Anticipated EIA Stock Build Favors Current Trading Range

Crude Oil (WTI and UK Oil) Analysis

- EIA weekly crude oil inventories expected to build further, weighing on prices

- WTI oil solidifies the trading range, picking up on news of output cuts

- Brent crude oil approaching the apex of a symmetrical triangle pattern

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Oil Forecast

Oil Inventories Expected to Build Further, Weighing on Prices

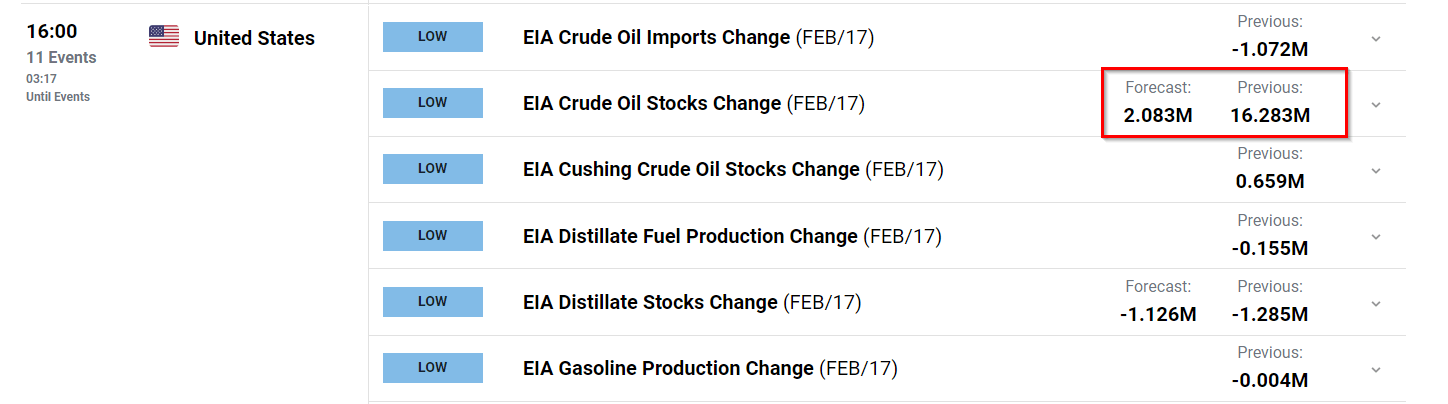

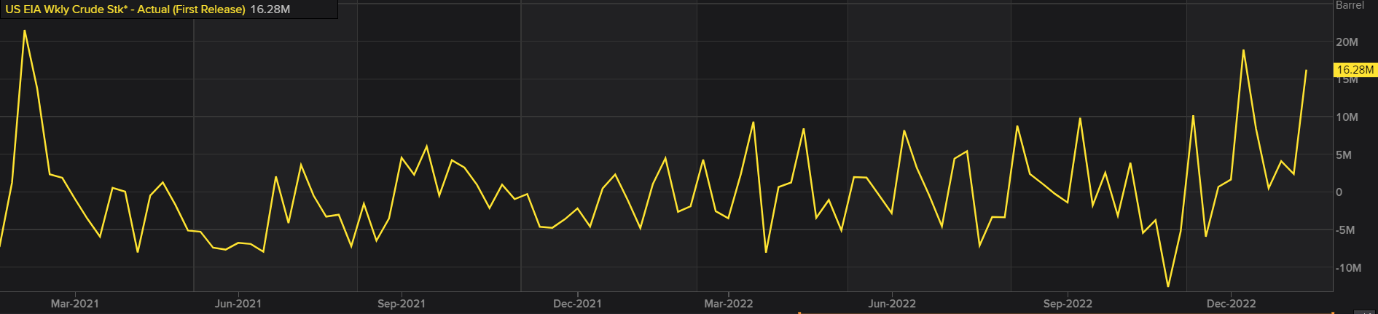

US crude oil stocks are anticipated to build even further on last week’s sizeable increase in oil storage. There has been a considerable uplift in oil stock builds sine the start of November 2022 which may be symptomatic of lower oil demand as the Fed continues to restrict financial conditions into the second half of the year.

EIA Crude Oil Weekly Stocks Change

Source: Refinitiv, prepared by Richard Snow

Yesterday’s FOMC minutes, while updated since we’ve had a massive labor (NFP) and economic print (services ISM) thereafter, continued the message that the Fed sees it fit to continue to hike rates despite admitting the “disinflation process has started”. More restrictive financial conditions and weak global growth have a direct impact on demand for the commodity.

