AUD/NZD and EUR/AUD Might Have Similar Trade Set-Ups. Will Ranges Break?

Australian Dollar, AUD/NZD, EUR/AUD, Moving Averages, Range, Reversal -Talking Points

- The Australian Dollar remains in the range against EUR and NZD for now

- Although there are some similarities, each currency pair has unique properties

- Momentum, retracements and triangles could provide some markers

Recommended by Daniel McCarthy

Get Your Free AUD Forecast

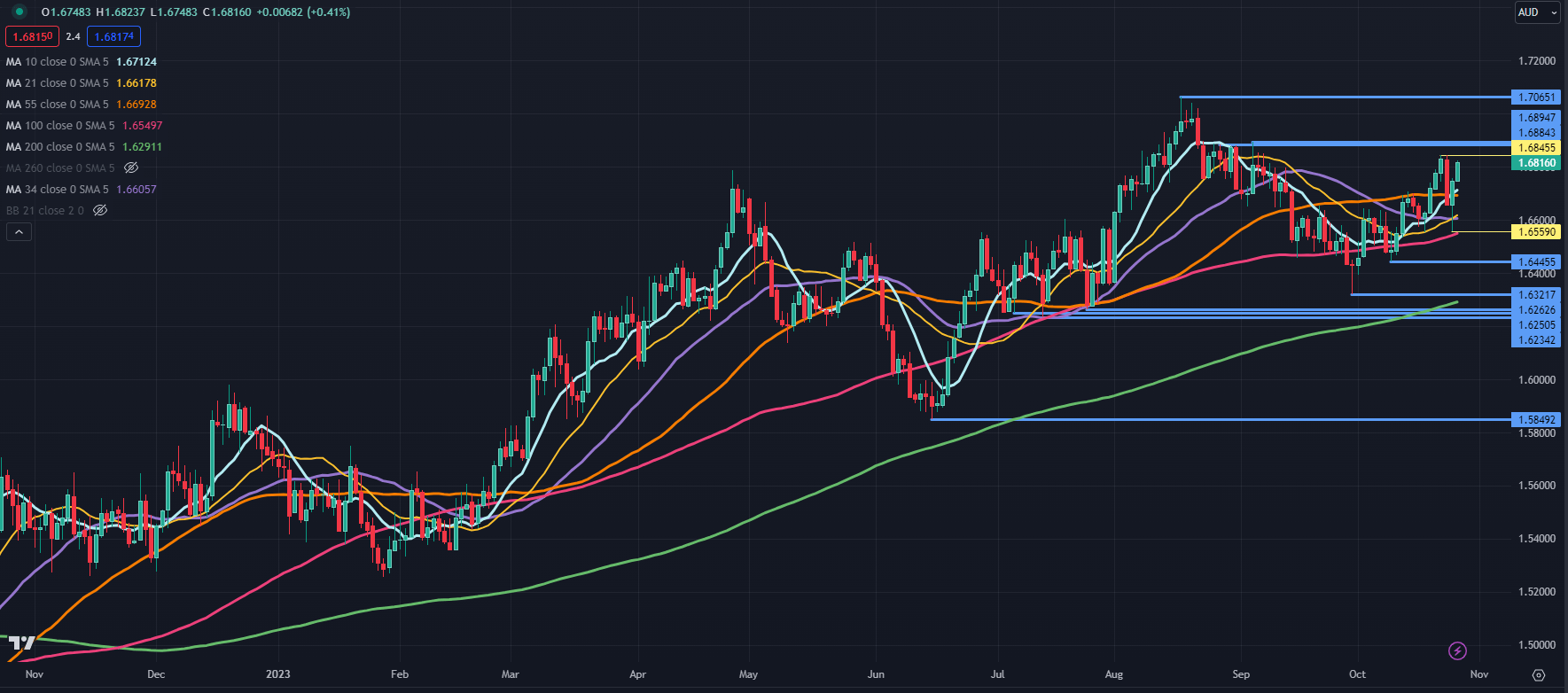

EUR/AUD TECHNICAL ANALYSIS

EUR/AUD has been contained between 1.6200 and 1.7100 for four months and might be in range trading mode for now. For more information about range trading, click on the banner below.

The price has struggled this week to overcome the recent peaks just below 1.6900 when it topped out at 1.6845 on Monday. Those levels might offer resistance on another retest ahead of the 2-year high at 1.7065.

