AUD/NZD, AUD/USD and AUD/JPY Price Setups

AUD Technical Analysis

Recommended by Richard Snow

Get Your Free AUD Forecast

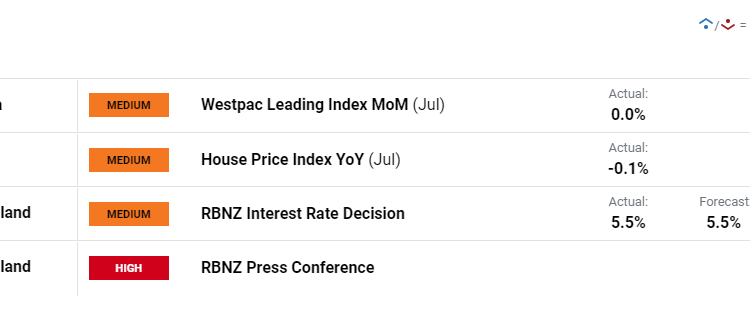

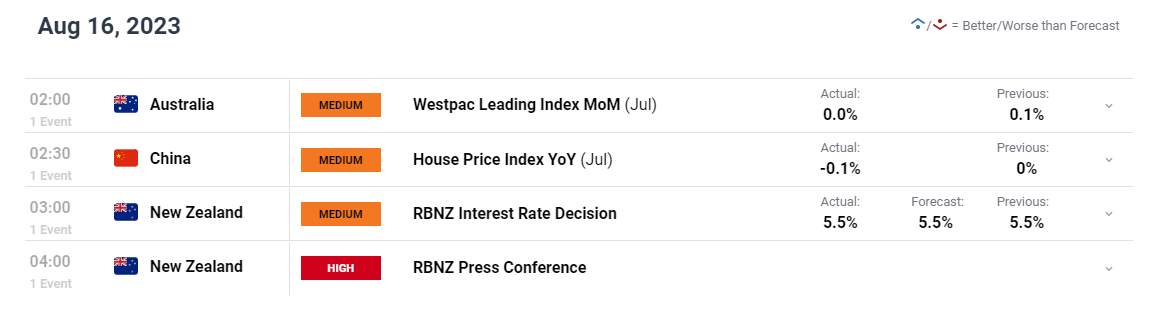

New Zealand Central Bank Joins the RBA Keeping Rates on Hold

The Reserve Bank of New Zealand voted to keep the official cash rate on hold, with the current elevated level of interest rates constraining spending and inflation, as intended. The RBNZ forecast however, opens the door to another 25-bps hike by the end of the year – something Governor Orr said should not be taken as forward guidance. AUD/NZD has recovered to levels witnessed before the announcement, after spiking lower immediately after the release.

