AUD/USD, GBP/AUD Analyzed as AUD Eyes a Recovery Post RBA Statement

AUD/USD, GBP/AUD PRICE, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

Get Your Free AUD Forecast

Most Read: The Reserve Bank of Australia: A Trader’s Guide

AUD FUNDAMENTAL BACKDROP

The Australian Dollar continued its recovery overnight with modest gains against both the Greenback and the GBP. The week thus far has proven to be another challenging one for the AUD following a continuation of the pause in rate hiking cycle by the RBA on Tuesday which weighed on the currency.

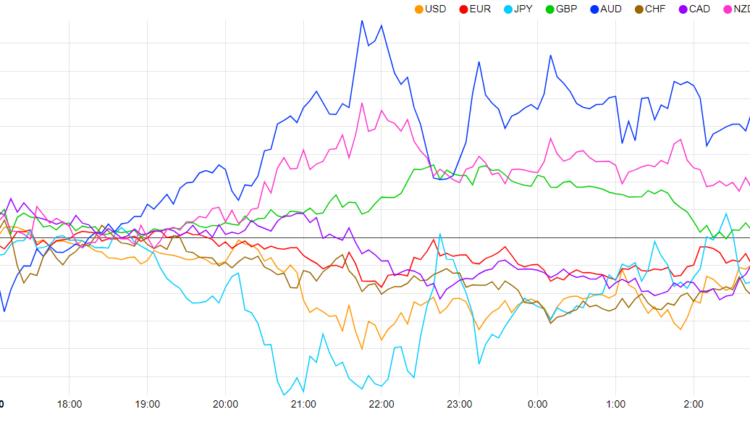

Yesterday saw the AUD regain some strength and arrest its recent slump finishing the day up 0.2% against the US Dollar. The move in part came down to a slightly weaker US Dollar as well as a wee bit of Australian Dollar strength which saw GBPAUD retreat from the fresh YTD high around the 1.9480 mark. Looking at the currency strength chart below we can see AUD is leading the charge this morning with the US Dollar in particular struggling as we do have NFP and Jobs data ahead later in the day.

Currency Strength Chart: Strongest – AUD, Weakest – JPY.

Source: FinancialJuice

The RBA Monetary Policy Statement this morning revealed the Central Bank contemplated a rate hike at this week’s meeting but felt that consumers and households were already experiencing a “painful squeeze” further cementing the case for a pause. The RBA stressed that this would also provide more time to assess how the how the economy and risks to inflation and employment were evolving. Inflation remains the Central Banks key focus moving forward with positive signs in the offing. Markets are still pricing in a 50-50 chance of one more rate hike in Q4 as services inflation remains elevated and productivity growth lags.

Economic growth forecasts have been downgraded with the Central Bank now expecting growth of just 0.9% in 2023 compared with the previous estimate of 1.2%. Other notable forecasts from the RBA included headline inflation at 4.1% by the end of this year, down from the previous forecast of 4.5%. The RBA does expect inflation to remain sticky in 2024 before easing back to 2.8% by end of 2025 which could mean higher rates are here for a sustained period of time, something which has been echoed by other Central Banks as well. Key uncertainties cited include Australia’s biggest export market China, household consumption, inflation getting more persistent than expected and goods prices declining significantly.

CHINA LIFTS TARIFFS ON AUSTRALIAN BARLEY

In positive new China have decided to drop anti-dumping tariffs on its barley imports with the Australian Government using the opportunity to call for an end to remaining trade restrictions. This could be a big win for the Australian Government as annual trade was once as high as A$1.5 billion ($986.25 million) and follows on from the resumption of trade in products like coal and timber as the trading partners continue their attempts to normalize commercial ties.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EVENT RISK

Later in the day US NFP and Jobs date could have an impact on AUDUSD as another positive and forecast beating NFP print could see the Dollar Index (DXY) continue its advance. The NFP print may be overshadowed by average hourly earnings however, as wage growth has proven a key component of inflationary pressure around the developed world in 2023. A positive and forecast beating print could in theory scupper any attempts of a recovery in AUDUSD.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

The technical outlook on AUDUSD testing the lower end of the symmetrical triangle pattern in play with a bounce from here needing to clear immediate resistance around 0.6600. A break above could bring a retest of the MAs with the 50, 100 and 200-day MAs all resting around the 0.6700 and could make a sustained recovery difficult.

Looking at IGCS IGCSshows retail traders are currently LONG on AUD/USD, with 83% of traders currently holding LONG positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are long suggests that AUD/USD may enjoy a short bounce before continuing lower toward the support area around 0.6450 (May Swing Low).

AUD/USD Daily Chart – August 4, 2023

Source: TradingView

If you would like to learn more about trading triangle patterns download the Free Guide Below

Introduction to Technical Analysis

Technical Analysis Chart Patterns

Recommended by Zain Vawda

GBP/AUD

GBPAUD has been on a tear since September 2022 with higher highs and higher lows since making its way toward the long-term descending trendline around the 1.9600 mark. This week has seen a fresh YTD high printed yesterday before a sharp pullback leaving the pair at a key support area around 1.9350.

There is a possibility for a deeper correction here, but the bullish trend remains strong with the Fundamental outlook likely to keep the GBP on the front foot for now.

Key Support areas which could come into play include the 50-day MA at 1.9180 before the psychological 1.9000, which could hold the key for bulls to retain control. On the upside yesterday's highs will be the first area of focus before the descending trendline around the 1.9600 handle may finally be reached.

GBP/AUD Daily Chart – August 4, 2023

Source: TradingView

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.