The dip on Wednesday stopped short of the 100-day Simple Moving Averages (SMA) near 1.6550 and it may provide support on another sell-off.

Further down, support could be at the previous lows at 1.6445 and 1.6320 ahead of a potential support zone in the 1.6235 and 1.6265.

The clustering of the 10-, 21-, 34-, 55- and 100-day Simple Moving Averages (SMA) between 1.6550 and 1.6710 could support the range trading perspective.

Recommended by Daniel McCarthy

The Fundamentals of Range Trading

EUR/AUD DAILY CHART

Chart created in TradingView

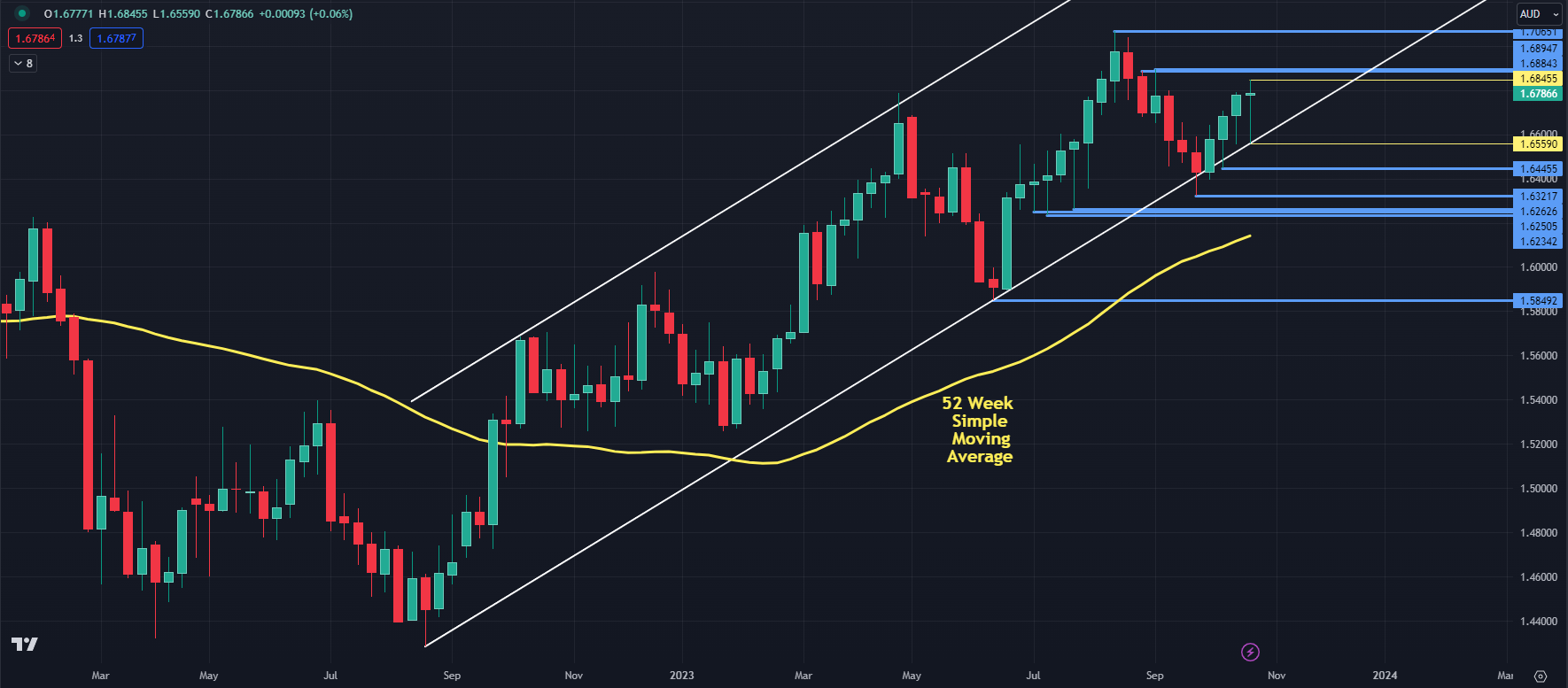

EUR/AUD TECHNICAL ANALYSIS – WEEKLY

Zooming out to the weekly chart, EUR/AUD remains in an ascending trend channel.