Customize and filter live economic data via our DailyFX economic calendar

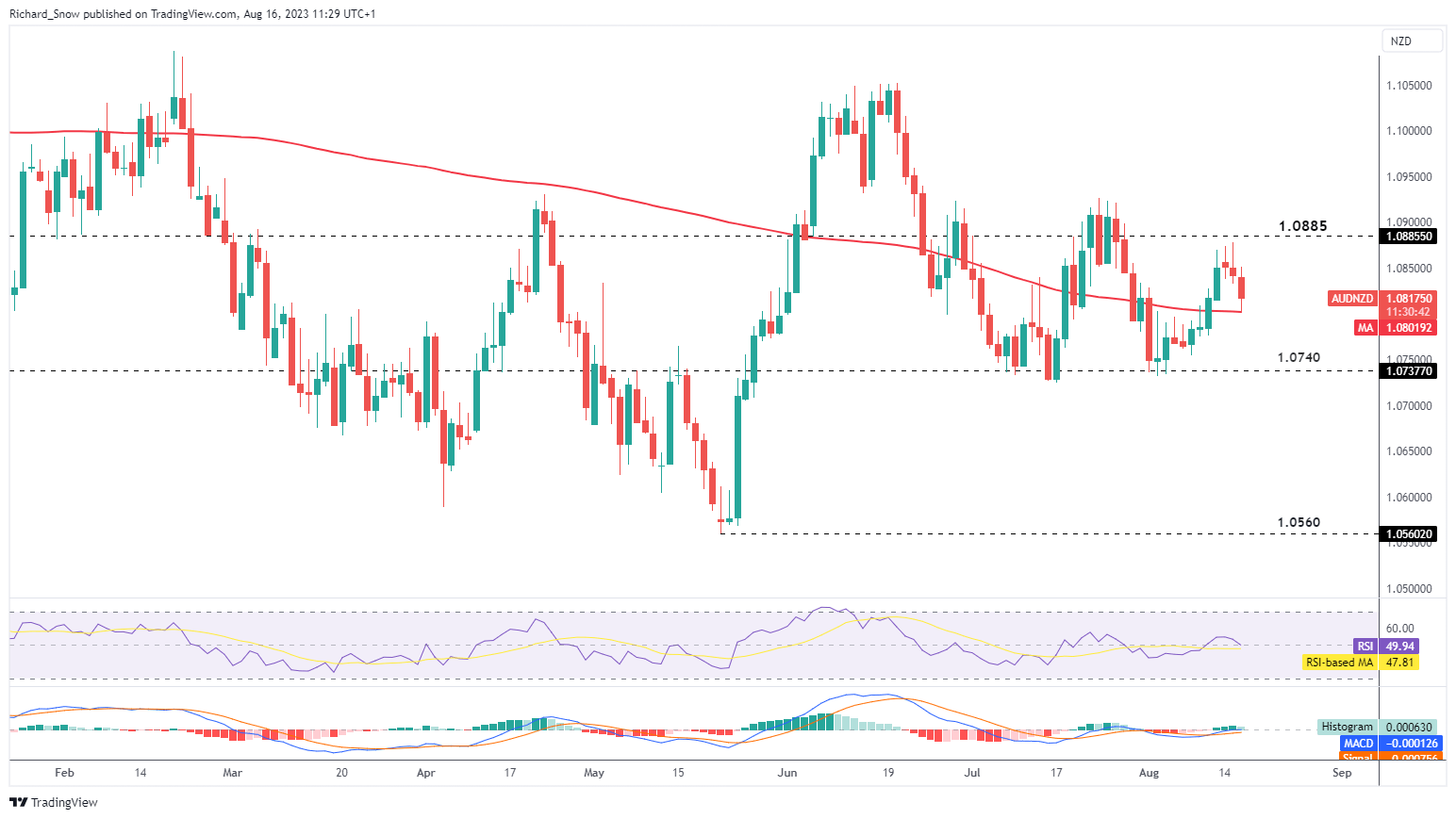

AUD/NZD: Choppy Price Action Sets up Ranging Potential

With AUD/NZD oscillating around the 200- day simple moving average (SMA), longer-term directional moves are less clear. In the near to medium-term, the pair has shown a tendency to trade within the broader band of 1.0930 and 1.0740. Now testing the 200-day SMA, a bounce higher could bring 1.0885 and possibly 1.0930 into focus.

Since both currencies and economies depend on China, the AUD/NZD offers traders a China-neutral play, focusing on the potential of both currencies. With both central banks on pause, bullish drivers are likely to be limited – hinting at a continued ranging trading landscape. Support lies at the 200 SMA followed by 1.0740.

AUD/NZD Daily Chart

Source: TradingView, prepared by Richard Snow

Learn how to prepare for range-bound markets by reading our dedicated guide below:

