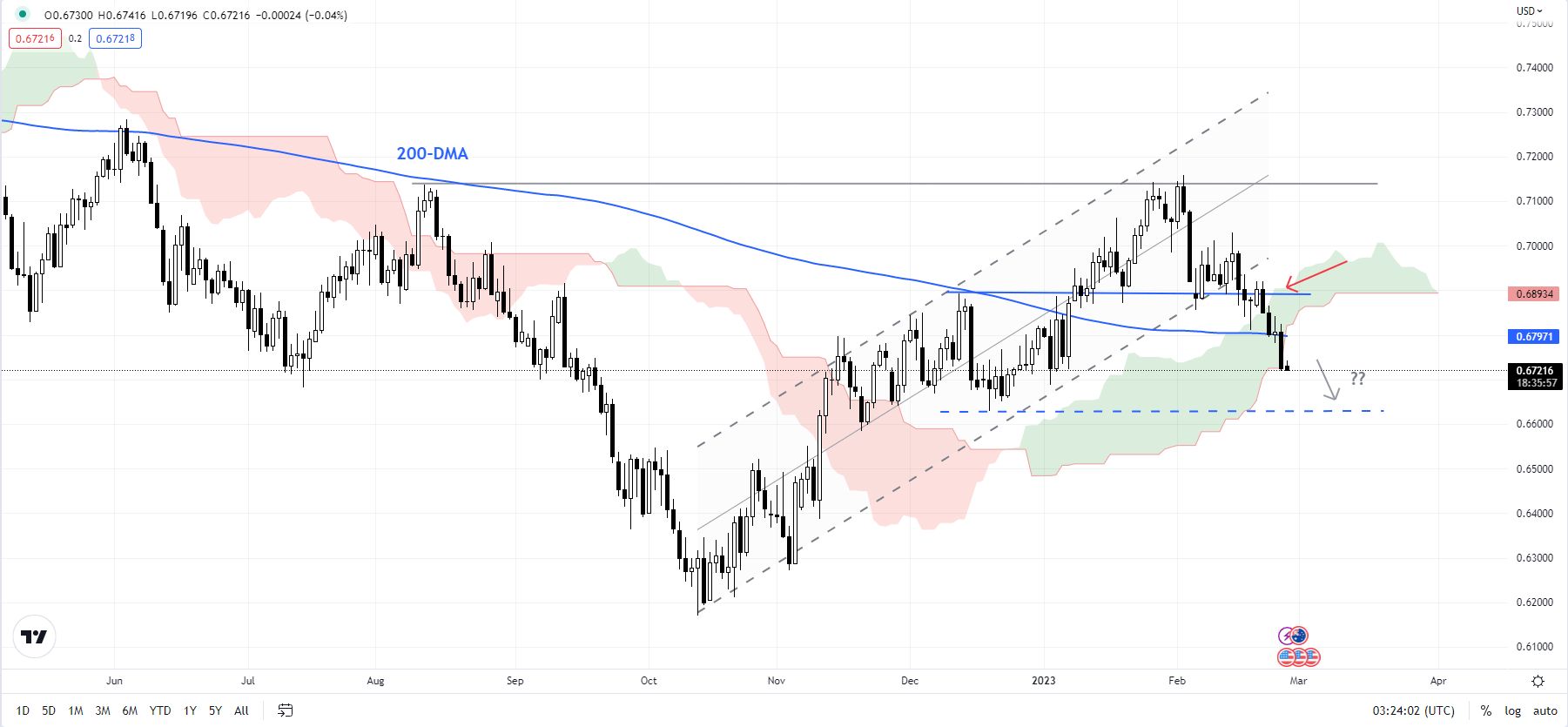

AUD/USD – Minor head & shoulders triggered

AUD/USD’s fall below significant support on a horizontal trendline from mid-January has at 0.6870 triggered a minor head & shoulders pattern (the left shoulder is the January 18 high, the head is the February 2 high, and the right shoulder is the February 14 high) with a price objective of 0.6580. Importantly, the drop below cushions on the 200-day moving average (DMA) and the 89-DMA confirms that the multi-week upward pressure has faded. Still, there is fairly strong support at the late-November low of 0.6585. AUD/USD needs to hold above the support for the four-month-long uptrend to remain intact.

