Australian Dollar Pauses After Trend Break. Where to for AUD/USD?

Australian Dollar, AUD/USD, US Dollar, Current Account, GDP – Talking Points

- The Australian Dollar adjourned the bearish run this week

- Retail sales and the current account surplus beat expectations

- The trend has been broken for now. What does it say about AUD/USD?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Australian Dollar has consolidated through the early part of this week after tumbling over 2% last week. That move was triggered by the US Dollar roaring higher on perceptions of a more hawkish Federal Reserve.

Domestic data released today reveal the underlying strength of the economy going into the end of last year and into 2023.

The fourth quarter current account surplus came in at AUD 14.1 billion against AUD 5.5 forecast and the previous print revised up to AUD 0.8 billion from AUD -2.3 billion.

Month-on-month retail sales for January were up 1.9% rather than 1.5% anticipated and -0.2% prior.

Keeping in mind that year-on-year CPI to the end of 2023 was 7.8%, the economy is running hot up to this point in time. When it comes to monetary policy for the RBA going forward, the issue is the impact of 300 basis points worth of tightening for fixed-rate borrowers when their loans roll off this year.

A problem measuring the potential impact of this dynamic lies in the available data being at a macro level rather than the ability to drill down.

Households that will see large increases in borrowing costs might have large reserves built up or other means to deal with the situation. Or perhaps not.

The RBA collect data from the major banks and will be able to get a better handle on the circumstances than the rest of the market.

In any case, the incoming data throughout this year is likely to be highly scrutinised for the impacts or otherwise of these fixed-rate loans rolling off.

AUD/USD appears to be more vulnerable to sways in global sentiment for now, rather than the state of the domestic economy.

If the exchange rate continues to trade near these levels, the current account and trade surpluses seem like they will continue to make a positive contribution.

According to a Bloomberg survey of economists, GDP data tomorrow is anticipated to show growth of 0.7% q/q for the fourth quarter and 2.9% y/y to the end of 2023.

Recommended by Daniel McCarthy

How to Trade AUD/USD

AUD/USD TECHNICAL ANALYSIS

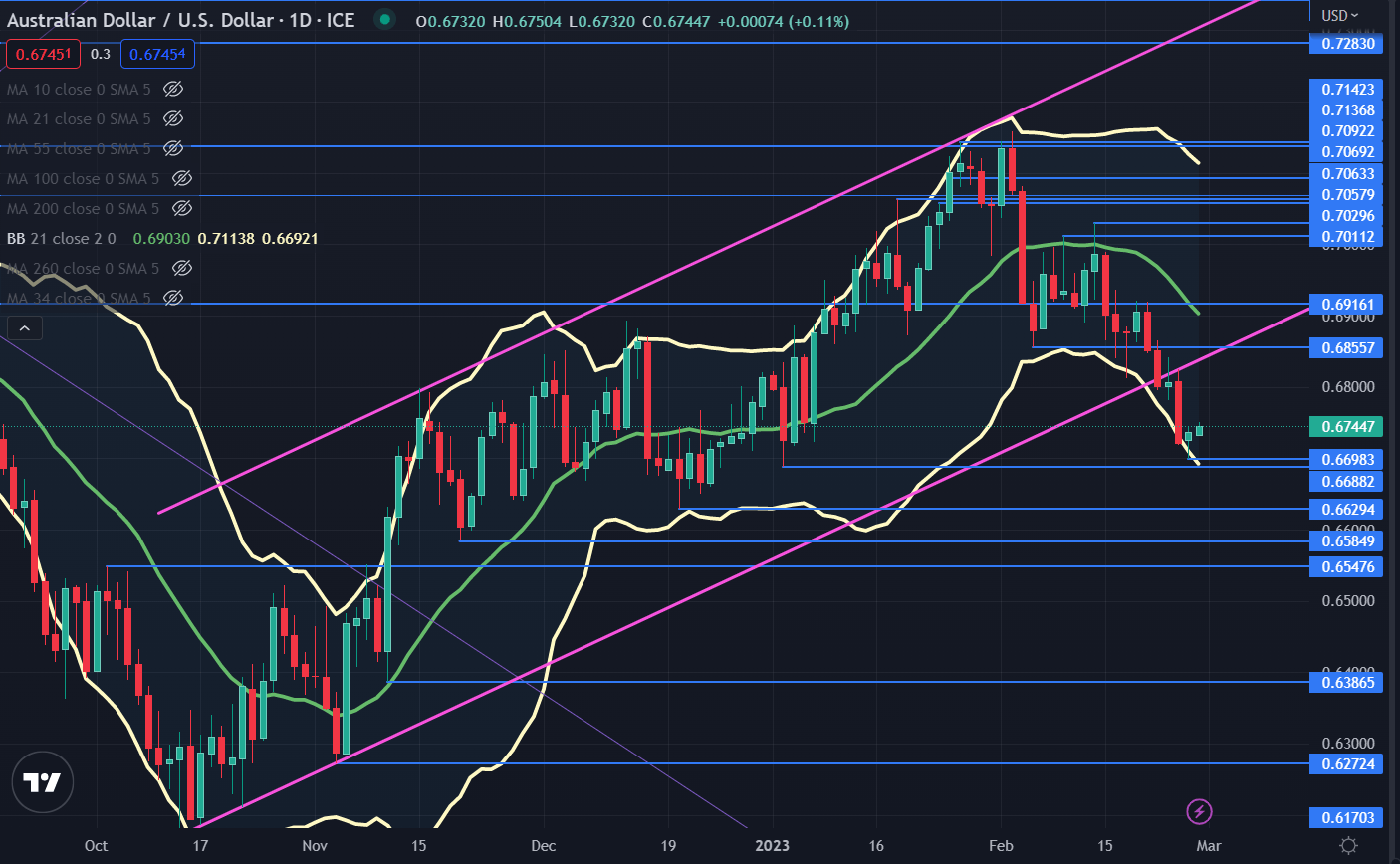

The Australian Dollar appeared to gain bearish momentum when broke the lower bound of an ascending trend channel last week.

It appears to have support for now near a prior low at 0.6688 when it traded as low as 0.6698. Support could be further down at the previous lows of 0.6629 and 0.6585.

The move lower saw the price close below the lower band of the 21-day Simple Moving Average (SMA) based Bollinger Band. Yesterday’s close was back inside the band and this might indicate a pause in the bearish move or a potential reversal.

On the topside, resistance could be at the breakpoints of 0.6856 and 0.6916 ahead of the prior peaks of 0.7011 and 0.7030.

AUD/USD DAILY CHART

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Comments are closed.