NZD/USD Looks Vulnerable Ahead of RBNZ Rate Decision

NZD/USD, NEW ZEALAND DOLLAR – Technical Outlook:

- NZD/USD tests key support ahead of RBNZ rate decision.

- A repricing in Fed rate expectations Vs a scale back in RBNZ rate forecasts have weighed on NZD/USD.

- What are the key levels to watch?

Recommended by Manish Jaradi

Traits of Successful Traders

NZD/USD SHORT-TERM TECHNICAL FORECAST – NEUTRAL

The New Zealand dollar is looking vulnerable as it tests crucial support as the market scales back expectations of an aggressive rate hike by the Reserve Bank of New Zealand.

Expectations for the RBNZ to hike interest rates at its meeting on Wednesday continue to be scaled back in the aftermath of the cyclone amid a softening economy, signs of peaking inflation, and a cooling housing market. The market is now pricing in less than 50 basis points of a rate hike this week to 4.75%, down from 55 basis points a week ago, and 61 basis points a month ago. In contrast, US Fed rate expectations have been repriced higher in recent weeks, keeping NZD/USD under pressure.

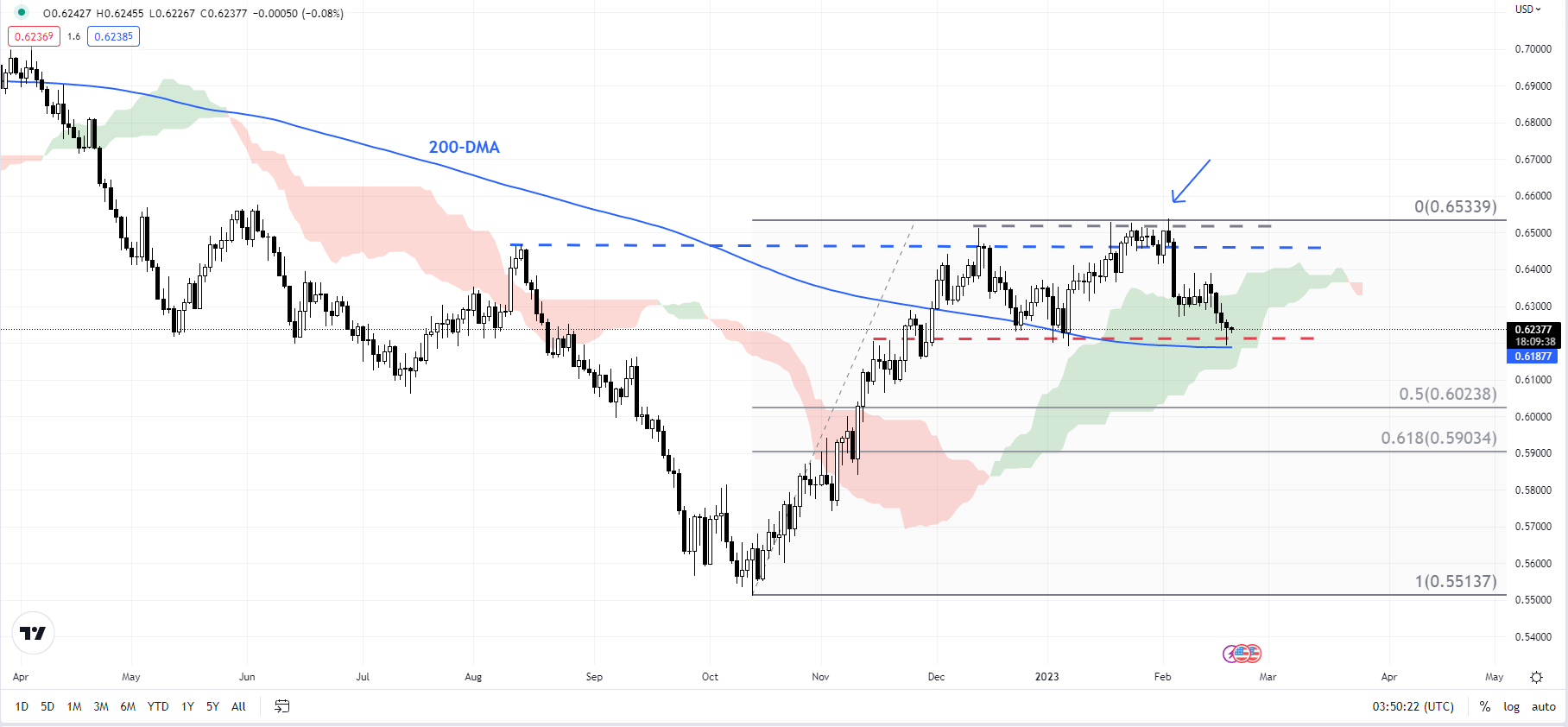

NZD/USD Daily Chart

Chart Created Using TradingView

On technical charts, NZD/USD is testing crucial converged support at the January low of 0.6190, coinciding with the 200-day moving average. This follows a failure to break past stiff converged resistance at the December high of around 0.6500, the 89-week moving average, slightly below the 200-week moving average (at about 0.6600).

