Australian Building Permits Hits 12-Month Low

AUD/USD ANALYSIS & TALKING POINTS

- Minimal volatility expected today as Aussie dollar catches its breath..

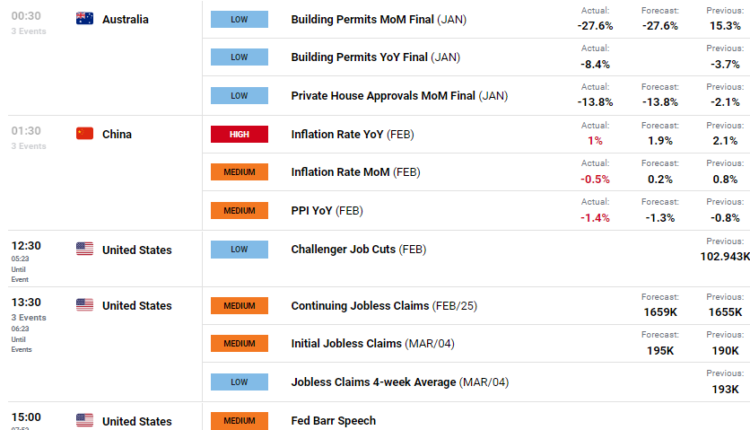

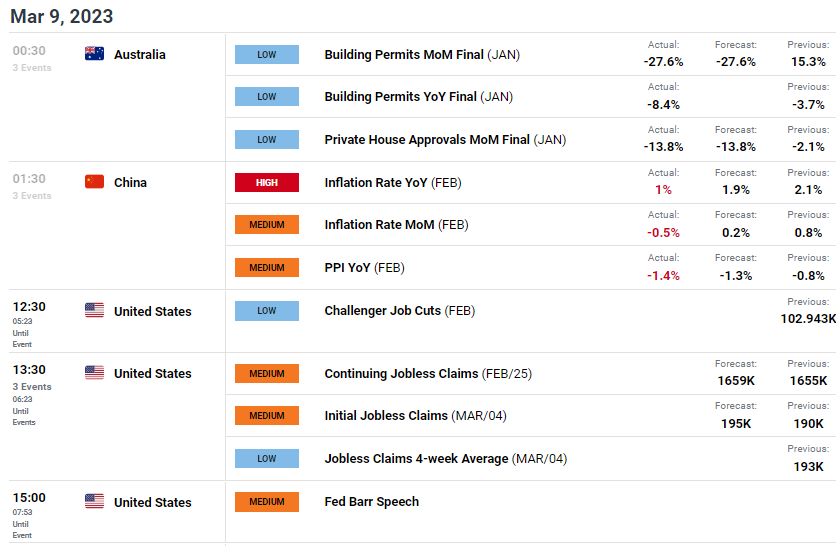

- Economic data today: Australian building permits, Chinese inflation and US jobless claims.

- AUD/USD pause ahead of US NFP data.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar is attempting a pullback this Thursday after Tuesday’s 2.2% fall against the U.S. dollar. The morning kicked off with some poor economic data (see calendar below) out of Australia by way of building permits and private house approvals for January. Both sets of data printed in line with estimates but reached levels last seen in January 2022. This deterioration in the housing and building sectors are a reflection of the high interest rate environment created by the Reserve Bank of Australia (RBA).

Comparatively, the RBA seems to be diverging from the Federal Reserve outlook and could continue to weigh on the Aussie dollar as the carry trade appeal for the USD increases. In addition, sustained political tensions in between Russia/Ukraine and US-China are feeding the safe-haven component of the greenback.

From a Chinese perspective (largest importer of Australian commodities), inflation figures this morning dropped possibly indicative of stagnating growth and does not bode well for export forecasts if this is the case.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Later today, US jobless claims data will be in focus alongside the Fed’s Barr. Should jobless claims come in lower than projections suggest, this could add to recent USD strength; however, today’s trading should be rather subdued as markets keenly await tomorrow’s Non-Farm Payroll (NFP) data.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