US EIA Crude Inventory Data (16:00) GMT

Customize and filter live economic data via our DailyFX economic calendar

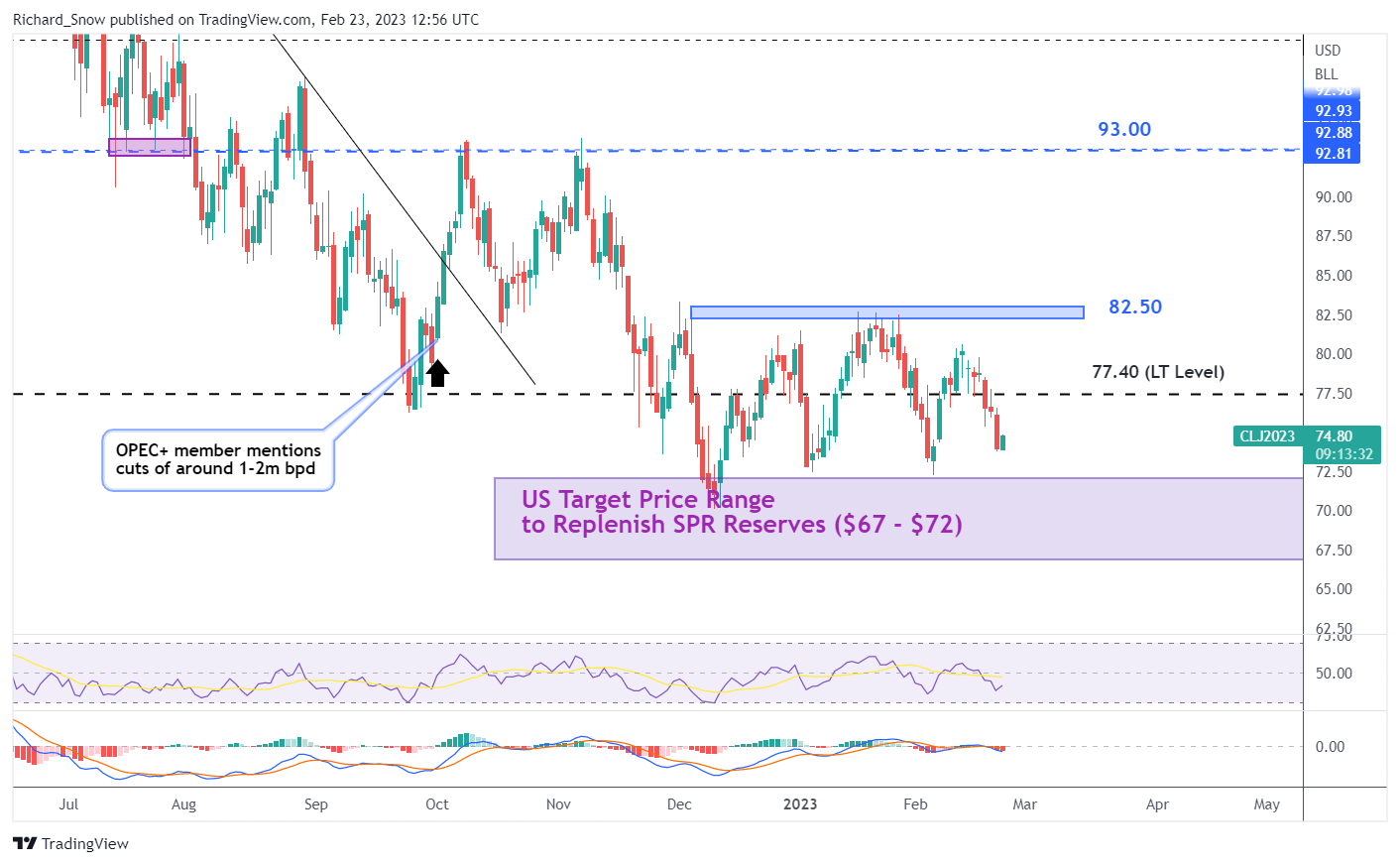

WTI Crude Oil Analysis

WTI continues to trade within this broader trading range that has developed since December last year. The range has appeared around the $82.50 and $70 levels. WTI trades marginally higher after yesterday’s more than $2 decline after Russia reported that plans to cut oil exports from its western ports by 500,000 barrels per day is likely to increase up to 25% in March. By implication, the tighter supply supports oil prices even if just in the short term.

Support remains at the rough midpoint of the $67 – $72 ‘SPR replenishing’ range at $70, with resistance at $82.50. The long-term level of interest at $77.40 can be used as a rough gauge for a move towards resistance or an indication of another drop towards support.

