Australian Dollar Hurt by Dampened Risk Appetite; AUD/USD, AUD/CAD, AUD/SGD Price Setups

Australian Dollar Vs US Dollar, Canadian Dollar, Singapore Dollar – Price Setups:

- A double top risk in AUD/USD as risk appetite scales back for now.

- AUD/SGD threatens to break below a bearish triangle.

- AUD/CAD drifts lower within a downtrend channel?

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

A scaling back in risk appetite and an unexpected pause by the Reserve Bank of Australia (RBA) earlier in the week is weighing on the Australian dollar.

Fitch’s downgrade of US credit rating and higher-for-longer rates following strong US private payroll data appears to be the recent catalysts for the setback in risk appetite. RBA delivered its second rate pause, contrary to expectations of a 25 basis-points hike, boosting the perception that Australia's interest rates may have peaked, or at least moving to a data-dependent approach with regards to further tightening.

Meanwhile, markets are awaiting fresh stimulus from China targeted toward the ailing property sector. Beijing has announced a series of measures to cushion some of the downside risks to the economy, including cuts in key lending benchmarks, targeted measures toward new-energy vehicles, the property sector aimed at the supply side, and the booming generative artificial intelligence sector, and signaled the end of the years-long crackdown on the technology sector.For more discussion, see “Australian Dollar Surges on China Stimulus Pledge; AUD/USD, EUR/AUD, GBP/AUD Price Action,” published July 25.

Additional measures for the struggling property sector addressing the demand side and infrastructure could provide a floor to the deteriorating growth outlook. China is Australia’s largest two-way trading partner in goods and services. Any improvement in China’sgrowthoutlook bodes well for AUD prospects.

