Australian Dollar Dunked After GDP Miss Provides Volatility. Will AUD/USD Go Lower?

Australian Dollar, AUD/USD, GDP, S&P ASX 200, CPI, RBA -Talking Points

- The Australian Dollar has lost ground after GDP disappointed

- Stagflation might undermine the prospect of a soft landing

- The RBA is anticipated to hike next week. Is that good or bad for AUD?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Australian Dollar sunk below 67 cents after 4Q quarter-on-quarter GDP came in at 0.5% rather than the 0.8% forecast and against the previous 0.7% that was revised up from 0.6%.

Annual GDP to the end of December was 2.7% as anticipated reveal more upward revisions to prior quarters. The prior read was 5.9%..

Today’s GDP figures arrive ahead of the Reserve Bank of Australia’s monetary policy meeting next Tuesday. They are anticipated to increase their cash rate target by 25 basis points (bp) to 3.60%. If they do, it will be the tenth hike since the lift-off in May last year.

The latest inflation read is way above the RBA’s target band of 2-3% at 7.8% year-on-year. Today’s data comes on the back of yesterday’s retail sales and current account.

The fourth quarter current account surplus came in at AUD 14.1 billion against AUD 5.5 forecast and the previous print revised up to AUD 0.8 billion from AUD -2.3 billion.

Month-on-month retail sales for January were up 1.9% rather than 1.5% anticipated and -4.0% prior.

The fundamental data points toward mixed signals for the economy but the RBA seem to have little choice but to tighten further in the near term with inflation so rampant.

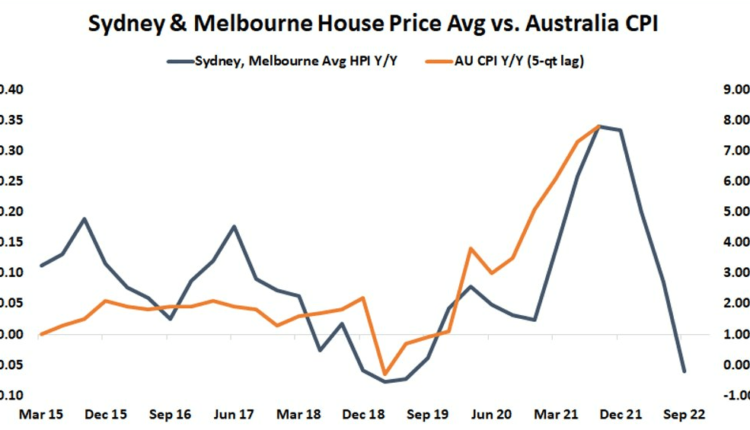

The picture down the track seems to be somewhat opaque with a high degree of uncertainty. Some leading indicators might be a harbinger of the headwinds ahead. Housing prices have continued to slip lower and business sentiment surveys are deteriorating.

Source; Bloomberg

Source; Bloomberg

Potentially compounding the problem could be the so-called ‘mortgage cliff’ where fixed rate borrowers will be re-adjusting the repayments at over 300 bp higher.

All of this illustrates the tricky road ahead for the RBA. The latest unemployment data showed the labour market loosening a fraction but still relatively tight by historical measures with the unemployment rate at 3.7%. Reining in price pressures at a time of softening aggregate demand might lead to deepening stagflation.

This scenario might be bearish for AUD/USD but in turn, a lower exchange rate may assist the domestic economy, especially if China is able to ignite its growth plans. The upcoming National; People’s Congress (NPC), which starts this weekend, may offer some insights into this prospect.

Recommended by Daniel McCarthy

How to Trade AUD/USD

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

Comments are closed.