WTI Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

The Fundamentals of Range Trading

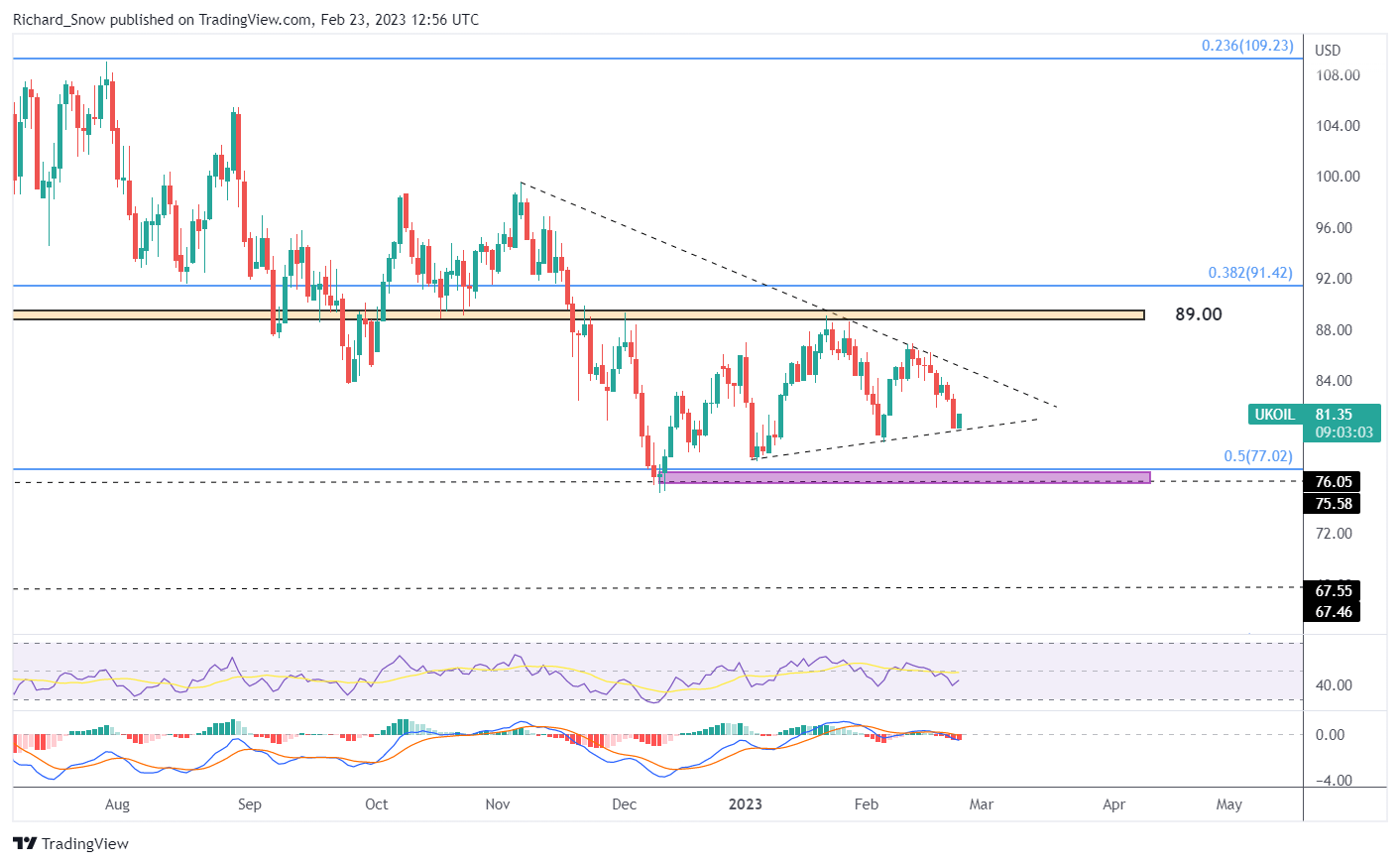

Brent Crude (UK Oil) Analysis

Brent crude oil has a slightly different technical posture, resembling more of a symmetrical triangle pattern – generally a neutral pattern. While the triangle pattern can resolve in any direction, the pattern if often viewed with consideration to the prior trend, which of course was the downtrend that ensued after March 2022.

With price action fast approaching the apex of the converging lines of support and resistance, traders ought to take note of support and resistance. Support remains the ascending trendline followed by the zone of support around $76, while resistance remains the descending trendline with a potential breakout bringing the $89 zone of resistance into focus. Momentum appears skewed to the downside according to the MACD indicator.

UK Oil Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.