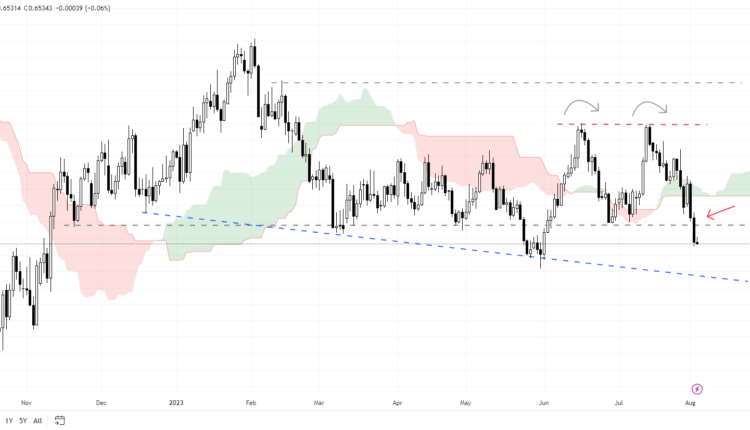

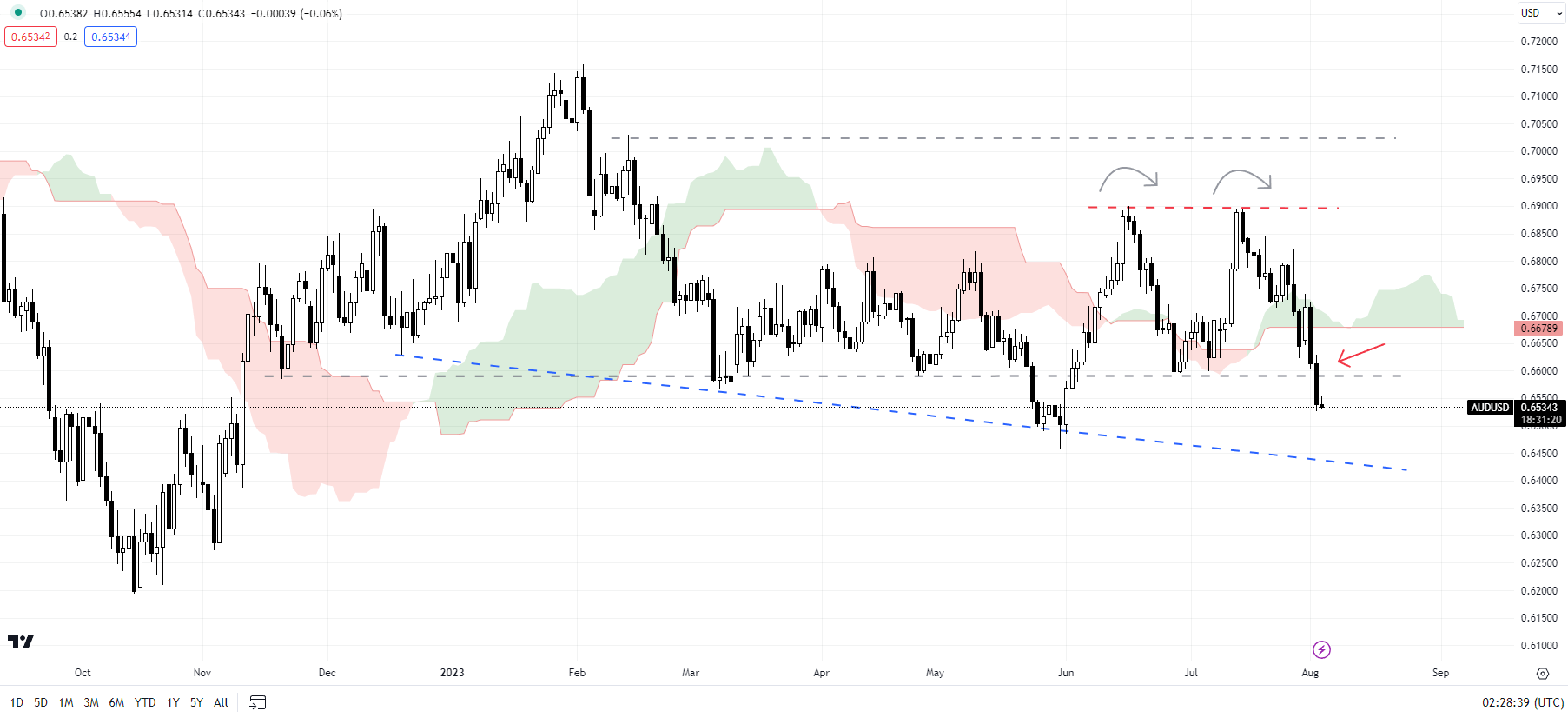

AUD/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

AUD/USD: Looking vulnerable

On technical charts, AUD/USD is attempting to break below a vital floor at the end-June low of 0.6600, triggering a double top (the June and the July highs), potentially exposing the downside toward 0.6300. However, there is interim support on the lower edge of a declining trendline (at about 0.6375). A double top as a reversal pattern tends to be reliable, especially after a well-defined prior trend. However, in the current episode, the choppy/directionless price action since Q2-2023 raises the risk of undershooting the price objective of the pattern.

Any break below 0.6375-0.6450, roughly coinciding with the May low of 0.6450, could open the door toward the end-2022 low of 0.6170.

