Runaway Sell-off Eyes Key Level of Support

Silver (XAG/USD) Analysis

Recommended by Richard Snow

Building Confidence in Trading

Silver Sell-off Gains Momentum as Yields Climb Higher

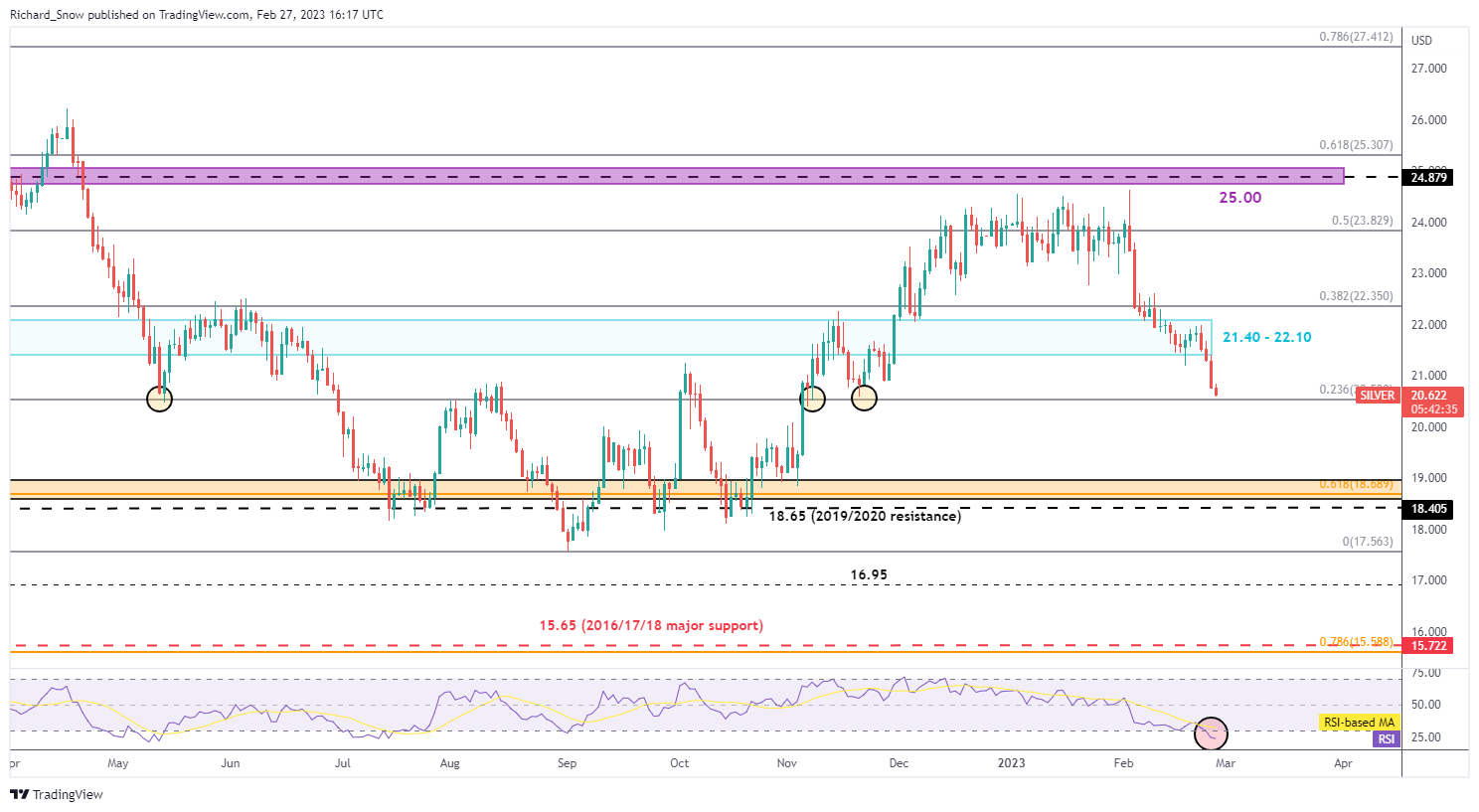

US dollar denominated commodities have had to endure some rather aggressive selling of late, with silver no exception. The metal’s bullish run was stopped abruptly at the $25 level, although, the numerous upper wicks beneath $25 hinted at an eventual failure to trade above.

Since the turnaround, silver has declined rather heavily, taking out the rather wide zone of support (21.40 – 22.10) with Friday’s PCE inspired move propelling the latest move lower.