Recommended by Richard Snow

The Fundamentals of Range Trading

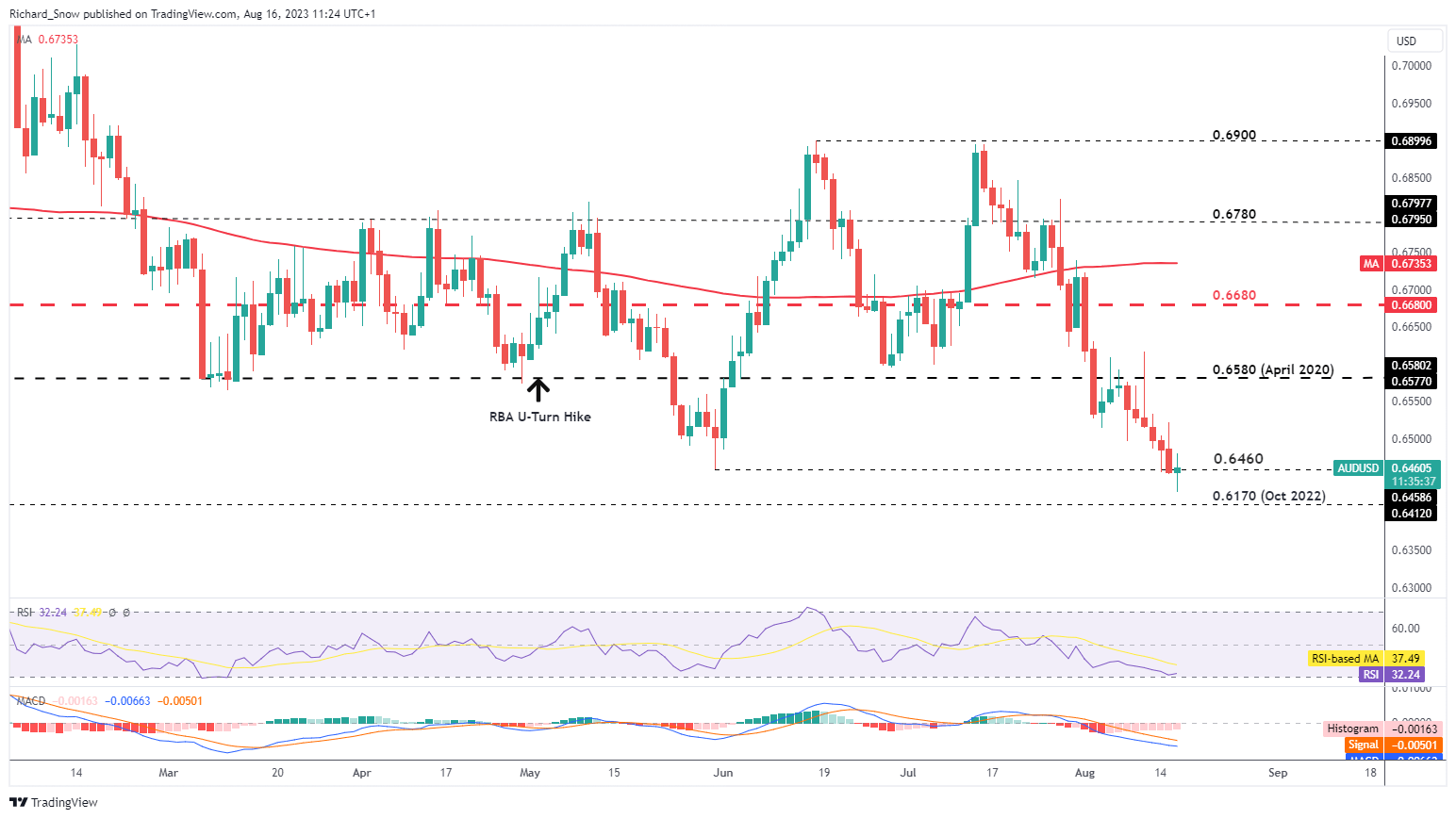

AUD/USD: Chinese Stimulus Measures Fail to Propel Aussie Higher

AUD/USD continues to selloff against the US dollar as deteriorating Chinese data weighs heavily on the procyclical currency. Poor manufacturing, trade and activity data, combined with deflationary risks, place the Chinese rebound at great risk.

With China being the destination for 40% of Australian exports, a weaker Chinese economy has been dragging Australian prospects lower. The chart below reveals a temporary move higher yesterday after Chinese authorities cut the medium-term lending facility by 15 bps. This proved to be yet another form of inadequate support which markets quickly disregarded. The cut brings next week’s 1 and 5 year loan prime rates into focus as cuts in the benchmark rate could prove more meaningful.

Prices currently test the 0.6460 level, where a break and close on the daily chart opens the door to the October 2022 low of 0.6170 next in view. Levels to the downside thereafter become trickier as prior levels of significance date back to 2020 or 2008. In the event prices pullback from here, support appears at 0.6580. The RSI reveals the selloff has entered oversold conditions.