The price has been trading above the 52-week SMA since September 2022, when the trend started to emerge. A cross below this SMA might indicate an exhaustion of the trend.

Recommended by Daniel McCarthy

The Fundamentals of Breakout Trading

EUR/AUD WEEKLY CHART

Chart created in TradingView

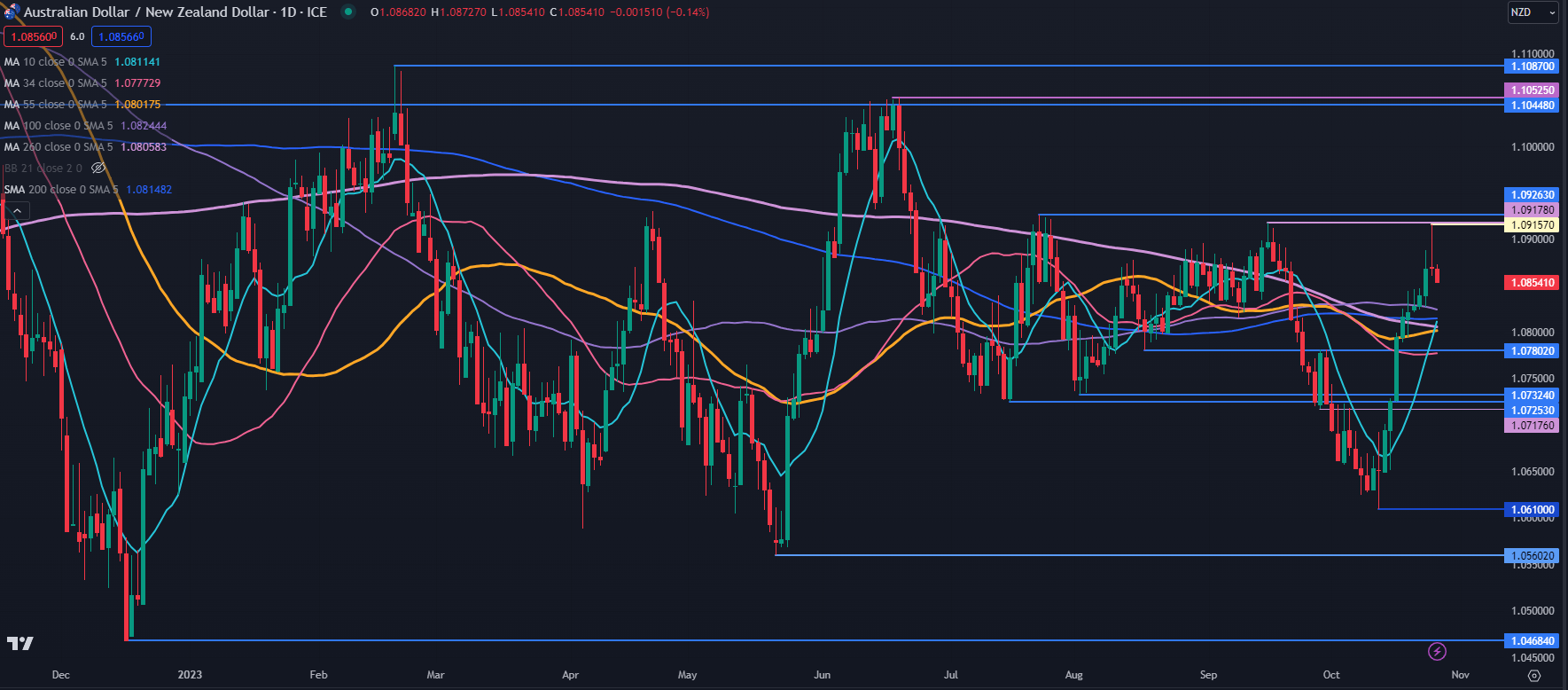

AUD/NZD TECHNICAL ANALYSIS

AUD/NZD has a tendency for range trading, albeit sometimes quite wide ranges, and this is not surprising given the close proximity and similarities of the two economies.

Similar to EUR/AUD above, the clustering of the 10-, 34-, 55- 100-, 200- and 260-day Simple Moving Averages (SMA) in AUD/NZD between 1.0777 and 1.0825 could back up the range trading perspective.

The price action yesterday displays a Spinning Top Candlestick and it could suggest that a reversal might be in play.