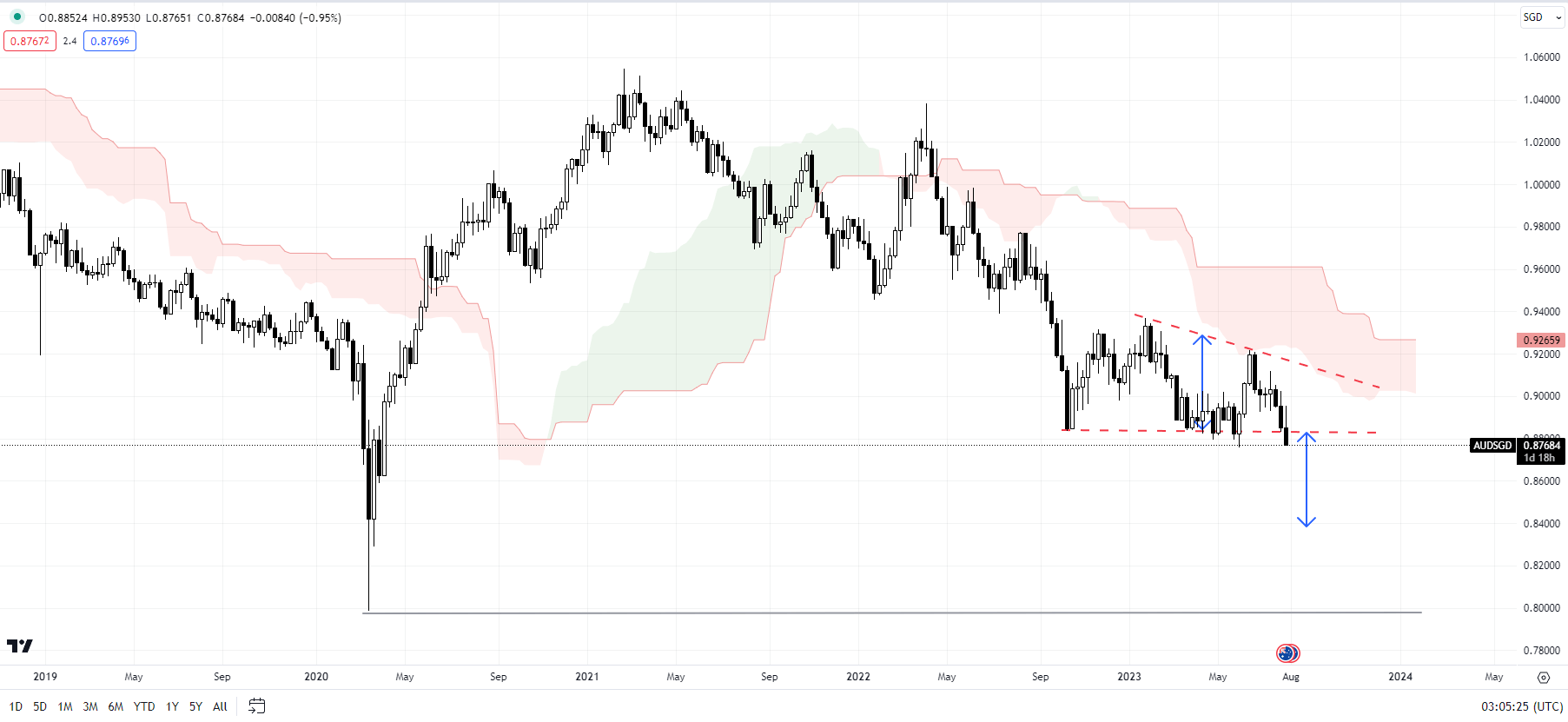

AUD/SGD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

AUD/SGD: Testing the line in the sand

Any break below a horizontal trendline from October, that comes in at about 0.8800, would trigger a breakout from a descending triangle. The upper edge of the triangle is a downtrend line from January. A breakout from the pattern could trigger a move of about 400 pips, based on the width of the pattern. Major support comes in at the 2020 low of 0.7980.

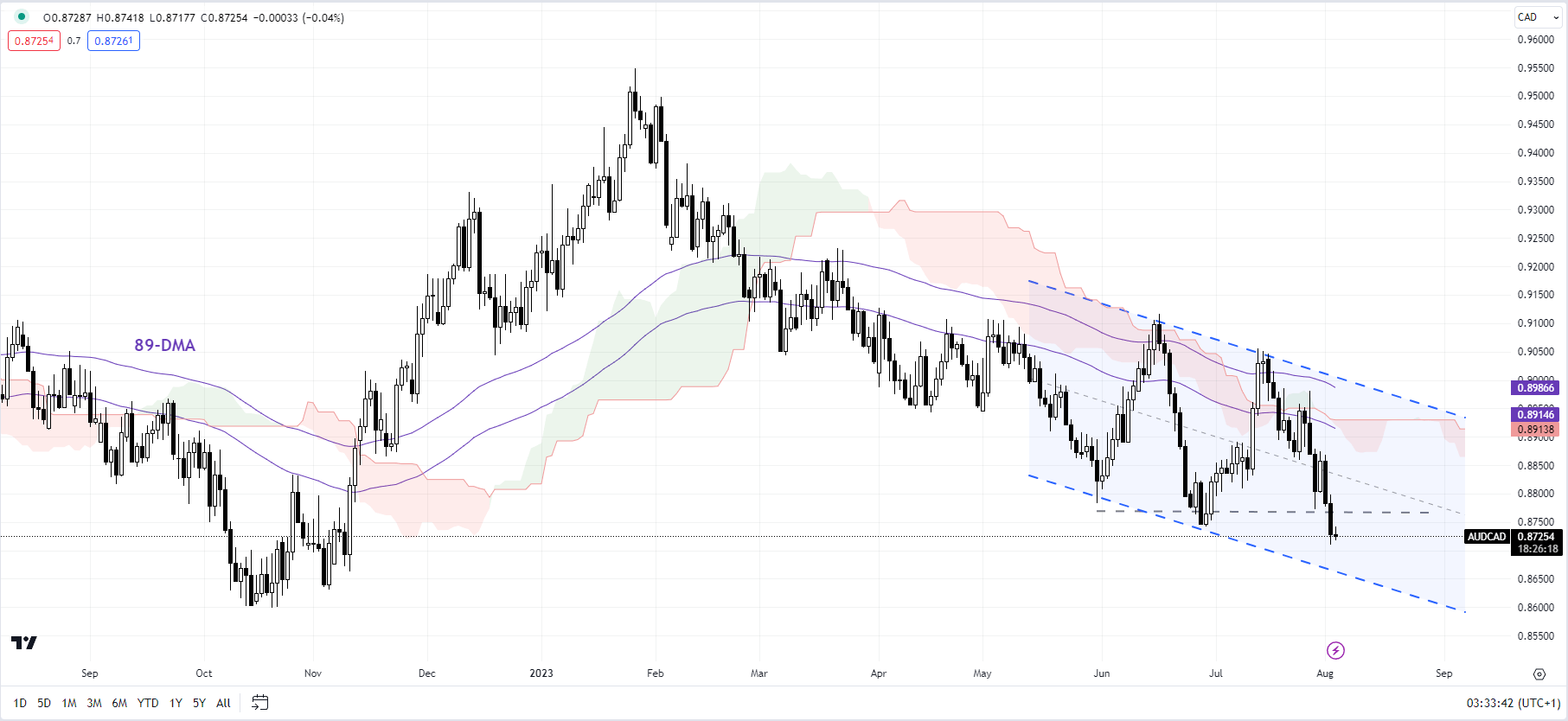

AUD/CAD Daily Chart

Chart Created by Manish Jaradi Using TradingView

AUD/CAD: Drifting lower

AUD/CAD appears to be well guided within a downward-sloping channel from June, with initial support on the lower edge, now at about 0.8675. The lower-lows-lower-highs pattern since the start of 2023 raises the scope of a retest of the end-2023 low of 0.8600.

Recommended by Manish Jaradi

How to Trade AUD/USD

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Comments are closed.