Silver (XAG/USD) Weekly Chart

Source: TradingView, prepared by Richard Snow

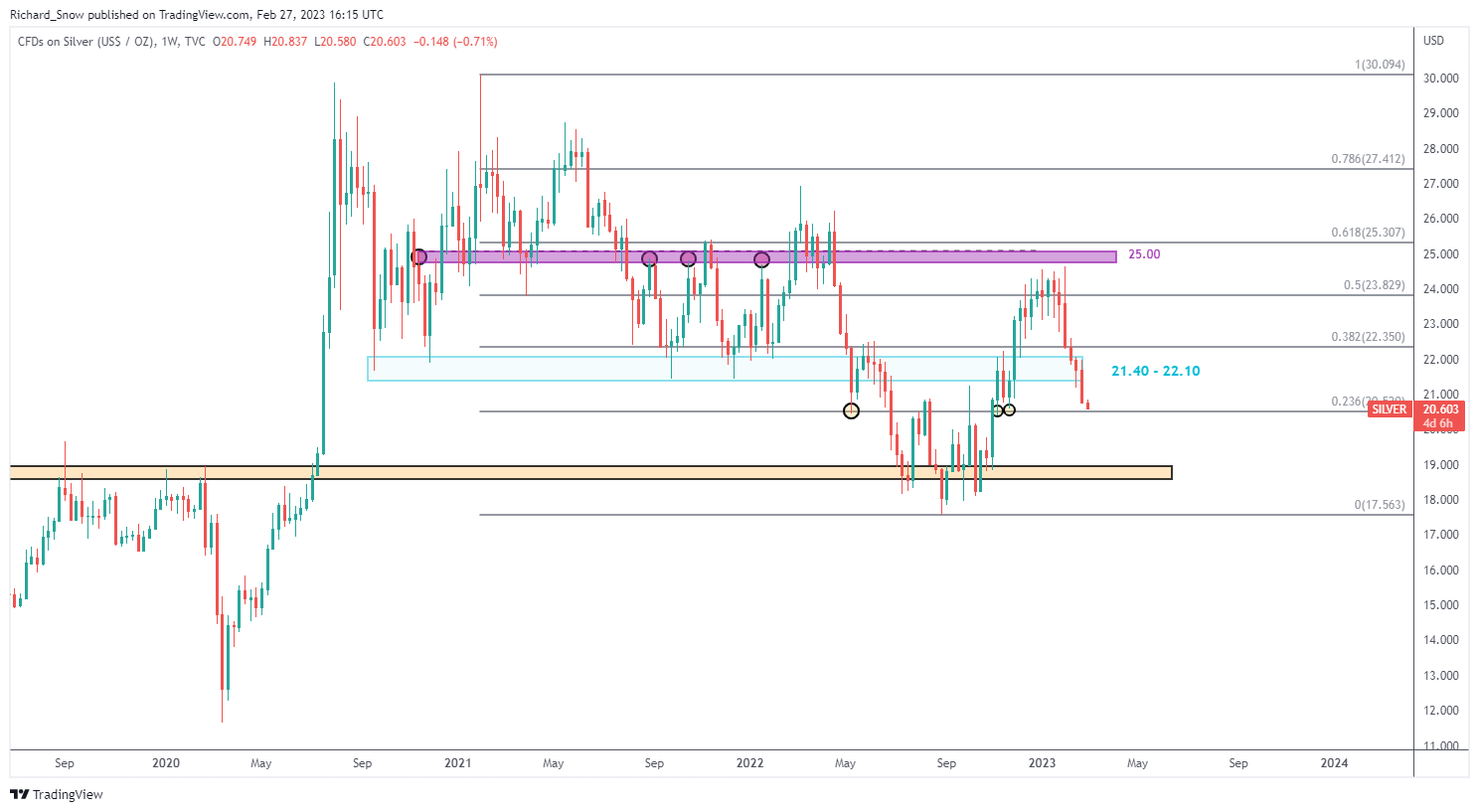

Silver Extends ‘Oversold’ Tag after Latest Decline

The daily chart reveals the next, imminent level of support – the 23.6% Fibonacci retracement of the large 2021 to 2022 decline at $20.52. Circled in yellow are the prior inflections at this very level – which may pose a challenge for continued selling if past price action is anything to go by.

Something to note in the coming days is the RSI, which continues in oversold territory. Should the level of support hold up, look to the RSI possibly returning from oversold territory for an indication of its significance within this broad sell-off.

Silver (XAG/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.