The peak seen yesterday at 1.0916 was just shy of the September high of 1.0918 and the July high of 1.0926. This area may offer resistance on a rally ahead of a potential resistance zone near 1.1050.

Support may lie at the existing breakpoints or previous lows of 1.0732, 1.0725, 1.0718, 1.0610 and 1.0560.

CTA BANNER HERE

AUD/NZD DAILY CHART

Chart created in TradingView

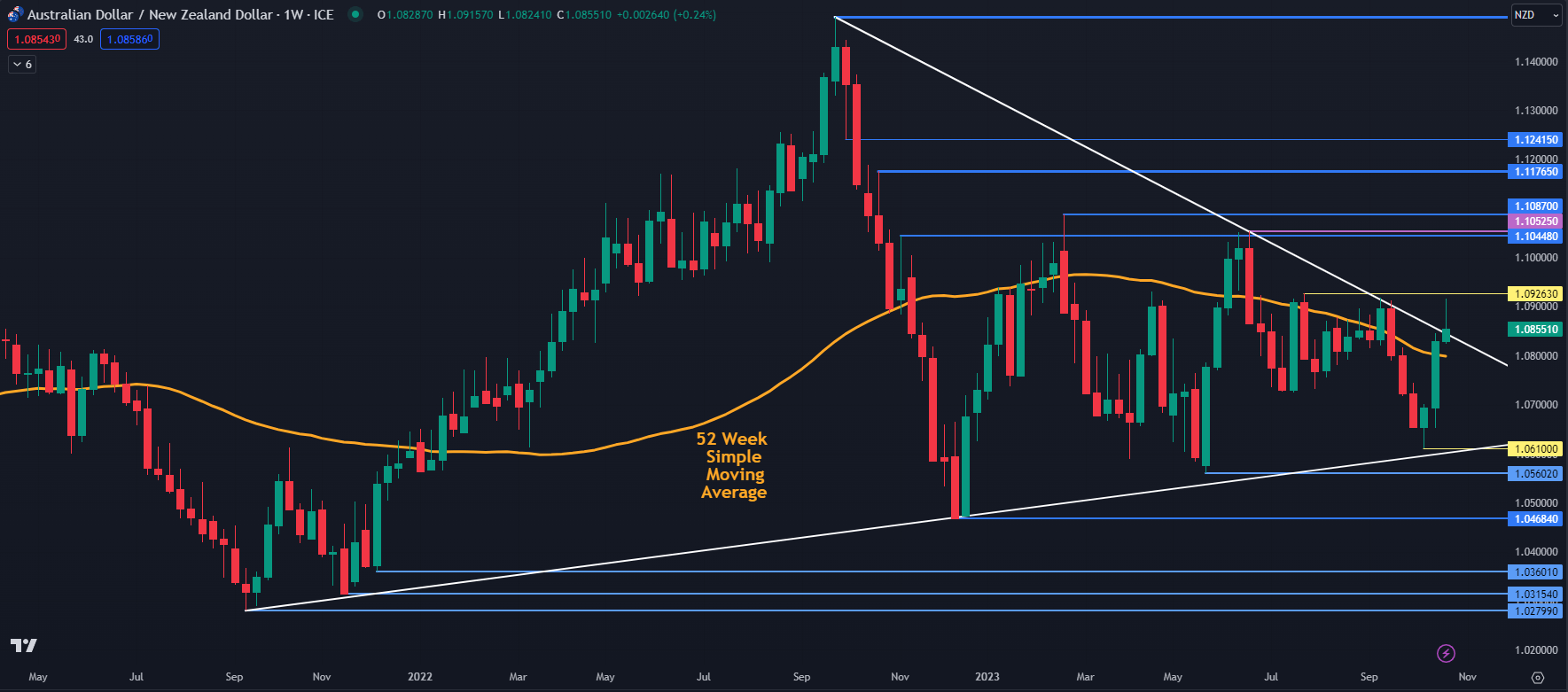

AUD/NZD TECHNICAL ANALYSIS – WEEKLY

The narrowing of ranges has seen AUD/NZD create a Symmetrical Triangle.

It is currently trading above the upper edge of the triangle and if it closes above the descending trend line, it might signal a breakout and bullish momentum might emerge.

If it does not close above the descending trend line, it could prove to be a false break and the triangle formation would be intact in that scenario, potentially signalling a reversal.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

AUD/NZD WEEKLY CHART

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

Comments are closed.