ECB Hike Rates by 50bps, EURUSD Looks Vulnerable

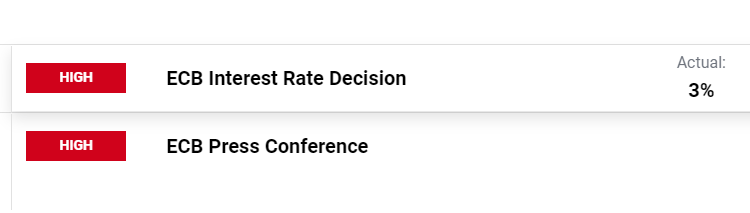

ECB Rate Decision Key Points:

Recommended by Zain Vawda

Get Your Free EUR Forecast

The European Central Bank has raised interest rates by 50bps in line with expectations. The central bankexpects to raise rates further keeping them at levels that are sufficiently restrictive to ensure a timely return of inflation to its 2% medium-term target. Inflation remains a sticking point with the ECB confirming it intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March and it will then evaluate the subsequent path of its monetary policy. Future decisions will be data dependent and follow a meeting-by-meeting approach.

Furthermore, the central bank confirmed the APP portfolio will decline at a measured and predictable pace, as the Eurosystem will not reinvest all of the principal payments from maturing securities. The decline will amount to €15 billion per month on average until the end of June 2023 and its subsequent pace will be determined over time.

For all market-moving economic releases and events, see the DailyFX Calendar

Looking Ahead to the March Meeting and Beyond

The ECB’s job is a tough one given the economic backdrop of the various countries in the Euro area. The Bank’s own December projections saw inflation remaining at 3.4% in 2024 and 2.3% in 2025, above its target rate of 2%. Energy prices have taken a dive since the ECB’s December meeting which could see the ECB lower their inflation expectations moving forward. The Russia-Ukraine conflict however remains an uncertainty as evidenced by the IMF’s warning that the conflict still poses a significant risk to global recovery.

Recommended by Zain Vawda

How to Trade EUR/USD

Looking ahead to the upcoming ECB Meetings and the rest of the year inflation and particular the core inflation data is likely to be a driving force behind the ECB’s decisions. ECB policymakers have been hawkish heading into this meeting despite some positive signs with the ECBS Klaas Knot stating that he wants at least two more 50bps hikes (today’s meeting and the upcoming March meeting), which seems to be the plan given the policy statement.

***UPDATES TO FOLLOW****

MARKET REACTION

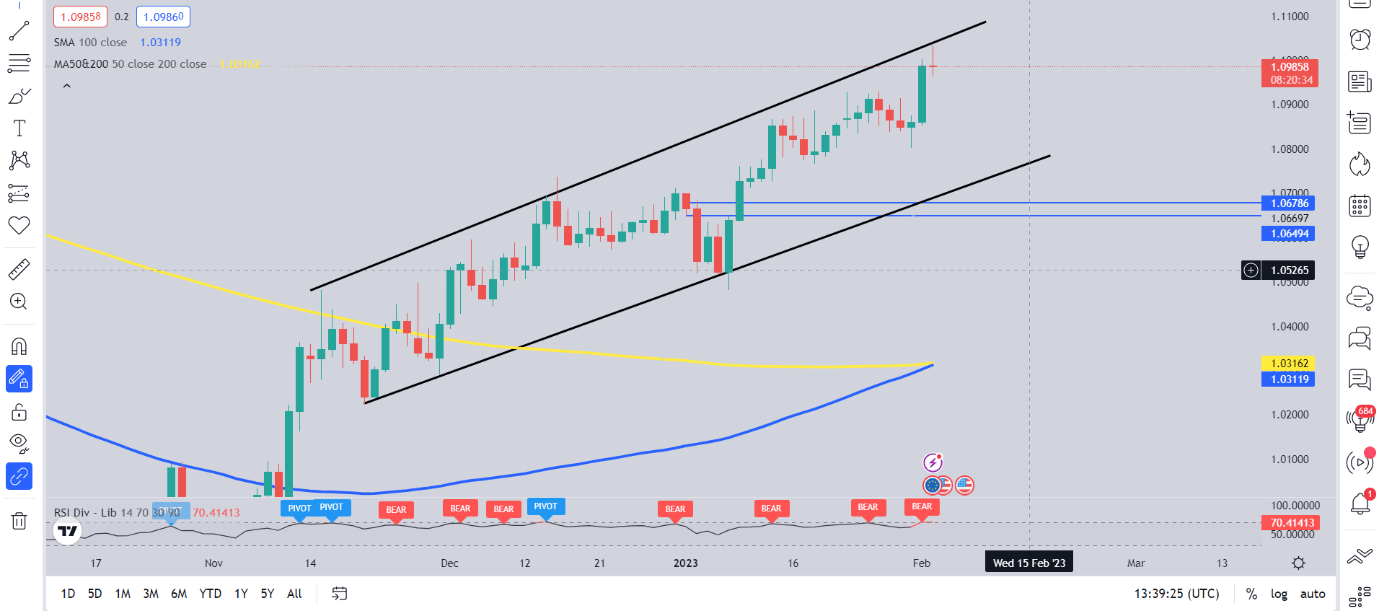

EURUSD Daily Chart

Source: TradingView, prepared by Zain Vawda

EURUSD initial reaction saw a 20 pip drop before trading flat ahead of the press conference. Having tapped the psychological 1.1000 level following yesterday’s FOMC meeting there remains very little resistance till the 1.1200 level. The RSI is however in overbought territory on both the 4H and D timeframe which could result in some pullback before continuing higher. We are also showing signs of rejection at the top of the ascending channel which we have been trading within since mid- November.

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently SHORT on EUR/USD, with 69% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are short suggests that prices could EUR/USD may continue rise.

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.