AUD/USD Daily Chart

Chart Created Using TradingView

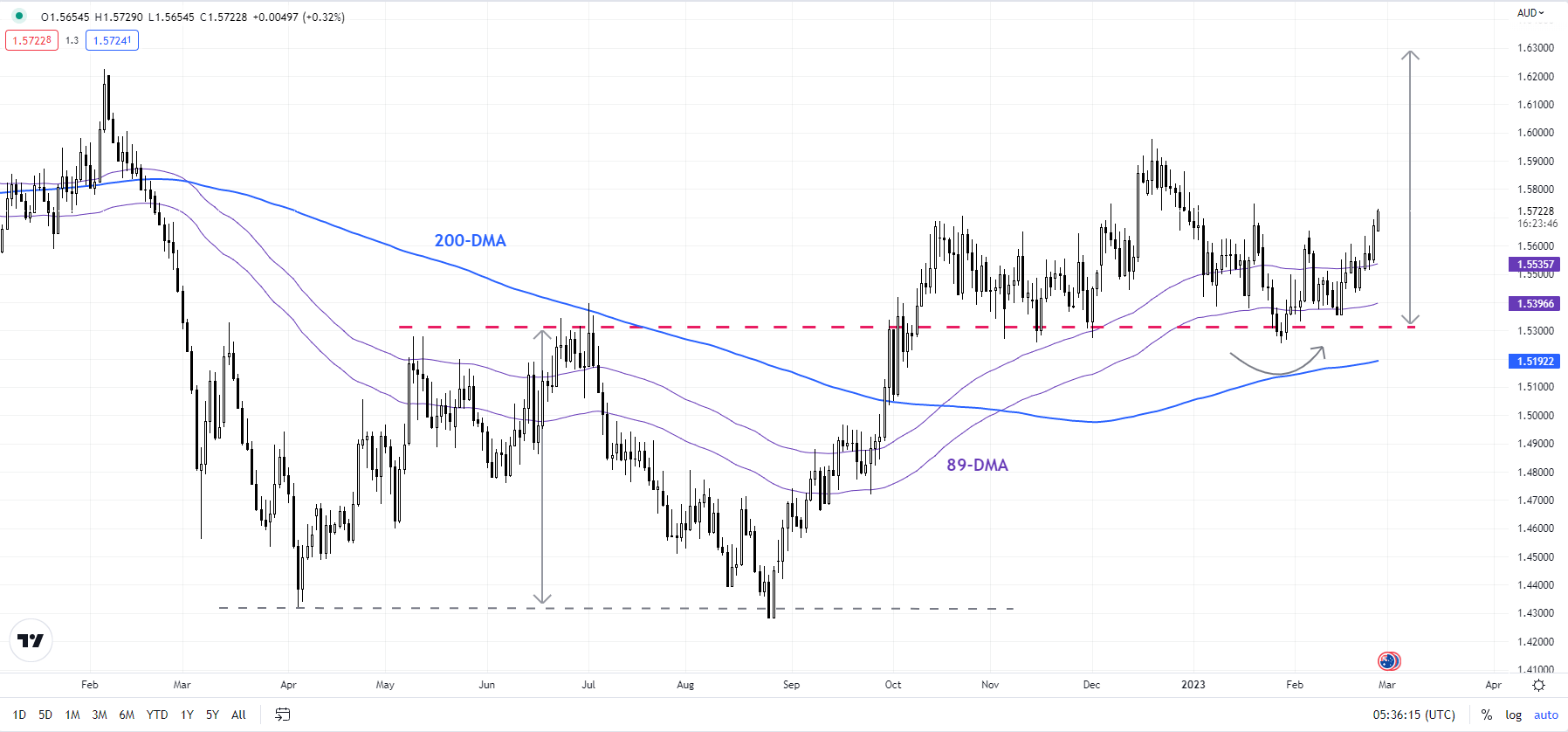

EUR/AUD: Double bottom points to more upside

EUR/AUD’s repeated hold above crucial support on a horizontal trendline from May at about 1.5315 confirms that the five-month-long uptrend remains intact. Any break above the immediate hurdle at the late-January high of 1.5750 could initially open the way toward the December high of 1.5980, followed by the February 2022 high of 1.6225. The break in October above key resistance at the July high of 1.5400 triggered a double bottom pattern (the April 2022 and the August 2022 lows) with a potential price objective of 1.6450.