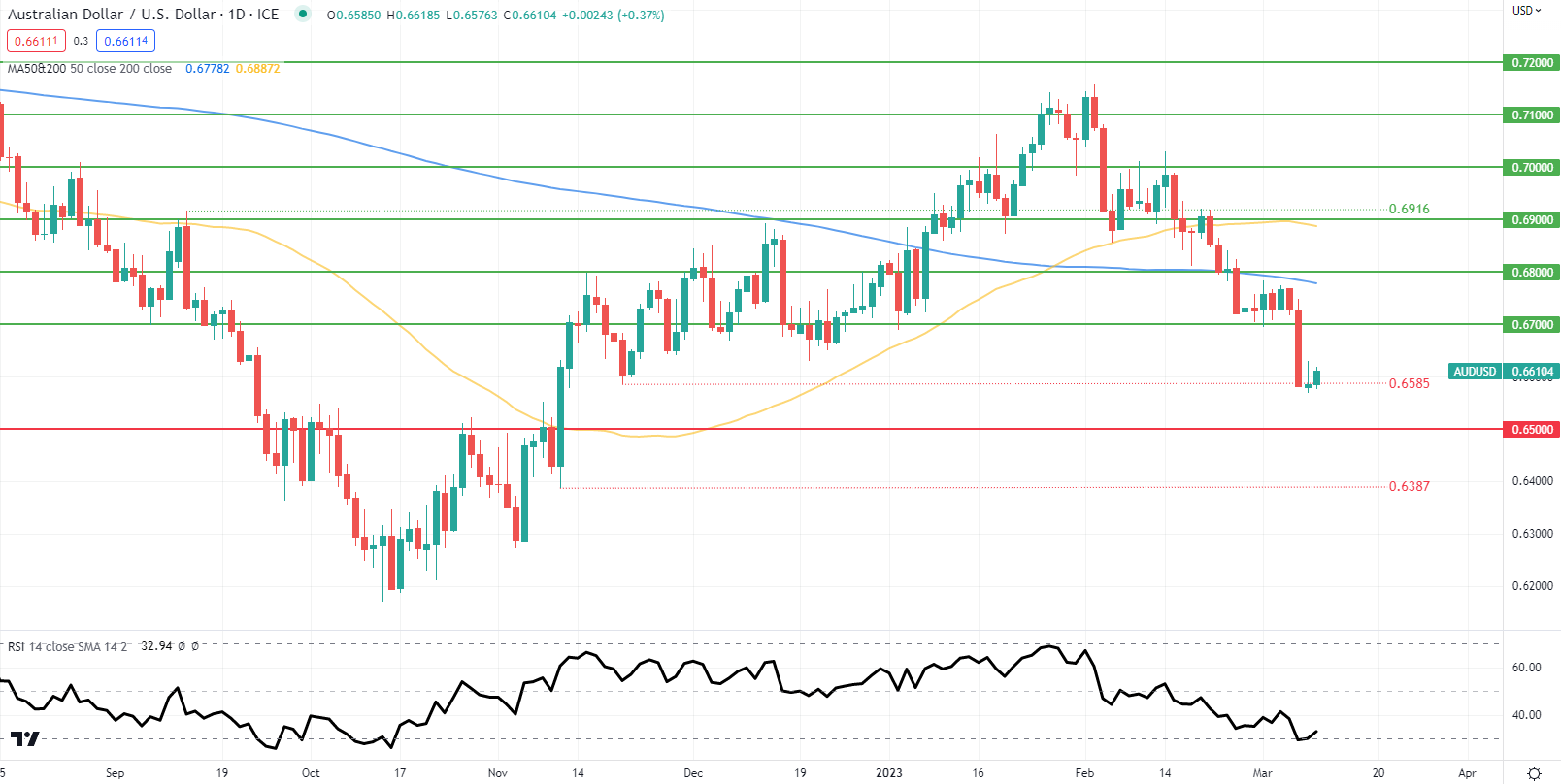

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action is being buoyed by the 0.6585 November swing low coinciding with an oversold Relative Strength Index (RSI). AS mentioned above, tomorrow’s NFP report will either add to the recent hawkish repricing of the Fed’s interest rate forecast or not. Therefore, a better than expected NFP print could easily see the AUD slip towards the 0.6500 psychological support handle .

Key resistance levels:

- 0.6800

- 200-day MA (blue)

- 0.6700

Key support levels:

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on AUD/USD, with 76% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning we arrive at a short-term cautious bias.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.