All Eyes on the Bank of England Rate Decision

GBP/USD Analysis and Charts

- The Bank of England is likely to raise rates by 25bps next Thursday.

- Will the BoE follow the trend of a ‘hike and hold’

For all market-moving economic data and events, see the DailyFX Calendar

Recommended by Nick Cawley

How to Trade GBP/USD

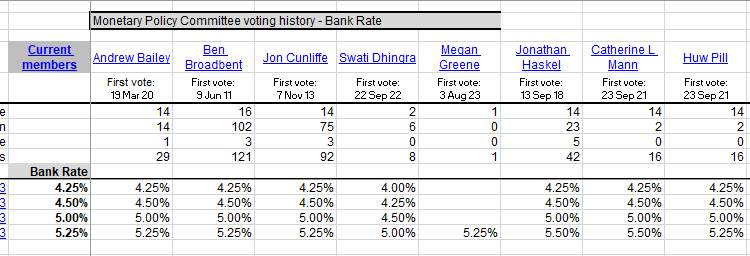

Next week’s Bank of England interest rate decision is likely to be a closer call than current market pricing suggests. Markets are looking for the BoE to raise interest rates by a quarter of a percent from 5.25% to 5.50%, a fresh 15-year high. It is unlikely that this decision will be unanimous as various voting members of late have been giving out differing views on the path of rates going forward. At the last meeting, a dovish Swati Dhingra voted to keep interest rates unchanged, while a hawkish Catherine Mann and Jonathan Haskell pressed for a larger, 50bps, hike.

Recommended by Nick Cawley

Traits of Successful Traders

Yesterday the ECB hiked rates and then suggested that they would hold rates at the new level in the coming months. This follows in the trend set by other major central banks, including the Federal Reserve, which it seems have hit, or are very close to, peak rates if market pricing is to be believed. Will the Bank of England follow in the Fed’s steps and give a faint hint that rates are near, or at, their peak?

The Bank of England will have the opportunity to see the latest inflation report before they make their decision. The August CPI report, released on Wednesday at 07:00 UK, is expected to show core inflation nudging lower by 0.1% to 6.8%, while headline inflation is seen moving 0.2% higher to 7.0%.

Cable is struggling to keep above 1.2400 as the US dollar goes from strength to strength. The greenback has been boosted by a weak Euro and stronger-than-expected US data, leaving the Fed some extra room to hikes rates if required. The US dollar index is touching levels last seen back in March, while a bullish 50-day/200-day crossover – golden cross – can also be seen on the daily chart.

US Dollar Index Daily Chart

Cable is breaking below the 200-day sma and heading lower. A confirmed close and open below the longer-dated indicator would likely see GBP/USD make an attempt at 1.2303, the late May swing low. Below here, GBP/USD may be vulnerable to sharp moves lower with little recent price action below 1.2303.

GBP/USD Daily Price Chart

Charts using TradingView

See How GBP/USD Traders are Currently Positioned

| Change in | Longs | Shorts | OI |

| Daily | 5% | 3% | 5% |

| Weekly | 11% | -7% | 4% |

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.