A Big Week Ahead for USD/JPY Traders

Japanese Yen Prices, Charts, and Analysis

- FOMC decision on Wednesday, the Bank of Japan on Friday.

- USD/JPY struggles with resistance.

Learn How to Trade USD/JPY

Recommended by Nick Cawley

How to Trade USD/JPY

The Federal Reserve (Fed) and the Bank of Japan (BoJ) will both announce their latest monetary policy decision this week – Wednesday and Friday respectively – with both central banks expected to leave interest rates untouched. Both decisions however have the potential to move markets, with the BoJ possibly the harder reaction to call.

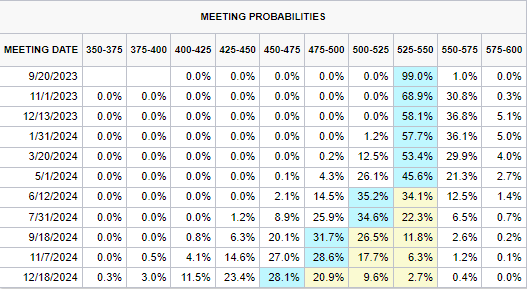

The Fed is fully expected to leave unchanged at a current level of 525-550, and if the latest market pricing is correct, the US central bank will leave rates untouched all the way through to May next year when they are forecast to start cutting rates. The post-decision press conference will likely see chair Powell reiterate that rates can go higher if needed, in part to keep some central bank flexibility. It will be some months yet until the Federal Reserve finally says that rates are at their peak.

CME FedWatch Tool

Learn About Central Banks

Recommended by Nick Cawley

Traits of Successful Traders

The BoJ will leave rates untouched but recent remarks from central bank governor Kazuo Ueda that the BoJ may conclude its negative interest rate policy by the end of the year will keep traders attentive to any accompanying post-decision commentary.

Japanese Yen Rallies on Bank of Japan’s Ueda Comments. Will USD/JPY Reverse?

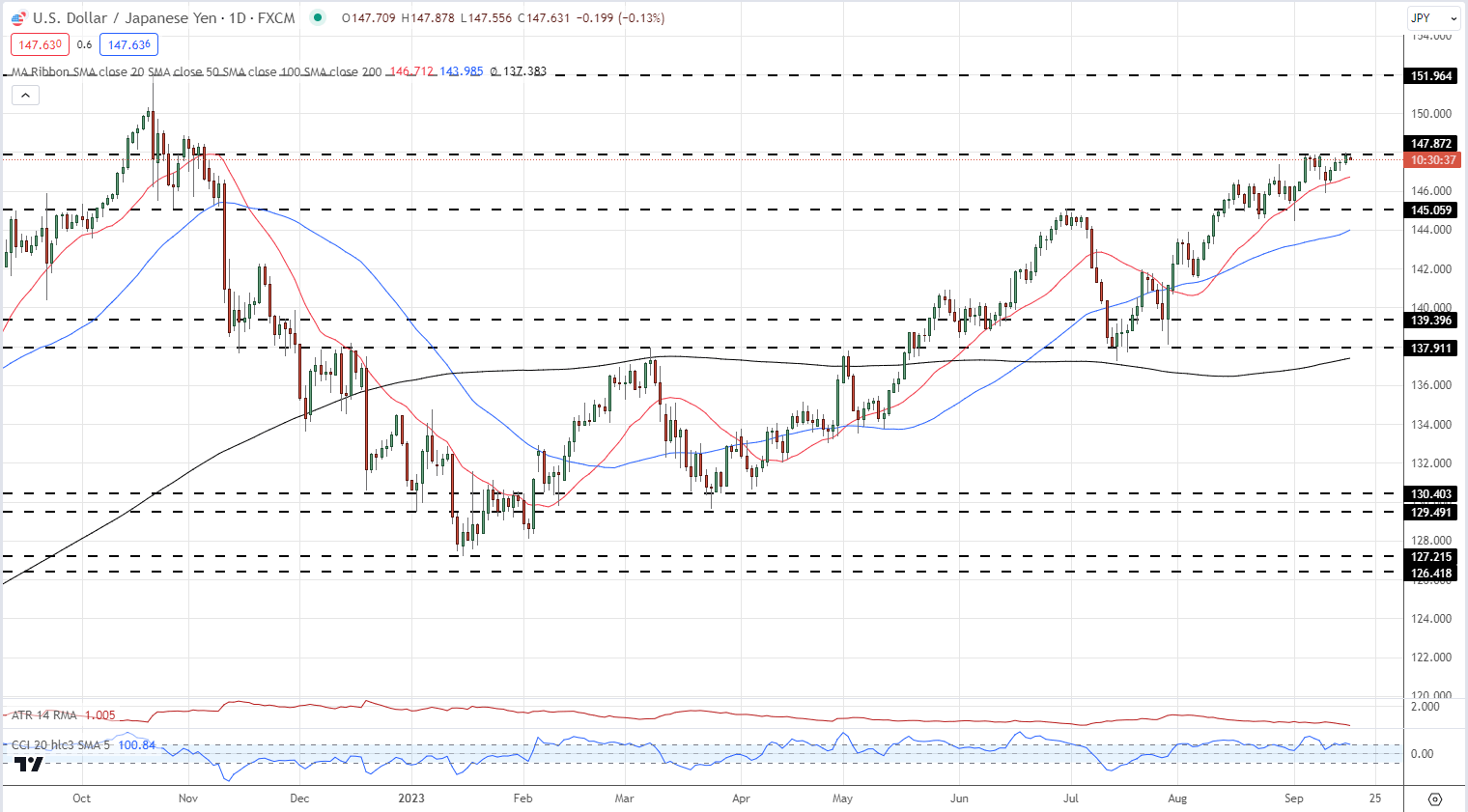

USD/JPY has moved sharply higher over the course of 2023 on the widening USD and JPY interest rate differential. While the Fed has pushed rates to multi-year high levels, the BoJ has kept bond yields in negative territory in an effort to stoke inflation and growth. The Japanese Yen has been used as a funding currency against the US dollar as well as against a wide range of other high-yielding currencies including the South African Rand and the Mexican Peso.

The daily USD/JPY remains biased towards further gains with the pair supported by all three simple moving averages. This month’s multiple touches, and rejections, just under 148.00 do flag up a warning sign that traders are becoming increasingly wary the BoJ or MoF may soon give notice that they are following yen moves closely. Back in late September 2022, the Japanese Finance Ministry intervened in the FX market, buying JPY. That intervention caused USD/JPY to fall from 151 in late September all the way back to 127.20 in early January 2023. Further upside in USD/JPY looks limited unless the BoJ turns dovish again on Friday.

USD/JPY Daily Price Chart – September 18, 2023

Download the Latest IG Sentiment Report to See How Daily/Weekly Changes Affect the USD/JPY Price Outlook

| Change in | Longs | Shorts | OI |

| Daily | 13% | 1% | 3% |

| Weekly | -5% | 15% | 10% |

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.