EUR/AUD Daily Chart

Chart Created Using TradingView

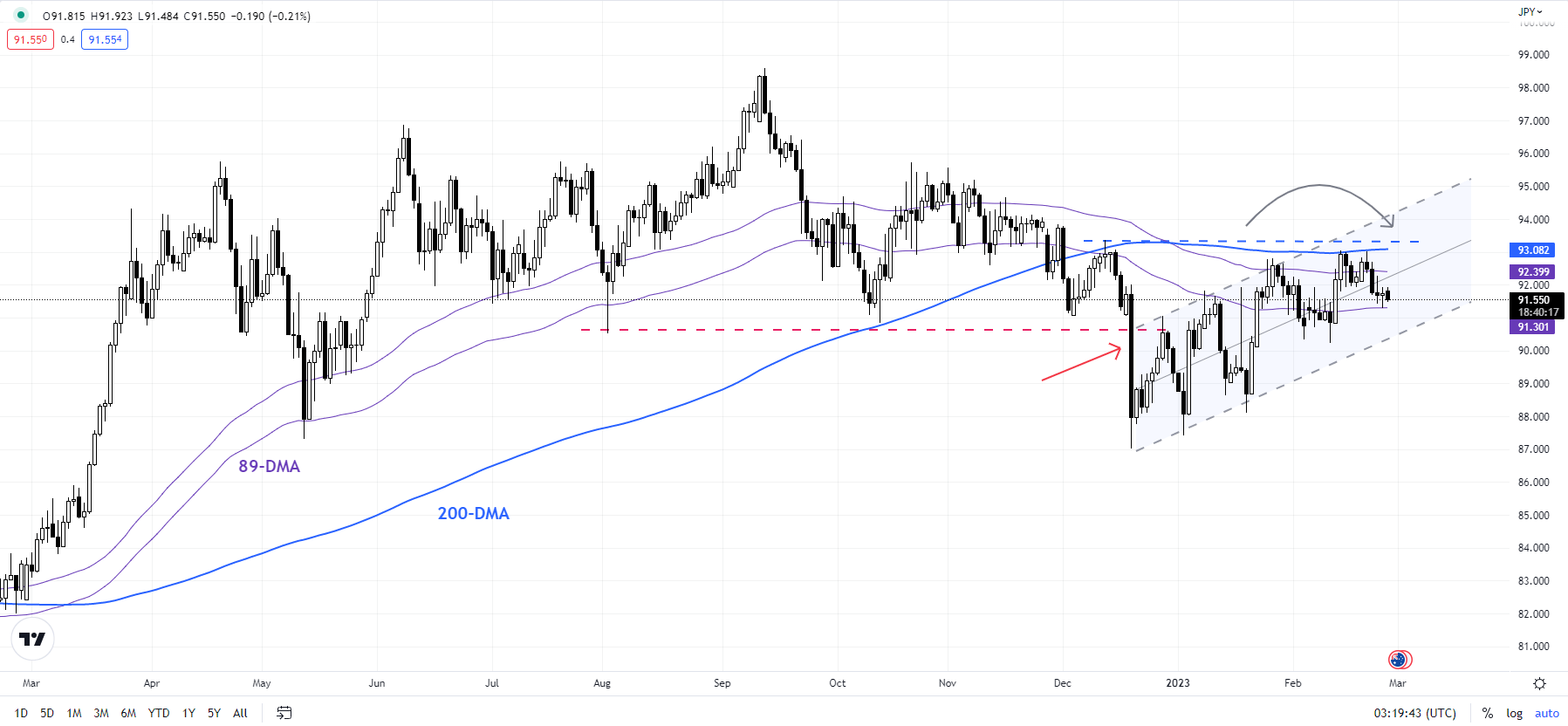

AUD/JPY – A potential double top

AUD/JPY’s choppy nature of the rebound since December suggests the rally is corrective after the cross failed to decisively break below the vital floor at the May low of 87.45. Failed attempts in recent weeks to break past the tough hurdle at the 200-DMA, coinciding with the mid-December high of 93.35 indicates that the rebound is running out of steam. Any break below the immediate cushion at the early-February low of 90.20 would trigger a minor double top (the January and the February highs), opening the way toward the December low of 87.10.

AUD/JPY Daily Chart

Chart Created Using TradingView

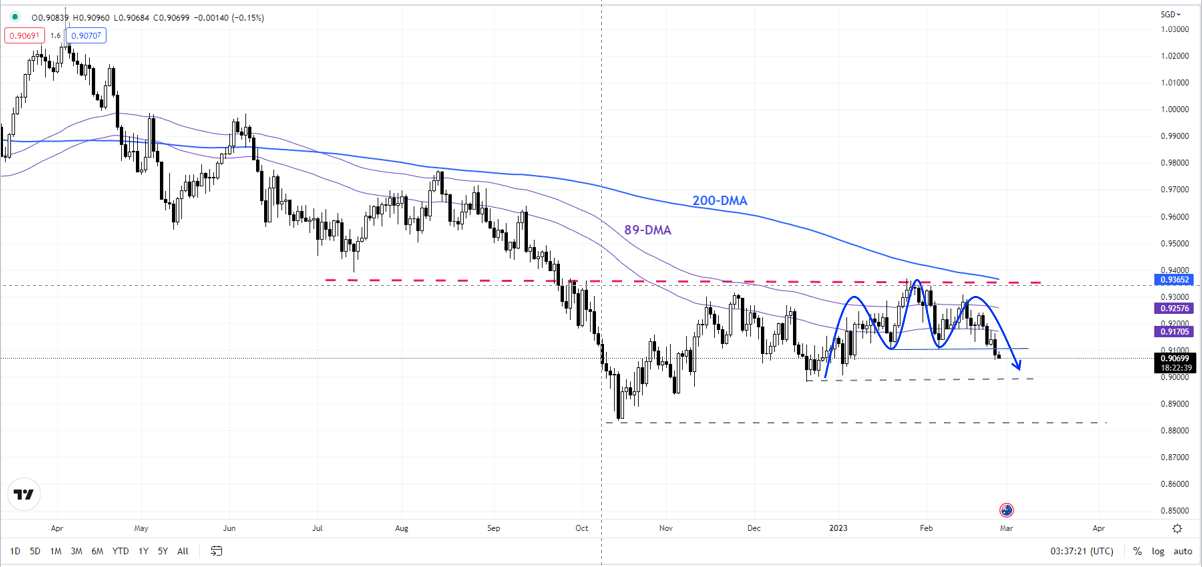

AUD/SGD: Minor head & shoulders pattern triggers

The rally since the end of 2022 looks corrective, rather than a reversal of the broader downtrend. Despite the rebound, AUD/SGD hasn’t been able to break past a solid barrier between the 89-DMA and the 200-DMA. Friday’s fall below the immediate cushion on a horizontal trendline from January at about 0.9100 has triggered a minor head & shoulders pattern (the left shoulder is the January 18 high, the head is the January 25 high, and the right shoulder is the mid-February high), potentially opening the way toward 0.8835. Importantly, any break below the December low of 0.8975 would trigger a double top (the end-2022 and the January highs), exposing downside risks toward the October low of 0.8820.

AUD/SGD Daily Chart

Chart Created Using TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

Comments are closed.