AUD/USD Daily Chart

Source: TradingView, prepared by Richard Snow

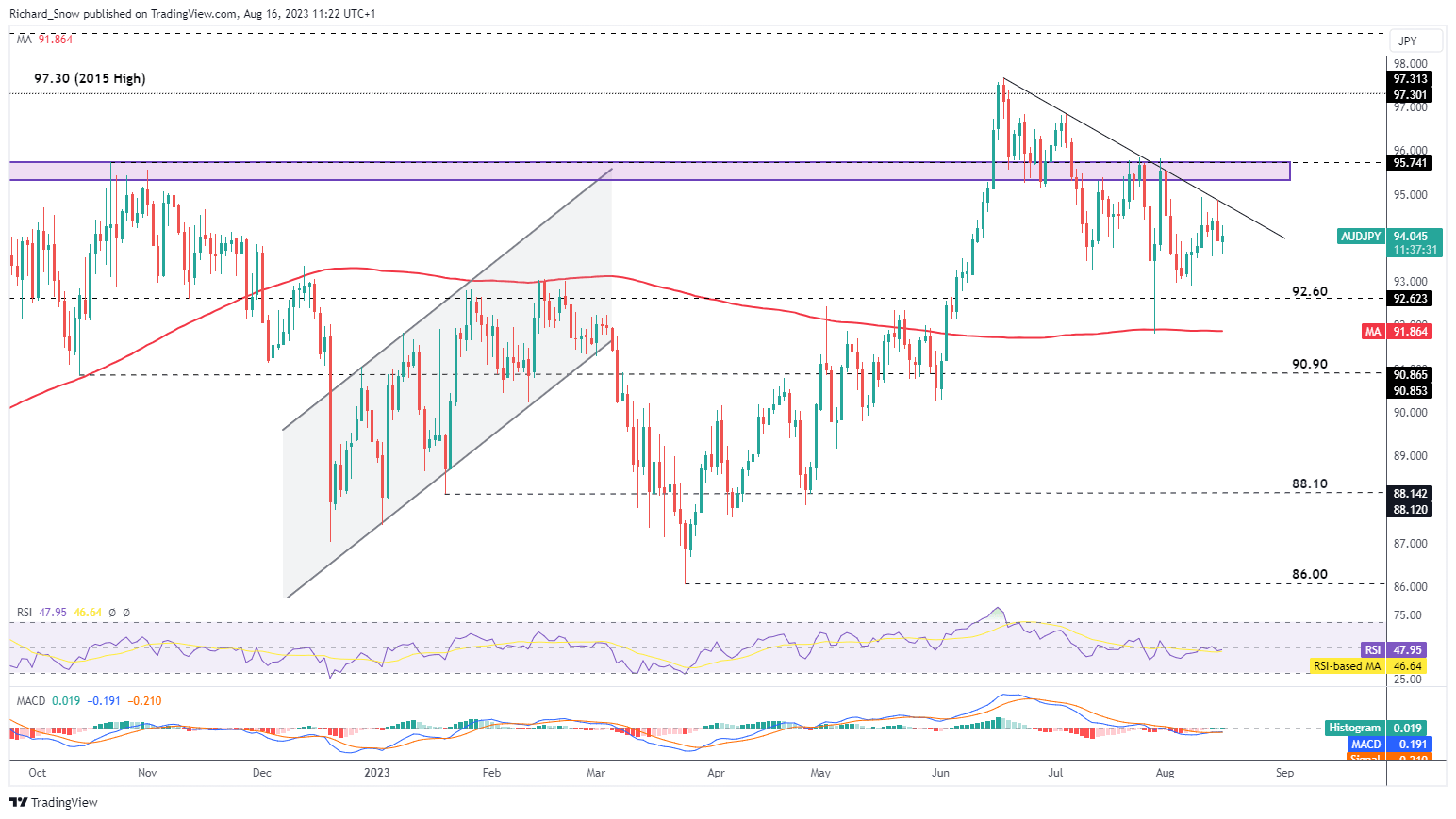

AUD/JPY: Aussie Loses More Ground After Latest Trendline Test

After the massive bullish advance in the first half of June, AUD/JPY has retraced a large portion of those prior gains. Despite the Japanese yen depreciating against G7 currencies, AUD/JPY actually heads lower, underscoring the detrimental spillover effects of the worsening Chinese outlook.

Japanese officials appeared to tolerate the recent depreciation, saying that the large volatile moves are what is undesirable, not the level of USD/JPY which is around 145 – a level that inspired prior intervention. What this indicates is that both pairs could continue to be out of favour which could see prices continue to grind lower until Friday's Japanese inflation data injects some volatility into the market.

Support is at 92.60 with dynamic resistance at trendline resistance.

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.