A Bit More Downside Within a Broader Consolidation?

US Dollar, Euro, EUR/USD – Outlook:

- A minor double top pattern points to some more downside in EUR/USD.

- However, it is too soon to conclude that EUR/USD’s multi-week uptrend has reversed.

- What is the outlook and what are the key signposts to watch?

Recommended by Manish Jaradi

How to Trade EUR/USD

EUR/USD SHORT-TERM TECHNICAL FORECAST – NEUTRAL

The Euro’s drop below key support against the US dollar spells some more troubles for the single currency ahead of key US data this week.

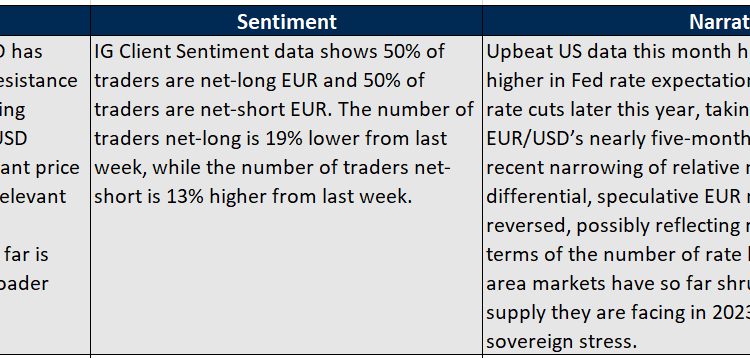

EUR/USD’s drop over the past couple of weeks has almost entirely been a US strength story, rather than a Euro area weakness narrative. The US Economic Surprise Index (ESI) has risen sharply during the period, while the Euro area ESI has been largely flat, but still around 20-month highs.

EUR/USD Daily Chart

Chart Created Using TradingView

Surprisingly strong US data since the start of the month (from services and jobs data at the beginning of the month to PPI last Thursday) had led to a reassessment of Fed rate expectations. Markets now expect the Fed funds rate to peak around 5.30% from around 4.90% at the beginning of February, while expectations for rate cuts for later this year have been scaled back. The key focus is now on US core PCE index due Thursday, which is seen rising 3.9% on-quarter.

EUR/USD Daily Chart

Chart Created by Manish Jaradi Using Metastock

On the daily technical charts, relevant for positional investors, the color-coded candles based on trending/momentum indicators suggest that the consolidation within the broader uptrend continues (see “EUR/USD Technical Outlook: Short-term Setback”, published Feb. 6).

EUR/USD 4-Hour Chart

Chart Created Using TradingView

EUR/USD hasn’t yet broken any significant price pivot that would threaten the nearly five-month-long uptrend. In this regard, the January low of 1.0480 is immediate support. A stronger cushion is on the 200-day moving average (now at about 1.0330). The fall below the February 13 low of 1.0650 has triggered a minor double top (the February 9 and February 14 highs), pointing to a setback toward 1.0480.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

Comments are closed.