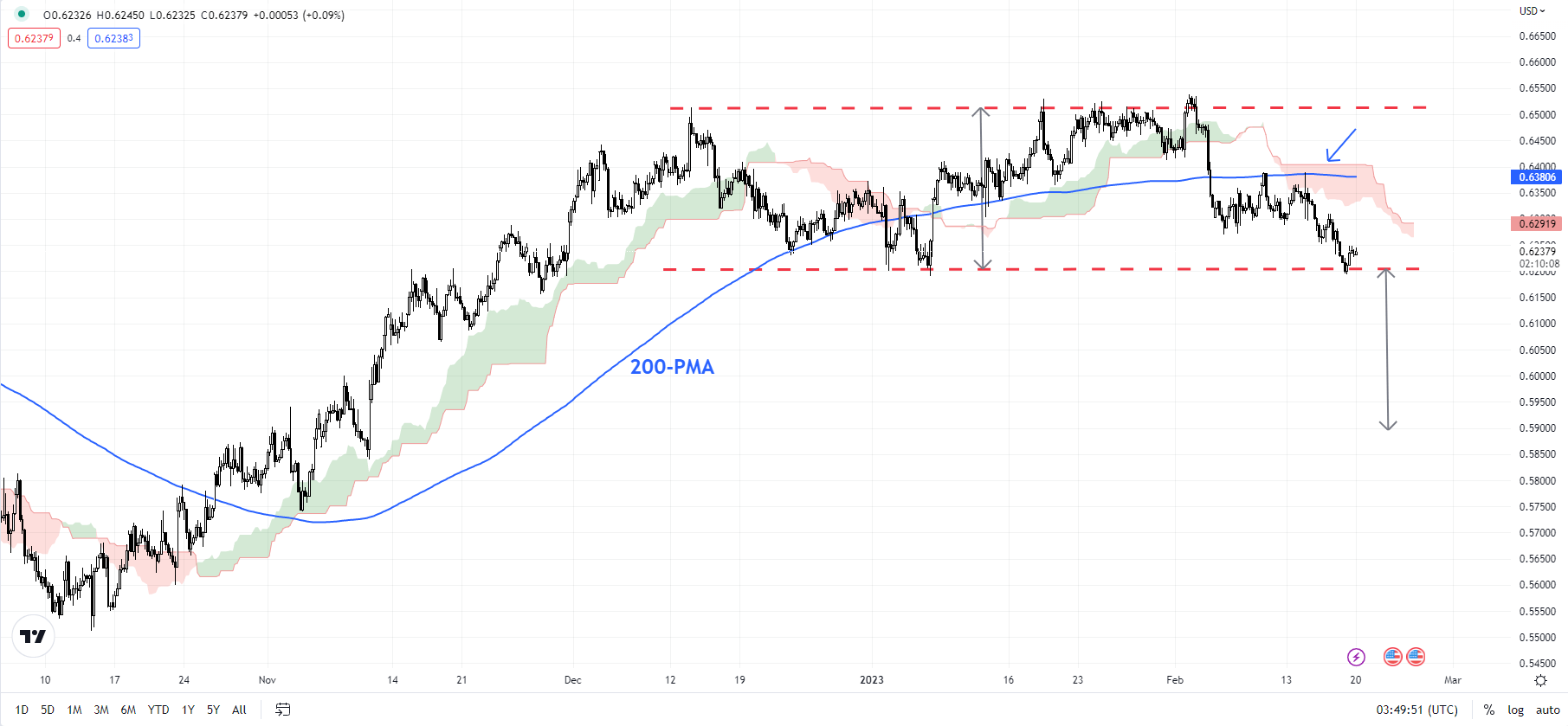

NZD/USD 4-Hour Chart

Chart Created Using TradingView

A break below 0.6190 would trigger a minor double top (the end-2022 and the January highs), potentially opening the door toward 0.5850. NZD/USD medium-term outlook has been improving since the fourth quarter of 2022, but the double top pattern, if triggered, would dent those improved prospects somewhat. Below 0.6190, there is support is at 0.6020 (the 50% retracement of the rise from 2022) and 0.5900 (the 61.8% retracement).

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

Comments are closed.